Inflation Rips Society Apart

-

Jared Dillian

Jared Dillian

- |

- September 9, 2021

- |

- Comments

Longtime 10th Man readers know that I am philosophically, even morally opposed to inflation. I began writing about inflation long before there was any, because it is absolutely the worst thing that can happen to a nation. The Fed does not share my beliefs.

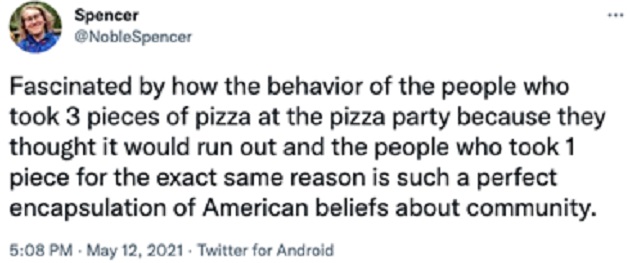

Anyway, I was cruising around on Twitter last week, and I came across this old tweet that has nothing to do with inflation, and yet it has everything to do with inflation:

You see, for the first time in a very long time, Americans have to deal with scarcity. Before, it didn’t matter if you took three slices of pizza, because there was more than enough for everyone. Now, there are shortages of all kinds of goods, from cat food to tennis balls to chlorine.

If you go to the store, and they’re running out of cat food, it’s perfectly rational to buy as much as you can, because you might not be able to later. But then you would be screwing everyone else. So what? I have cats to feed. You snooze you lose.

That is what happens to society during inflation—it turns into every man for himself, and there is no more sense of community. But during periods of deflation or disinflation, there is enough supply to go around, there is no hurry to buy anything, and people band together.

I’ve always found it odd that the Federal Reserve views Japan’s deflation as the worst possible outcome, when from a societal standpoint, it is the best possible outcome. Japan, after decades of deflation, is a peaceful and productive society. Everyone gets along. There is no social unrest. Cultural differences, perhaps, but I’d like to see how Japan behaves under inflation and persistent shortages of goods.

It’s Going Around

I’m not much of a social commentator, but there is a bit of that going around these days—every man for himself. People are unwilling to make sacrifices of any kind. To be candid, neither am I. I gave at the office.

I’m not the first to make this observation, but let’s contrast our collective response to the attacks on September 11, 2001, with a hypothetical attack today. Even faced with an imminent threat like the coronavirus, we’ve spent the better part of the last two years arguing about the Democratic and Republican response. In 2001, millions of American flags came out of nowhere.

There are a lot of factors at play here, and my job is to analyze the financial factors. Last year, 61% of taxpayers had no federal income tax liability—no skin in the game. If you don’t have a financial stake in what’s going on in the country—no matter how small—you tend not to shoulder any responsibility. Everyone pays HOA dues, so people are pretty engaged with what goes on in their community, like the hours that the pool is open. If you don’t pay taxes, what goes on at the highest levels of government is simply above your pay grade.

Keep in mind that I am an individualist, not a collectivist, and people shouldn’t be asked to make sacrifices of any kind—they should do so if they believe the cause is worthy. We are all better off when people act individually in their own enlightened self-interest. But when financial incentives are in place to take all the pizza and hoard it, and to speculate on the price of pizza, you can’t really blame them. Don’t hate the player, hate the game.

Extreme Politics

The real danger here is that persistently high inflation has historically led to extreme politics in a diverse group of countries. I don’t need to list the examples; you know them by now.

I expected political polarization to improve after the election, but it hasn’t—and after a few years of inflation, I expect it to get even worse. Inflation leads to extremism, war, and financial collapse.

It may seem a bit early to talk about war and financial collapse, and it probably is. But I’m keeping one eye on sentiment and the other on inflation anecdotes. Inflation will get much worse before it gets better. In fact, it might not ever get better. I fully expect double-digit inflation by the middle of 2022. And the idea that these are simply “supply chain issues” is complete nonsense.

Capitalism provides us goods and services in large quantities in a timely fashion. When it doesn’t, it’s because someone has naively intervened in the system. It’s not a failure of capitalism. You have catastrophes in the natural world—hurricanes, floods, and earthquakes. There are no catastrophes in the economic world. Every economic disaster is man-made.

Jared Dillian

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian