When the Trend Is No Longer Your Friend

-

Jared Dillian

Jared Dillian

- |

- March 15, 2018

- |

- Comments

Special edition this week—the first-ever video issue of The 10th Man!

Why now? Because we’ve had a regime change in the markets, and the last regime lasted for years. I think that warrants a special edition.

If you’ve been reading The 10th Man for a while, you’ll remember me saying that the low volatility regime is over. Volatility is back, and will be for some time.

But as much as the market was in a low-vol regime, it was also in a trend-following regime. And that regime is also over… but people don’t seem to realize.

They don’t really understand (or remember) that the market follows different regimes—that you can have a trend-following regime followed by a mean-reverting regime. Investors who follow trends will go through a lot of pain in a mean-reverting regime.

And if you think you’re not a trend follower… you just might be, without knowing. That’s part of what I discuss in this video issue. It’s important viewing.

Click below to watch (you can get a transcript too).

To make things even easier, here’s some of what you’ll be finding out, and where you can find it in the video:

- What the new market regime looks like, and why “the trend is no longer your friend” (1:36)

- Why index fund investors could be in trouble without realizing it (2:30)

- What kind of investor you need to be in this new environment (3:58)

- The smartest thing investors can do right now (6:33)

- My thoughts on the next market correction… when, how big, and why (7:34)

- Ed D’Agostino, Mauldin Economics publisher and COO, weighing in with a pretty great story about his own personal portfolio—interesting lesson here (10:16)

I encourage you to go and watch it. I hope you enjoy it—but more importantly, I hope it gets you thinking about what you might need to change in your portfolio so that this new regime doesn’t take you by surprise.

New game, new rules.

|

|||

|

One Final Thing

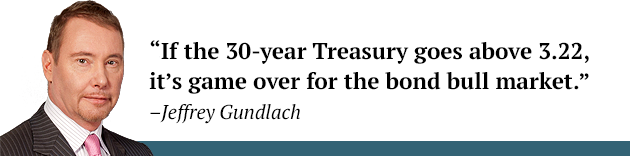

I was at the Strategic Investment Conference last week, and it was a great experience. I talk a little bit about DoubleLine Capital founder Jeff Gundlach’s presentation in the video, but another big highlight was Passport founder John Burbank.

In fact, his presentation sparked off a trade idea, which I told my subscribers at The Daily Dirtnap about in the very next issue I emailed out. It has all the makings of a classic Daily Dirtnap trade.

Moral of the story? Go to conferences!

Or do the next best thing—pick up a Virtual Pass, and watch it all from your couch. Probably less tiring, and you get all the good stuff.

The Virtual Pass is still available now (and at a big discount), but won’t be for long.

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian