Unrealistic Return Assumptions

-

Jared Dillian

Jared Dillian

- |

- December 13, 2018

- |

- Comments

There is no shortage of stupid people tricks in the financial markets, but probably the worst thing people can do is to have unrealistic return assumptions.

Question to you, dear reader. On a long-term basis, what can you expect your annual returns to be in a broad-based stock market index?

- 6 percent

- 8 percent

- 10 percent

- 12 percent

The answer is E. We have no freaking clue! All we know is what stocks have returned in the past. We have no idea what they will return in the future. The conditions that led to prior returns may not be present for future returns.

Most people will tell you that you can expect to earn 8 percent from the stock market per year. That is about what it has returned historically. So, a little perspective. That 8 percent annual return (over a period of about 100 years or so) easily beats any other stock market in the world. Why is that?

It’s because America has the rule of law, property rights, all that jazz. We have something special here in the United States that other countries don’t have. We have a legal framework that protects private property. This lets financial markets flourish. You see that in varying degrees as you travel around the world. The really dastardly places don’t have stock markets at all.

Anyway, it makes sense that a loss of respect for private property rights or the rule of law might lead to diminished stock market performance. That is one reason the stock market might not return 8 percent. I can think of a bunch of other reasons why stock markets might not return in the future what they have in the past, and a big one is that they have just become so freaking expensive. When stocks get overvalued, forward returns go down. Few people disagree with this.

There are lots of smart people out there who expect future stock market returns to be much lower than they have been in the past. It is not just me being a crank.

Stupid and Irresponsible

The problem is, people take this 8 percent number and extrapolate it out in the future, and they break out Microsoft Excel for the first and only time to figure out how much they need to save every month in order to retire at age X. The FIRE dillweeds have made big news because they think that you can retire at age 35, and yes, they are relying on that generous 8 percent number (or higher) to reverse engineer a future standard of living.

This is dangerous. If you have unrealistic return assumptions for the stock market, you will:

- Retire earlier, when you should actually retire later—and you will run out of money.

- Consume more, when you should be consuming less—and you will run out of money.

- Invest, instead of paying down debt, which could result in capital losses to go along with increasing debt balances—and you will run out of money.

The worst example of this comes from a competitor of mine who claims in his book Total Money Makeover that an allocation to “growth-stock mutual funds” will lead to returns of 12% a year.

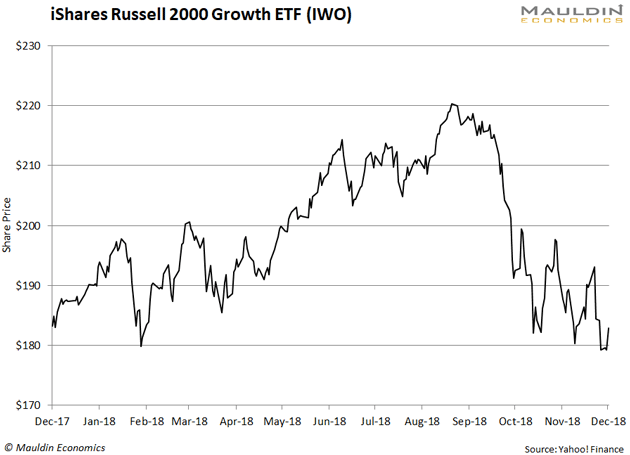

The bizarre thing about this claim is that this guy is so conservative when it comes to saving money and paying down debt, and yet so liberal in his attitudes towards investing, which could be downright ruinous. After all, the main small cap growth ETF (IWO) is down about 19 percent from the highs—losses that are difficult to recover from.

Not to mention: in that book, there is no discussion of an allocation to bonds.

A 12 percent assumption for stock market returns is irresponsible and ignorant of decades of global financial markets history. The stock market is not a bank account! It doesn’t pay interest. It isn’t a magic money machine. Average investors can find themselves in a position where they sustain losses over a very long period of time.

I’ll tell you how crazy this is. If someone came up to me with a pitch book for a hedge fund claiming they could make 12 percent a year, I would probably report them to the SEC. The best, smartest, most amazing investors in the world have a hell of a time making 6-8 percent over Fed funds.

Realistic Return Assumptions

So what are realistic return assumptions? Well, I think 5 percent for stocks is reasonable, and maybe 3 percent for bonds, so a 50/50 portfolio will get you to about 4 percent.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

They are going to have to save more.

This is the no-spin zone. People should spend a lot less time thinking and dreaming about 8 or 10 or 12 percent returns, and more time thinking about shoveling cash into a bank account which they can link up to Treasury Direct and earn 2.5% on treasury bills risk-free. Sure, 2.5% would be suboptimal, but not the worst thing in the world. It’s capital preservation.

Here’s the real reason not to be loaded up on stocks and hoping for a 12 percent return—when the 19 percent drawdown comes, you won’t panic into a diaper and sell, at which point the compounding comes to an end.

As ETF 20/20 readers know, the goal is to design a portfolio that you can sit in in good times and bad—so you can keep compounding.

Please temper those return assumptions. The stock market does not magically puke out 8-12 percent a year to a bunch of passengers along for the ride. This is not a case of me being pessimistic. We can’t possibly know what stocks will return going forward, so we should probably prepare for the worst.

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian