Celebrity Deathmatch

-

Jared Dillian

Jared Dillian

- |

- February 2, 2017

- |

- Comments

The FOMC meeting was yesterday—and we’ll get to that in a minute—but I want to talk about the backdrop to the meeting, Trump’s relationship with Yellen and Yellen’s relationship with Trump.

Trump hasn’t had much good to say about Yellen. He said that her interest rate decisions were politically motivated. Hey, I was saying the same thing at the time. No disagreement out of me. No rate hikes for years, and now that Trump is elected, the Federal Reserve is suddenly keen on hiking with renewed vigor.

But let me tell you—as much as Trump does not like Yellen, Yellen does not like Trump. You couldn’t find two more opposite extremes. Yellen is about as cautious and risk-averse as it gets. Trump is like a drunk at the poker table, playing every hand, losing a lot of small pots, then next thing you know you’re losing a big hand to him.

I’m not even sure they’ve been in the same room, and I don’t know what would happen if they were.

I have to give the Federal Reserve credit—they take their jobs very seriously. It is not a “hack” institution; these are smart people who dedicate their lives to maintaining the purchasing power of the currency. We can say that they are misguided from time to time, but they are not malicious, and they are not hacks.

But you also have to remember that these are human beings, and human beings have emotions. So if Trump has made it very clear that he wants a weaker dollar—as he did on Tuesday—then you can bet that Yellen probably wants a stronger dollar, at least on a subconscious level.

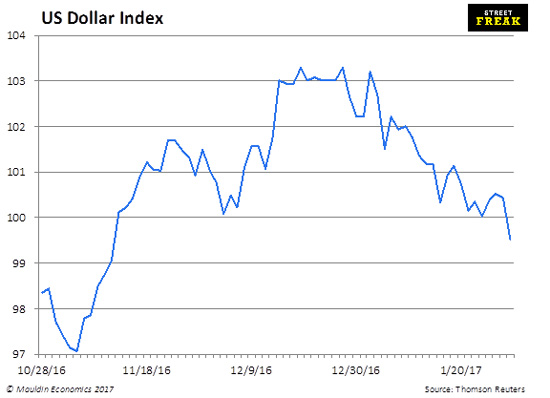

Trump has been jawboning the dollar lower—with some success:

But what happens if Yellen starts jawboning it higher? Or what if it’s not jawboning—what if they actually hike rates? It’s hard to be short USD when rates are going higher.

Yellen is supposed to be around for another year, and I’m guessing that there probably will be some epic collision between her and Trump in the not-too-distant future.

It would be highly unorthodox for Trump to fire Yellen—that almost never happens, mostly because it leads people to believe that the Fed isn’t all that independent—but this is Trump we’re talking about here. Although I’m dying to know who Trump has lined up as her replacement.

The Trump Fed

Here is the reality of it: there are two vacancies on the Board of Governors that can be filled immediately. Who will Trump choose? I can’t find any speculation on the Internet on this.

Then, next year, Yellen and Stanley Fischer will be gone, so Trump will be able to appoint a chairman and vice chairman.

I’ve seen some names floated for these positions: Martin Feldstein, Larry Kudlow, but Reagan/Laffer supply-side economists don’t seem like the right fit with Trump. Trump is going to want a trade guy. He is going to want someone who wants the dollar lower. Trump is a debtor. He is going to want someone who will explicitly inflate1.

Of course, the number one Trump Trade is still intact: short bonds.

Between the two open seats and the chair/vice chair roles, Trump will have four of his own people on the Fed in the span of a year. And my suspicion is that these four folks will make it very uncomfortable for the Obama holdovers.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Yesterday’s FOMC

If Yellen has a grudge against Trump, she sure isn’t showing it.

Yesterday’s meeting was pretty dovish. They acknowledged rising inflation, but didn’t seem too worried about it. Several Fed officials had said that they want to hike three times this year, but the Fed is well off that pace. Based on yesterday’s directive, it’s unlikely that they’ll hike in March, which means they’re probably looking at June.

One thing to point out is that the composition of the FOMC is different from one year to the next, as four regional presidents rolled off and four new ones came on. All the dissenters are gone; this is a considerably more dovish FOMC, with Harker, Kashkari, Kaplan, and Evans.

It kind of goes without saying that I believe inflation is ramping and the Fed (like any government institution) is going to quickly find itself behind the curve. It’s not just ramping in the US—it’s even worse in Europe.

I think this is what happens if you leave rates at zero for eight years and print about four trillion dollars. People have been wondering where the inflation was—well, here it is. And it’s about to get worse before it gets better.

Trump will probably have more to say about Yellen because he doesn’t like Yellen, but the reality is that yesterday’s Fed meeting clearly helped Trump. All of which illustrates that the Fed isn’t a bunch of hacks, or is very concerned with maintaining the perception that monetary policy is not politically motivated.

But not hiking rates when inflation is roofing—that’s pretty much the definition of bad central banking.

________

1 This is pretty much the opposite of what I was saying before, but trade has been the number one focus out of the gate.

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian