Sentiment

-

Jared Dillian

Jared Dillian

- |

- July 16, 2020

- |

- Comments

Occasionally I give talks at financial institutions on mental health in the workplace. At one of these, during the Q&A, a woman asked if I was an empath.

I didn’t know what that was. I looked it up later. It’s a person with a paranormal ability to ascertain the mental or emotional state of another individual.

That’s not me, but I spend a lot of time thinking about my feelings and about other people’s feelings. I especially spend a lot of time thinking about the feelings of a group of people—investors.

Feelings are important in finance. But nobody talks about that. We spend most of our time with our heads in spreadsheets, looking at numbers.

But the answer is not in the numbers.

Back in March, during the middle of the meltdown, the stock market was trading on raw, unadulterated emotion. I tweeted this:

By the way, I am very scornful and/or dismissive of the chartered financial analyst (CFA) program. Like I said, the answers are not in the spreadsheets. The answers are on Twitter, in newspapers, on TV, and in conversations with people you know.

I have had a 21-year career on Wall Street, but I don’t know how to analyze financial statements. I barely know how to use Microsoft Excel.

I flunked Level 2 of the CFA and quit. But my former colleagues will probably tell you that I was a pretty good trader. And I probably have a more sophisticated understanding of risk than most.

Fundamental analysis is the study of financial statements and data. Totally useless—everyone is looking at the same stuff. Technical analysis is the study of charts. Again, this is weak-form market efficiency in action.

Sentiment analysis is the study of feelings—knowing that human beings are hopeless at trading from an evolutionary perspective. We are excited by higher prices and demoralized by lower prices.

The bull case is always most compelling at the highs, and the bear case is always most compelling at the lows.

People don’t like to talk about feelings. It’s not a science. It’s squishy. It’s “voodoo” (certainly no more voodoo than lines on a chart). Plus, it’s feelings—nobody wants to talk about their feelings. We’re all a bunch of tough guys.

I’m going to give you my framework for thinking about sentiment. How I interpret information, and how I apply it to trading.

Contrarianism

When everyone is bullish, be bearish, and when everyone is bearish, be bullish.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

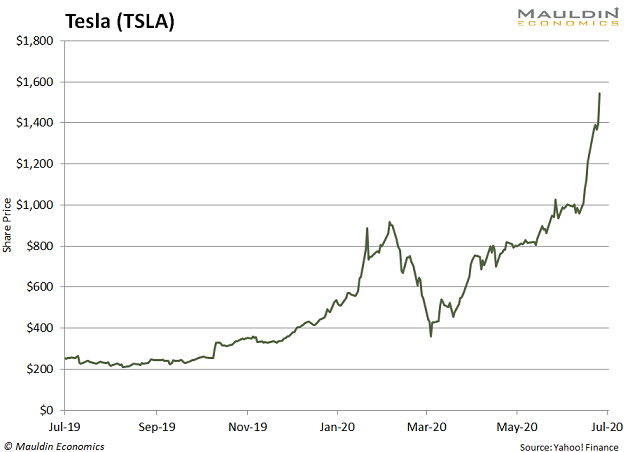

Who would short Amazon (AMZN) right now? Or Tesla (TSLA)? It’s madness. You’d have to be out of your tree.

The insane trade is usually the right trade. That’s why this is hard, folks.

Was anyone buying oil at negative $40? It was the point of max bearishness. Again, you’d have to be out of your tree.

But at this particular moment, people feel really good about Amazon and Tesla, and a couple of months ago, they felt really bad about oil.

Anyway, this article is going on the website, and six months from now, you can go back and see if this worked.

Everyone knows how sentiment trading works. They just don’t do it, because it’s too hard. By that I mean it’s a reputational risk.

Trading sentiment makes you take positions that will harm your reputation if you are wrong.

Nobody will get fired for being long Amazon at $3,200. People will get fired for being short Amazon at $3,200.

I saw this tweet the other day:

This is not the type of thing you see on the highs.

Smart and Dumb Money

You have to put people into one of two buckets:

- The Smart Bucket

- The Dumb Bucket

98% of people go into the dumb bucket. If they are bullish on stocks, you want to go the other way. Dumb doesn’t mean dumb—plenty of smart people are dumb.

What I mean by dumb is a person who is influenced by all the voices around him, whether it is CNBC, social media, or people he talks to. That describes most of the population.

People in the smart bucket are independent thinkers. They aren’t influenced by all the noise around them. These people have better-than-average market calls.

There is an adage on Wall Street that the people who are wrong all the time are valuable, too—you just do the opposite of what they do.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

I consider the source of everything I read on the internet. Most of the mainstream news goes into the dumb bucket. TV, too. There are a few newsletters I pay attention too, and a few analysts, but not much else.

By the way, the green section of USA Today is the perfect contrarian indicator known to mankind. If USA Today is writing about Amazon and Tesla, it is time to go the other way.

Big Sentiment Indicators

Along those lines, Elon Musk now has more money than Warren Buffett.

This is what we call in the business a BIG SENTIMENT INDICATOR. The symbolism of this is impossible to miss. The brilliant and depraved Elon Musk with his minimally profitable car company passing perhaps the greatest investor of all time in terms of cash in the bank.

The last time I saw something like this was back in 2011, when the SPDR Gold Trust (GLD) surpassed the SPDR S&P 500 ETF Trust (SPY) in assets for a single day—and that marked the top of the gold bull market.

You have to be on the lookout for this stuff.

I have spent the last 20 years trading off anecdotes like this. If it didn’t work, I wouldn’t still be around.

Put your pencils down, pick up the phone, go outside, and start talking to people. Ask them how they feel about stocks. Don’t just listen to what they say, listen to how they say it.

Every single conversation you have, every single article you read, every tweet you scroll by is a data point. If you’re a sentiment investor, you’re analyzing data—just in a subjective fashion.

As for the CFA, I would rather have hantavirus.

Jared Dillian

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian