Ten Baggers

-

Jared Dillian

Jared Dillian

- |

- December 9, 2021

- |

- Comments

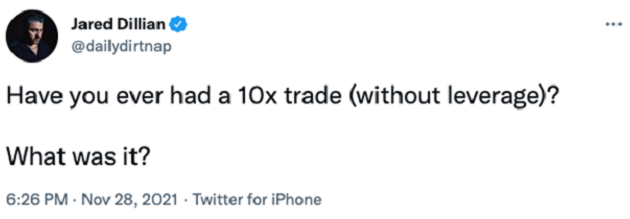

Last week I asked the following question on Twitter (by the way, you should follow me on Twitter):

Wow, the responses. First, let me explain: Leverage is when you use margin, futures, or options. It’s fairly easy to get 10x returns using leverage; much tougher to do in spot.

As it turns out, lots of people have had 10x returns on stuff. Most of it has been in tech or in crypto, which is to be expected.

Why is this an important question? Because it is hard for your portfolio to keep pace with the index unless it has a couple of big winners.

As it turns out, I have never had a 10x return without leverage! I’ve had some 3x/4x returns, but that’s about it. I am a trader at heart, and I start to get impatient with things that don’t keep going up.

But if you look at some of the big tech stocks, like Apple (AAPL), Amazon (AMZN), or Microsoft (MSFT), they’ve had some huge drawdowns over the years, along with long stretches where they just went sideways. Having 10x returns requires you to take a very long-term view on a stock and maintain that conviction in the face of sizable drawdowns.

Trouble is, I don’t have that much conviction on anything, which says something about my style of trading. I’m not a high-frequency trader, but the turnover in my portfolio is probably around 50%–70%. I’m constantly cycling in and out of ideas because I’m a sentiment trader, and as sentiment waxes and wanes, I rotate in and out of stocks. I’ve sold my share of stuff that kept going up.

I’ve said this before, and I’ll say it again: The people who are the most successful in the stock market are typically nonprofessionals who pay for professional help, build a portfolio of 20 blue chip stocks and leave them alone, rebalancing periodically. It’s not the Vanguard investor market-timing their mutual funds, and it’s certainly not the Robinhood customer buying fractional shares and trading odd lots of crypto.

The Point Is

The point is nobody can see out 10–20 years, other than people who are incredibly naïve. The types of people who spit platitudes such as “I like the stock” and “this is a great company.” Nobody can possibly predict what will go right or wrong over a period of decades. If you do this, and you get it right, it will be because of luck.

But that’s the point—the point is to be positively exposed to luck. Good things can’t happen if you don’t allow them to happen. Pretend, instead, that you are investing in a venture capital fund. You have no idea what the managers are going to do, and you don’t care. You are going to buy a bunch of early-stage companies and watch them grow into something like Facebook—while locking up your money for 10 years.

In fact, most people now believe private equity is so successful because of the lockup feature. You may want to sell, but you can’t.

So, if the lockup feature is what makes venture capital and private equity so successful, why not emulate it in your retirement account? Buy a bunch of stocks and don’t touch them. One or two will go to zero, a bunch will go sideways, and one or two will have trillion-dollar market caps one day—and if you know anything about math, the returns of your portfolio are going to be dominated by one or two stocks.

This is pretty hard to do if you’re hawking over your retirement account on your brokerage app every day. I’m a big believer in the idea that more information is actually bad. What would happen if you only checked your account once a year? The chance that it would be down drops by a lot. You would actually get positive reinforcement. And if you didn’t have any 2/3/5/10-baggers, it would probably be the result of a small sample size. 30 is usually the number of stocks considered sufficient for diversification.

Follow-Up Question

If you’ve ever had a 10-bagger in your investing career, have you ever had one that started as more than 50% of your portfolio?

Did you ever bet it all on a single stock—and win?

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

But as someone who invests passively in stocks, it’s unlikely that you would get that lucky. We simply operate at an information deficit.

Again, it’s far more likely you will make 10x in a private investment—because you couldn’t get your money out even if you wanted to.

10x ideas are a dime a dozen. Actually executing them is a different story. Because when we see that green P&L number get bigger and bigger, the temptation to sell becomes irresistible.

But not for everyone… it just so happens a friend and colleague of mine named Thompson Clark has all the patience in the world to wait and watch that number keep going up. He just released some new research about how he targets founder-led companies with 10x potential over time. And it’s well worth your time to watch this video of Thompson with John Mauldin where he reveals more about this strategy, along with the ticker of one of his highest conviction stocks. Just click here to start watching.

Jared Dillian

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian