We Sang Dirges in the Dark

-

Jared Dillian

Jared Dillian

- |

- August 17, 2017

- |

- Comments

I only study politics recreationally, so I feel that I only have a recreational grasp of it. I have a lot of respect for the very smart and incisive political pundits.

But I don’t stare at politics every day. I stare at markets every day, and I am pretty comfortable saying that my knowledge of markets is smarter and more incisive than most people’s.

And you know what I have noticed about markets lately? They don’t care about Trump.

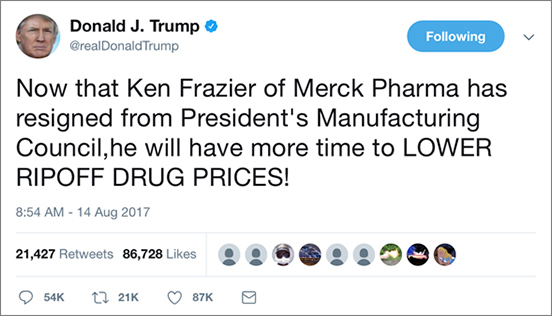

When Merck CEO Ken Frazier stepped down from the President’s Manufacturing Council on account of Trump’s remarks on Charlottesville, did you see Trump’s reaction?

That sounds like a direct threat of litigation to me. You know what Merck stock did in response?

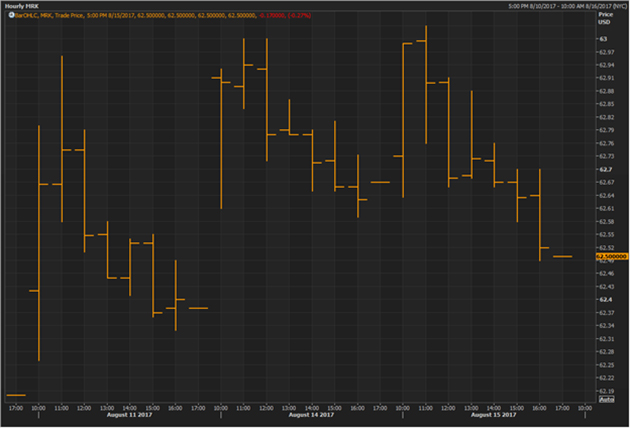

It went up.

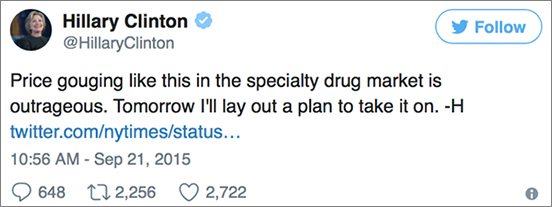

That isn’t supposed to happen. Do you remember this tweet from Hillary Clinton during the presidential campaign?

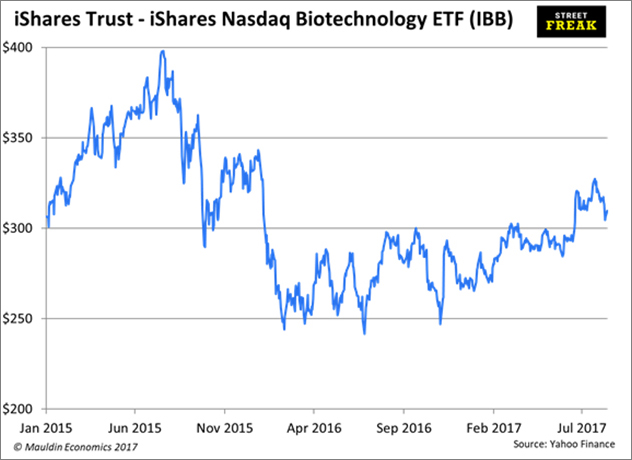

That one tweet sent the entire biotech sector into a bear market that lasted eighteen months.

Is Hillary more powerful than Trump? That isn’t the right way to look at it. Hillary was just a candidate at the time. Trump is actually president. But the market ignored Trump and listened to Hillary.

The market believes that Hillary’s threat was more credible than Trump’s.

By a lot.

Honey Badger Don’t Care

The stock market just does not give a crap about what President Trump says. He tweets about the market, about individual companies, on a pretty regular basis… and the market stopped caring a while back.

The market is smart. The market knows that Trump can’t or won’t follow through on any of his statements.

Is Trump really going to go after the pharmaceutical industry? He might want to, but no other Republican is interested in doing that.

But if you told me a year ago that a sitting president would issue a direct threat to an individual company and the stock would be up on the day… madness.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

But there are broader implications here, too. If Trump has already lost credibility with the stock market, who might he lose credibility with next?

Not Good

Here is my prediction: in a few years’ time, maybe sooner, people will have figured out that Trump is a lot of talk and not much else. About everything.

That is not good.

It has implications for legislation we might want to pass, like tax reform.

It has implications for foreign policy. Like, what if there is no actual fire and fury? Just a lot of hot air?

The biggest risk for Trump isn’t that people successfully oppose him—

It’s that people ignore him.

Tax Reform

Right now, I give tax reform a 30 delta. That’s options language for saying it has a 30% chance of happening.

Maybe less.

Tax reform is very important. I think the prospects for it passing account for virtually all of the market’s 20% gain since election night. It’s basic equity valuation—stocks are valued on after-tax cash flows. Lower tax rate equals higher stocks.

Not only does corporate reform look less likely, but there has been open discussion of higher individual tax rates. Not encouraging.

The world looks a lot less hopeful than it did in those first few days after the election, when Trump was busy assembling an economic dream team.

Let me put it this way—if the Democrats are successful in the midterms, and if they are successful in 2020, tax rates are not going down.

Sorry to be a bit of a downer, but nobody else is doing their job.

Discomfort

If you watched Trump’s inexplicable press conference at Trump Tower on Tuesday afternoon, you probably saw Steven Mnuchin and Gary Cohn over his right shoulder, looking a bit uncomfortable.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

(In my experience, it never works that way.)

What happens if those good people leave?

Since the press conference, Cohn has already expressed dismay about Trump’s remarks. I suspect he is trying to hold on for 1) tax reform and 2) a Fed chair nomination. We’ll see how much longer he can last.

Between Kelly, McMaster, Mattis, Cohn, and Mnuchin, Trump really does have some safe hands in the administration. If they leave—and they probably will, at some point—smell you later, stock market.

The prediction that Trump would cause volatility so far has been wrong. It might be one of those predictions that ends up being right in the long run.

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian