Double Leaning Jowler

-

Jared Dillian

Jared Dillian

- |

- April 26, 2018

- |

- Comments

I just returned from a cabin in Wisconsin where I spent a couple of days with some of my old Lehman pals. Usually our reunions revolve around drinking, ripping on each other, playing cards, more drinking, and in this case, eating lots of bratwurst. When in Wisconsin, do as the Wisconsinites do.

We also played Pass the Pigs, a game of risk and money management—very much like craps, except you’re not dealing with fair dice.

In Pass the Pigs, you roll pig-shaped dice to score varying amounts of points. If the pigs both land on the same side, you score 1 point. If one lands on its back (razorback) or its feet (trotter), it is worth 5 points. If both land on their backs or their feet, it’s worth 20 points.

Sometimes one lands on its nose (snouter), which is worth 10 points—40 if both of them do. And there is the exceptionally rare “leaning jowler,” where a pig lands balanced on its jowl and ear, which is worth 15 points. Pictured below is the extremely rare “double leaning jowler,” worth a whopping 60 points (this almost never happens).

Here is how the game works—you roll the pigs and score points until one of two things happen: you either pass the pigs, and bank your score until the next round, or you roll a side out.

A side out is where the pigs land on opposite sides, which resets your score to its starting point, and you lose your turn. First person to 100 points wins.

I got curious about the math behind Pass the Pigs so I did some searching online. Wouldn’t you know, there have been several academic papers published on the math behind the game, which I appreciate, but also speaks to what passes for research these days.

Anyway, people have roughly figured out the odds of each roll, simply through trial and error. In one study I saw, the professor got his students to conduct over 11,000 trials. The life of a grad student.

Basically, you have a 21% chance of a side out on any given roll, so the chance of still holding the dice after ten rolls is low. A 20-roll possession would be an epic roll. I did see a 90-point roll last weekend, but it’s usually wise to pass the pigs after 20 points or so.

Obviously, each throw of the pigs is an independent event, and getting “hot” in pig-rolling has no more significance than getting hot in coin-flipping or dice-throwing—although we tend to believe it does.

Press Your Luck

The conventional trading wisdom is that you’re supposed to add to winning trades and cut losing ones. There have been about five hundred books written on this topic, and there are a lot of widely-followed Twitter personalities whose advice basically amounts to… add to winning trades and cut losing ones.

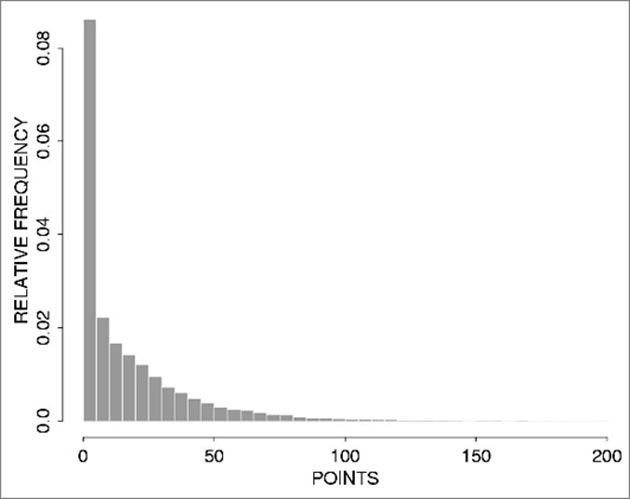

I suppose it is worth all the ink because people rarely do it. It’s a difficult skill to learn. When we make money, our instinct is to take profits immediately, and pass the pigs. As you can see from the chart below, the likelihood of getting to 100 points on one roll of the pigs is very, very small.

Source: Pig Data and Bayesian Inference on Multinomial Probabilities by John C. Kern, Duquesne University

If the probability of a “home run” trade by adding to winners over and over again is very small, why do people do it? Well, people do it in the belief that markets trend, and that pig rolls are serially correlated.

If rolling a double razorback meant there was an increased chance of rolling another double razorback, then you would be reluctant to pass the pigs to the next player. But we all know that pig rolls are independent events, and market observations are not… right?

We have more or less disproved the efficient market hypothesis—even as markets have become more efficient. Trend following is real. I have a mixed track record personally with trend following—I have worn out my welcome in a few trades over the years and it has cost me dearly.

It is my personal theory that trend following happens in regimes, like volatility, and lots of other things. I talked about this here.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

So if trend following is perhaps in hibernation, maybe this is a good time to be hitting singles and doubles instead of trying to uppercut the ball over the fence.

I spend most of my time telling people they should have a very long time horizon, which is the only way to gain an advantage over the computers. But in the current environment, it is better to have a shorter time horizon. One measured in months, not years.

Don’t misunderstand me—most people have no business trading tactically. Just think about taking profits (and cutting losses) a bit sooner, rather than later.

As for the pigs, yes, I am easily amused.

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian