The Truth about Volatility

-

Jared Dillian

Jared Dillian

- |

- June 11, 2020

- |

- Comments

O brave new world!

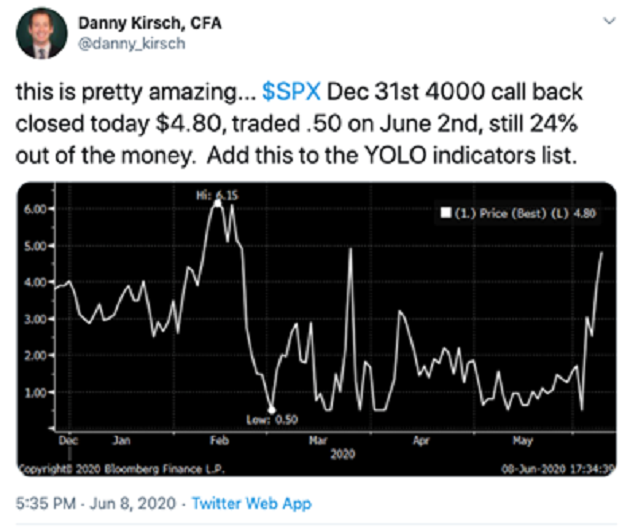

This is a bet that the S&P 500, currently at 3,200, will reach 4,000—by the end of the year. A 25% move in six months. As you can see, the probability of that happening is not zero.

The downside put options are also expensive—the probability that the S&P 500 falls to 2,000 by the end of the year is not zero.

It might be tempting to sell the 4,000 strike call options, and the 2,000 strike put options, which is known as “selling a strangle.” You’re betting that the market will finish somewhere in between.

That is not one of my favorite trades.

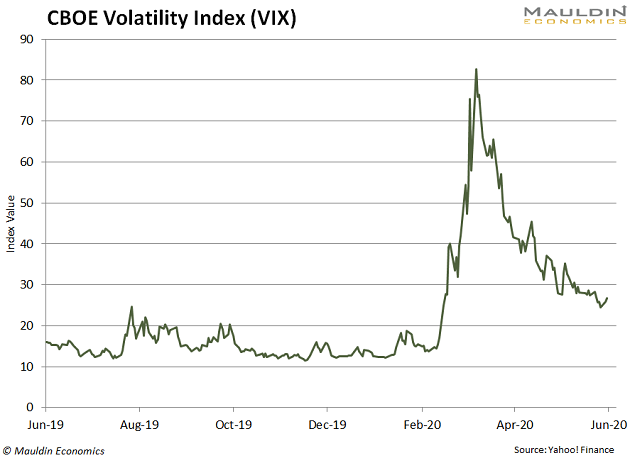

As everyone knows, stocks have gone up a lot recently. And volatility has come down, but not all the way down to historical levels. It is still quite high.

Just look at the CBOE Volatility Index (VIX):

The volatility market is smart. It knows that things haven’t completely returned to normal after the peak of coronavirus deaths. It knows that things haven’t completely returned to normal in the aftermath of the civil unrest. It knows that there is an election coming up, and there are a number of ways it could turn out, all of them bad.

Over the course of my career, I have morphed from a mean reversion trader to a trend follower.

Everything trends—including disorder.

Source: Alex Norris

Regimes in Volatility

Twenty years ago, former quantitative analyst (and physicist) Emanuel Derman wrote a seminal paper called “Regimes of Volatility” while working at Goldman Sachs. I read it when I was 26 years old, though I didn’t understand all of it then.

There are regimes in volatility—sometimes it is persistently low, and sometimes it is persistently high. It is low more often than it is high.

My take is that we recently passed from a low volatility regime to a high volatility regime—without really knowing it. What I mean is that disorder trends.

We are experiencing financial and social disorder. The two are related.

Sure, stocks have gone up, but that’s not the point—the point is the volatility. And as you know, there’s all kinds of weird stuff happening in the stock market, with day traders bidding up bankrupt companies like Hertz (HTZ) and SPAC electric truck makers.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

- Less Crazy

- More Crazy

The answer is b. Things will definitely get more crazy.

I spoke to my mom the other day on the phone, who told me that the protests following the death of George Floyd were bigger than what she experienced during the Vietnam War. And those protests are pretty well-known.

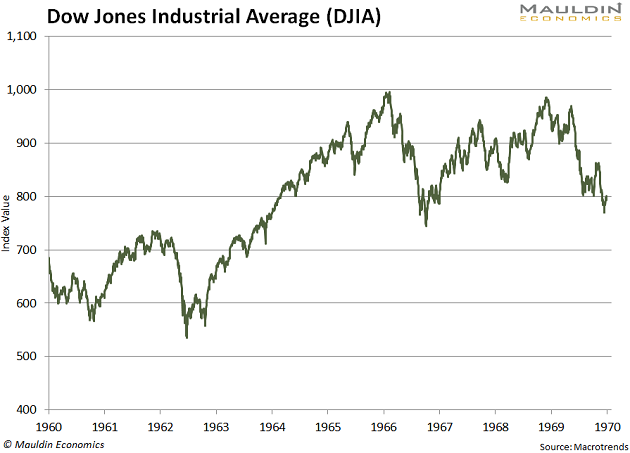

People think of the late ‘60s as a time of great social turmoil. This was also right around the time that stock markets peaked:

You Don’t Want to “Sell Options”

You don’t want to sell any options.

A lot of people don’t realize there are a lot of ways to sell options that don’t involve actually using options.

- When you buy a corporate or municipal bond, you are selling options.

- When you buy an index fund, you are selling options.

- When you buy a stock that is conducting a share buyback, you are selling options.

I talk a lot about how you should build a portfolio that gains from disorder.

One thing I recommend doing is stress-testing your portfolio. What will it look like with stocks down 30%? What will it look like with stocks up 30%?

But stress-testing doesn’t even cover it. Stress-testing wouldn’t have predicted price movements in the early weeks of COVID-19, when the credit markets crashed and seized up, and the airlines nearly went to zero. Stress-testing wouldn’t have predicted what happened after that, either.

The point is that you want to own optionality, rather than be short it.

In finance circles, this is the conventional wisdom. People pay money for hedges all the time. But hedges are expensive, and people sometimes fall in love with their hedges.

2020

There are countless memes on Facebook and Twitter about how 2020 is the worst year ever. People were even talking about “murder hornets” for a little while.

But I look at it differently—it’s not the worst year ever. 2020 is the most volatile year ever, and people are uncomfortable with volatility. I happen to thrive in volatility. It’s been a pretty great year.

There are two types of people in finance: people who understand options and people who don’t. The people who don’t are missing out on 90% of the story.

Options were the first thing I learned about in finance, and it shaped my entire view of risk and reward. People who don’t understand options see the world in a very linear way. Options traders understand nonlinearity. They try to gain exposure to it, rather than being exposed to it.

If you can’t handle a second iteration of what happened in March, cash is probably a good place to be.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Jared Dillian

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian