Thinking the Unthinkable

-

John Mauldin

John Mauldin

- |

- January 15, 2011

- |

- Comments

- |

- View PDF

The Fed Adds a Third Mandate

A Rational Voice in Dallas

Thinking the Unthinkable

The Threat of the Irish

Has China Found a Miracle Business Cycle?

LA, Winnipeg, Las Vegas, and Thailand

Last week, in the first part of my annual forecast, I suggested that 2011 would be better than Muddle Through, with GDP growth in the US north of 2.5%. World GDP growth should be even better. This week we look at what I see as the real downside risks to that prediction. Oddly enough, the risks are not in the US but on the other side of both our oceans, in Europe and China. Plus, we will visit a few other items, assuming we have space (Bernanke’s recent speech just screams for some comments).

Two housekeeping items. First, I will once again be hosting, along with my partners Altegris Investments, our 8th annual Strategic Investment Conference, in La Jolla April 28-30. Save the date. Each year the conference gets better. We have as strong a lineup of speakers as any conference in the country. I will announce when we will take reservations. It always sells out, so I suggest you do not procrastinate.

Secondly, between finishing my book and the holidays, I have been rather quiet the past few months in regards to my Conversations with John Mauldin, but that is getting ready to change. Over the next few weeks I will be doing conversations with David Rosenberg, Lacy Hunt (his quarterly will be next week’s Outside the Box), George Friedman of Stratfor, and John Burns and Rick Sharga to get the latest on the housing markets; and I am lining up some more very interesting Conversations, so that subscribers will get more than their money’s worth. Now, let’s jump into the letter.

The Fed Adds a Third Mandate

The Fed has two mandates: keeping prices stable and creating an economic climate for low unemployment. I am sure I was not the only one to listen to Steve Liesman’s interview of Ben Bernanke this week and shake my head at the spin he was giving us. First, let’s set the stage.

In a paper with Alan Blinder early last decade, Bernanke made the case for the Fed to target a specific inflation number, and the number that came to be accepted as his target was 2%. In his famous helicopter speech in late 2002, he assured us that deflation could not happen “here,” even if the short-term rate was zero, because the Fed would move out the yield curve by buying large amounts of medium-term bonds. This would have the effect of lowering yields all along the upper edge of the curve. This became known as quantitative easing. In Jackson Hole last summer, he made very clear his intention to launch a second round of liquidity-injecting quantitative easing (QE2). In that speech, in later speeches in the fall, and in op-ed pieces he said that such a program would lower rates.

Then a funny thing happened on the way to QE2: long-term rates began to rise all over the developed world. As Yogi Berra noted, "In theory, there is no difference between theory and practice. In practice, there is." It’s got to be driving Fed types nuts to see the theory of QE, so lovingly advanced and believed in by so many economists, be relegated to the trash heap, along with so many other economic theories (like that of efficient markets). The market has a way of doing that.

So, Liesman asked Bernanke about one minute into the clip (link below) about the little snafu that, following QE2, both interest rates and commodity prices have risen. How can that be a success? Ben’s answer (paraphrased):

“We have seen the stock market go up and the small-cap stock indexes go up even more.”

Really? Is it the third mandate of the Fed now to foster a rising stock market? I wonder what the Fed’s target for the S&P is for the end of the year? That would be an interesting bit of information. Are we going to target other asset classes?

Understand, I am not against a rising stock market. But that is not the purview of the Fed. And certainly not a reason to add $600 billion to the balance sheet of the Fed when we clearly do not understand the consequences. If it looks like they’re making up the rules as they go along, it’s because they are.

Here is the clip: http://www.cnbc.com/id/15840232/?video=1742165849&play=1

A Rational Voice in Dallas

Richard Fisher is the president of the Federal Reserve branch in Dallas and a voting member this year of the FOMC committee. (Also a true gentleman, one of the nicest guys you could want to meet, and my neighbor, just a few blocks down the street.) But being a nice guy doesn’t keep him from espousing some strong and dissenting views about Fed policy. He recently gave a speech to the Manhattan Institute that should be required reading (link below) for all policy makers at all levels of government, and not just Fed types. As an anecdote to the Bernanke spin above, let me quote a few paragraphs:

“The new Congress and the new staff in the White House have their work cut out for them. You cannot overstate the gravity of their duty on the economic front. Over the years, their predecessors — Republicans and Democrats together — have dug a fiscal sinkhole so deep and so wide that, left unrepaired, it will swallow up the economic future of our children, our grandchildren and their children. They must now engineer a way out of that frightful predicament without thwarting the nascent economic recovery.

“I have been outspoken about the limits of monetary policy as a salve for the nation’s fiscal pathology. The Fed has done much, in my words, to provide the bridge financing until the new Congress gets to work restructuring the tax and regulatory incentives American businesses need to confidently expand their payrolls and capital expenditures here at home.

“The Federal Reserve has held rates to nil. We have expanded our balance sheet to unprecedented levels. After much debate — which included strong concern expressed by one member with a formal vote and others, like me, who did not have voting rights in 2010 — the FOMC collectively decided in November to temporarily undertake a program to purchase U.S. Treasuries that, when added to previous policy initiatives, roughly means we are purchasing the equivalent of all newly issued Treasury debt through June.

“By this action, we have run the risk of being viewed as an accomplice to Congress’ fiscal nonfeasance. To avoid that perception, we must vigilantly protect the integrity of our delicate franchise. There are limits to what we can do on the monetary front to provide the bridge financing to fiscal sanity. Last Friday, speaking in Germany, [European Central Bank President] Jean-Claude Trichet said it best: ‘Monetary policy responsibility cannot substitute for government irresponsibility.’

“The entire FOMC knows the history and the ruinous fate that is meted out to countries whose central banks take to regularly monetizing government debt. Barring some unexpected shock to the economy or financial system, I think we have reached our limit. I would be wary of further expanding our balance sheet. But here is the essential fact I want to emphasize today: The Fed could not monetize the debt if the debt were not being created by Congress in the first place.

“Those lawmakers who advocate ‘Ending the Fed’ might better turn their considerable talents toward ending the fiscal debacle that has for too long run amuck within their own house. The Fed does not create government debt; fiscal authorities do. Deficits and the unfunded liabilities of Medicare and Social Security are not created by the Federal Reserve; they are the legacy of those who control the purse strings — the Congress, working with the president. The Fed does not earmark taxpayer money for pet projects in local communities that taxpayers themselves would never countenance; only the Congress does that. The Congress and administration play the dominant role in creating the regulatory environment that incentivizes or discourages job creation.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

“… A reader of Shakespeare will recall the dialogue between Glendower and Hotspur in Henry IV. Glendower claims, ‘I can call spirits from the vasty deep.’ And Hotspur replies, ‘Why, so can I, or so can any man; But will they come when you do call for them?’

“We shall see if the new Congress will prove worthy of the power the American people have ‘loaned’ them, and, together with the president, actually draw the spirits of fiscal reform and sanity from the ‘vasty deep’ to at long last implement meaningful fiscal and regulatory policy that incentivizes private-sector job creation here at home while arresting the hemorrhaging of our Treasury. If they do, then more Americans will find work and be better off, better paid, and freer to make their own decisions about the economy.

“If they don’t, then woe to our children, their children, and the American Dream.”

Let us hope President Fisher will find support within the FOMC. I commend his speech to you: http://www.dallasfed.org/news/speeches/fisher/2011/fs110112.cfm . And now on to Europe.

Thinking the Unthinkable

My baseline assumption is that Europe kicks the sovereign debt can down the road for the rest of the year. We have seen Portuguese debt sales go well this week, even if at a very steep price. Spain looks like it will also do OK. Trichet is beginning to drum up support for an even bigger fund to stave off the bond vigilantes. It is unthinkable, we are told in many corners of Europe, that a sovereign nation would default on its debt or obligations. But, in my experience, it is the unthinkable things that can rise up to bite you in the derriere. Sometimes rather viciously. It was unthinkable that US subprime mortgages would infect the entire planet. Well actually, not entirely, as some of us did think that very thing in writing, well in advance of the crisis.

It is one of my jobs here in Thoughts from the Frontline to sit around and think about the unthinkable. What is there on page 16, or in some obscure research paper, that is going to make its way to the top of page one?

When asked in interviews what my number one concern is today, I readily answer, “European sovereign debt and European banks.” (In 2006 it was subprime debt. In 2007 it was bank debt and derivatives. Etc.) That heads a long list of present concerns, I will admit, but it is clearly at the top.

Italy, Spain, Belgium, and Portugal will need to raise over $800 billion this year to cover rollover debt and new borrowing. Add in Greece, Ireland, and a few other countries and it quickly gets to a trillion or so. Doable. But is does add a lot of debt.

I posted a piece a few months ago about Belgium. Belgium is not on the “usual suspects” list when we talk about European debt woes. But this page-16 story may be making its way to page one over the next few years.

Belgium’s total debt is pushing 100% of GDP and, given its fiscal deficits, probably will push through that level soon. This is a country of just 10 million people, and a deeply divided one at that, unable to elect a government. They are making progress on getting their fiscal house in order, but are not there. And the market is getting nervous.

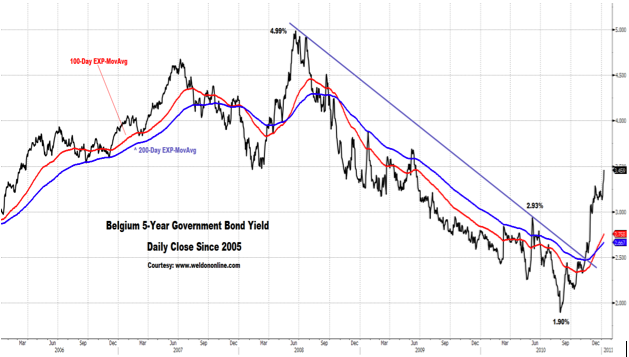

My good friend and data maven Greg Weldon gives us some details. Belgian interest rates, while down from the depths of the credit crisis, are once again beginning to rise, along with those of Spain and Italy. (www.weldononline.com)

It is unthinkable that Belgium could have a problem, isn’t it? Except that there is a very serious and growing contingent of citizens who want to divide the country into two parts. I am sure cool heads will prevail, but I do pay attention to Belgium’s politics. I will also be in Brussels in March, so I will get some first-hand stories.

But that is not a 2011 story. No, for this year my concern is the large amount of Irish sovereign debt on the books of European banks.

The Threat of the Irish

In the midst of the credit crisis last year, the Irish government guaranteed not only the deposits of Irish banks but their bonds. Irish banks, like Icelandic banks, were larger than the GDP of the country. As it turns out, those guarantees are going to cost a great deal of money, about 30% of GDP. That would be the equivalent of over $4 trillion for the US, just for some perspective. And many of those guarantees are to German, French, and British banks. Irish taxpayers are in effect bailing out not only their own banks but banks all across Europe.

The “bailout” engineered by the ECB and European authorities will require that that Irish pay around 10% of their national income in a few years just to service the debt, according to Barry Eichengreen, professor at U Cal Berkeley. How can you take 30-50% of your government taxes and pay down such high debt loads at 6% interest? That doesn’t leave much for actual government services. The short answer is, only with a lot of local pain and none for the bank bondholders, which again are German, French, and British banks. As Eichengreen writes:

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

“This is not politically sustainable, as anyone who remembers Germany’s own experience with World War I reparations should know. A populist backlash is inevitable. The Commission, the ECB, and the German Government have set the stage for a situation where Ireland’s new government, once formed early next year, rejects the budget negotiated by its predecessor.

“Do Mr. Trichet and Mrs. Merkel have a contingency plan for this?

“Nor is the situation economically sustainable. Ireland is told to reduce wages and costs. It must engage in ‘internal devaluation’ because the traditional option of external devaluation is not available to a country that lacks its own national currency.

“But the more successful it is at reducing wages and costs, the heavier will be its inherited debt load. Public spending then has to be cut even more deeply. Taxes have to rise even higher to service the debt of the government and its wards such as the banks.

“This in turn implies the need for yet more internal devaluation, which further heightens the burden of the debt in a vicious spiral. This is the phenomenon of ‘debt deflation’ about which the Yale economist Irving Fisher wrote in a famous article at the nadir of the Great Depression.”

This is precisely the same phenomenon that I was describing last year when I was writing about Greece. I deal with it at length in my new book, Endgame, out in early March (I hope). This debt deflation/devaluation spiral will end in tears. The question is, will those tears be from Irish eyes?

Let’s think what is unthinkable by most Europhiles, but not to Eichengreen or your humble analyst.

All the polls indicate that the governing party, which cut the deal to increase the debt load by some 30% of GDP, will lose the elections, most likely to parties that are campaigning on repudiating that debt. Irish bank bondholders could face a haircut of some 80% or more, which is more like a leg amputation than a haircut.

The party (or parties if there is a coalition) will have a mandate to simply not guarantee Irish bank debt, which would get their total debt-to-GDP down to a still-high but manageable 100%. Not good, but something they can grow out of over time. There are a lot of good things still happening in Ireland, and you don’t have to look too hard to find some positives.

I read a very good blog about Ireland written by Ronan Lyons, whom I hope to share a pint or two with some day, when I make my first pilgrimage to the Fair Isle. He gives us eleven reasons to be optimistic about Ireland. Maybe it’s just the nature of the Irish to find that silver lining, but this comes under the heading of optimistic realism. Here’s Ronan:

“So, while Ireland faces very significant challenges, we should not write ourselves off just yet. Yes, our problems are largely our own fault in not preparing for life in the eurozone. Yes, the next five Budgets are going to be tough ones for everyone. And yes, Ireland in 2016 will not be what we might have thought it would in 2006…

“But Ireland in 2016 will probably be a far better place to live than any of us thought possible in 1996, 1986 or indeed any previous decade. The Celtic Tiger was not a mirage. And we have a very real economy that, with a good bit of hard work and with a fundamental reorganization of how government raises and spends money, can deliver for us again. That starts in 2011.”

(http://www.ronanlyons.com/2011/01/11/eleven-reasons-to-be-cheerful/)

But part of that reorganization may involve some very tough negotiations. The incoming parties should stick to their mandate. Why should they back Irish bank debt to the Germans and the French at the expense of being mired in a depression for a decade or more? At least I think that is what the political discussion will be.

If the ECB, IMF, and the rest of the EU says, “If you don’t take on that debt we will not buy any more of your debt. You will be shut off from the subsidized debt markets,” then what? Ireland could answer back, “You want us to pay the rest of this debt? Go pound sand.” Or whatever the Irish equivalent is. It will be a very intense and interesting set of negotiations.

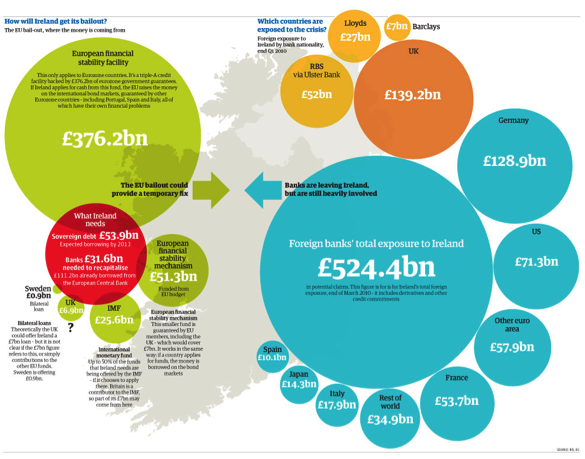

But while that is happening there is a lot of uncertainty, and markets hate, hate, hate uncertainty. Will the EU or ECB buy that bad bank debt off the books of the private banks? (Refer to the graph below to see where the debt is.) Who picks up the tab? German taxpayers? The Bank of England? Note that nearly $100 billion is owed to US banks. That is NOT chump change.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Britain is particularly exposed. What would it do to the pound if the Bank of England had to bail out British banks to the tune of almost $200 billion? Note that Royal Bank of Scotland and Lloyds are almost wards of the state, as it is. And the euro could come under intense pressure.

If eurozone leaders do not act, such a confrontation could spiral out of control rather quickly. Think November 2007. Think Bear Stearns and Lehman. Interbank lending could dry up almost overnight.

Will it happen? No one knows. But it should be on our radar screen. Here’s a side issue. If Ireland walks away, what does that say to Greek voters? Or to the Portuguese? Is it a one-off —Ireland just not wanting to back their bank debt — or could it be the first domino of a general debt restructuring? This we will need to watch. There. We thought about it.

Has China Found a Miracle Business Cycle?

Quickly, let’s look over the Pacific Ocean to China. They seem to have repealed the laws of business-cycle gravity, going from one fabulous growth year to the next. Most analysts are predicting another solid year of high single-digit growth. And that is the base-case scenario. But what if the unthinkable happens?

Official inflation is in the high single digits. Unofficial inflation may be running closer to 20%. Simon Hunt wrote last year:

“Our friends in Beijing talk about the daily cost of living rising at an annual rate of around 20%. In Shanghai gas prices to the home have risen by some 600% in two years and electricity by over 300%.”

More recently he wrote:

“The large increase in minimum wages announced after Christmas have two powerful implications. First, de facto, they suggest that actual inflation is higher than is being shown in the official CPI data; and, second, that China’s pool of surplus labor is drying up. The latter has important implications for wage inflation and the structure of manufacturing.

“Beijing announced an increase in minimum wages of 21%, after raising them by 20% in June this year. Across China every municipal authority has already raised its minimum wage with most only six months ago. Further hikes are possible early this year. Wage increases of this size are more than can be warranted by normal living adjustments. They reflect an abnormal rise in inflation and a tightening labor market.”

The Chinese central bank keeps raising reserve requirements for banks, and is slowly allowing interest rates to rise. Can the Chinese central bank engineer a soft landing with inflation so high?

I am not sure about this year, but I do know this: no country has ever figured out how to repeal the business cycle. Eventually there is a recession. And when China has a recession, the rest of the world will feel it, just as the world responds to a US recession. Recessions are just nature’s way of wringing out excesses. They are not permanent. In fact some research suggests that the longer a recession is delayed, the worse the excesses get. This is yet another situation we will need to give close attention.

As an aside, I think the inflation predicament China finds itself in will give the Chinese some reason and room to gradually allow the renminbi to rise against the dollar. And the country is to be applauded for recently allowing more free trading of their currency in the US. Eventually they will float their currency, as it cannot become a real candidate for a reserve currency until they do. But that is clearly what they would like to see. It is just a matter of time.

LA, Winnipeg, Las Vegas, and Thailand

If you are an investment advisor or broker, meet me in Las Vegas, where I will be speaking for my partner Steve Blumenthal of CMG on February 3-4. We have a very solid lineup, including Christopher Geczy, Ph.D. of Wharton, at the CMG Investment Forum. Go to http://cmgfunds.net/sys/docs/234/Feb%20Las%20Vegas%20Invitation.pdf to learn more.

I fly to LA tomorrow morning for some meetings with the execs at ISCO, and then attend a fundraiser with good friend Lee Stein for the Professional Baseball Scouts Foundation. Loads of fun for us baseball fans, with lots of Hall of Famers in attendance. I will be the groupie tomorrow night.

Next week I fly to Winnipeg, getting a lot of reading done on the way. Then on to Thailand, where I will be speaking in Phuket at a meeting of the execs of MGPA, a large real estate private equity group. After that, I take a few days to be a tourist in Bangkok with my old friend Tony Sagami, who now lives in Thailand. I have never been and really look forward to it.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Last week in Cabo was something special. What a fabulous time. I need more of those moments. I can’t resist showing a picture of Tiffani, Ryan, my granddaughter Lively, and your humble analyst. A very contented family that evening. If you look at Tiffani’s baby pictures when she was one, it is hard to see a difference between her and Lively. That bodes well.

Have a great week. And here’s to hoping for a smooth 2011.

Your hoping to keep warm in Canada analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin