Take a Dirtnap, for Starters

-

Jared Dillian

Jared Dillian

- |

- October 6, 2016

- |

- Comments

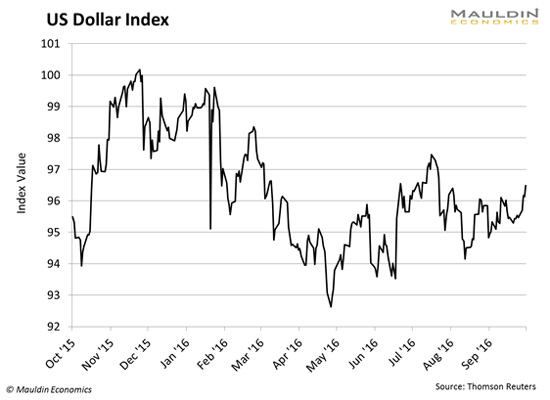

Tuesday was the day when the dollar broke out of its long consolidation—and it’s headed higher.

No doubt about it. This has implications for… everything. I’ve been yapping for months about how FX was going to be the primary driver in the markets. And it’s happening.

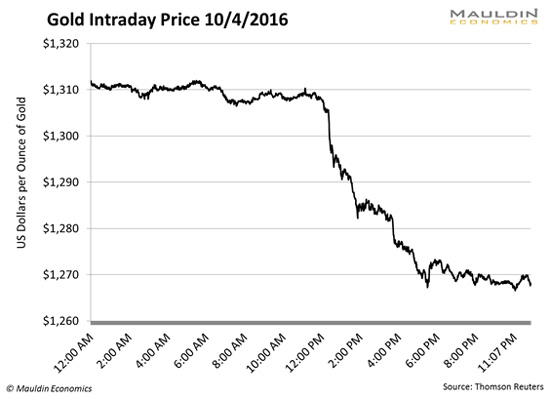

This happened to gold:

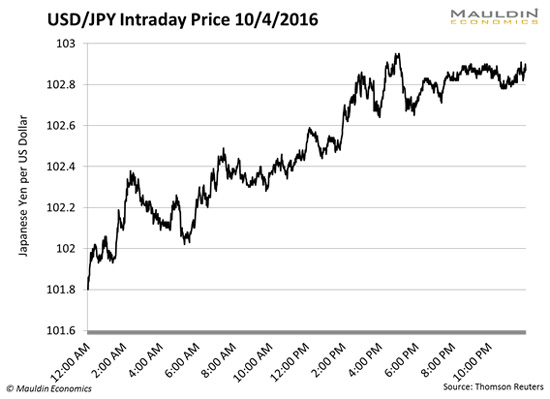

And this happened to USDJPY, which I have been saying has been undervalued for some time:

Gold miners were down almost 10% in a day—now, that is a few standard deviations.

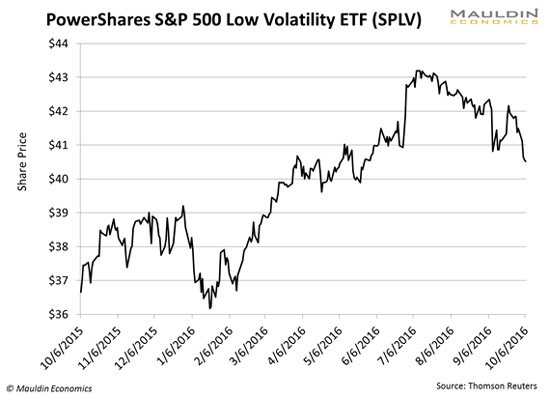

Meanwhile, the low-vol trade is starting to unwind. Check out this chart of SPLV, one of the low-vol ETFs:

And utilities are absolutely falling apart:

There are a lot of “safe” trades that people have been hiding out in, and the market has a way of smoking people out after a while.

So is there any safe place to be?

Nope.

I take that back. It is safe to be in cash, as we discussed here.

Newsletter Jerks

Newsletter guys have a reputation for being bearish all the time and saying that collapse is just around the corner. I hope I haven’t earned that reputation. My views are a little more nuanced.

But in the last few weeks, I’ve been getting more and more pessimistic, and I’ve talked about some of those things in The 10th Man, like the stupid low-vol/high-dividend trade, which just a few weeks ago I said was in danger territory.

So a few points:

- I don’t think that economic collapse is imminent. What I do think is:

- Housing markets across the world (Canada, Australia, Sweden, and others) are massively overvalued, and a downturn in those housing markets could cause a coordinated recession in the developed world.

- I think the low-vol trade is over, and that’s probably bad for the market.

- If there is a risk-off trade globally, US markets will probably do best.

- I think we’re going to get to crazy levels in USD—far beyond what people are imagining right now.

- I think it’s bad for gold and silver, but not catastrophic.

- It’s probably not great for EM.

- It’s probably not great for credit, but credit will be a decent place to hide out.

- It’s bullish on volatility for sure, but there are a ton of problems being long volatility (as an asset class), so I have no interest in that.

- I think that a 20-30% drawdown in the SPX is very likely, and given that it’s been over eight years since we’ve had a drawdown of that magnitude, it’s going to be very painful for people and has the potential to be worse.

- If Trump wins, the Fed will hike. They might hike anyway.

- If rates back up significantly (like we discussed here), that is only going to add to the chaos.

- If we do get a recession, it is probably going to be the end of capitalism as we know it in the US.

Yep.

That Last Point

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

What do I mean by that?

Let me ask you a question: If the stock market goes down 20% or 30% like I think it might—someone will get blamed.

Who do you think will get blamed?

Exactly.

Who do you think should get blamed?

Exactly.

A bear market certainly won’t be blamed on the Federal Reserve and their quantitative easing and ultra-loose monetary policy, and their inability to raise rates even with unemployment in the 4 handle. It won’t be blamed on providing so much liquidity for so long that even the slightest withdrawal of it causes a global recession.

It will be blamed on:

- Banks

- Brokers

- Wall Street fat cats

- Hedge funds

- Speculators

- Quants

- HFTs

- CEOs

I’ve seen this movie before, and I know how it ends. It ends with even more regulation, and perhaps even a financial transactions tax (which is something that Hillary Clinton’s party wants), the biggest economy-killer known to man.

So there is a lot at stake here. We really, really do not want a bear market. But we’re going to get one. That’s capitalism, or at least what’s left of it.

Having said all that, the hedge fund community is probably going to benefit from this. And not just hedge funds, but all active managers generally.

I would say the primary beneficiary of ultra-loose monetary policy has been—indexers! Active managers have generally been pushing back against it for the last five years, to the detriment of their own performance. So I think finally we will see the benefits of active management.

It’s going to be an interesting year, 2017. I hope you’re ready.

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian