Capital Formation and the Fiscal Cliff

-

John Mauldin

John Mauldin

- |

- November 26, 2012

- |

- Comments

- |

- View PDF

Your Perception Is Your Reality

Growth = Population Growth + Productivity Increases

Reduced Capital Spending

Bismarck, DC, New York, and Europe

In today’s economic environment, we often complain about volatility and uncertainty, but there is one thing I think we can be fairly certain of: taxes are going up. I constantly try to impress upon my kids, most of whom are now adults, that ideas and actions have consequences. In today’s letter we will look at some of the consequences of an increase in taxes. Please note that this is different from arguing whether taxes should rise or fall. For all intents and purposes that debate is over. As investors, our job is to deal with reality. We must play the hand we are dealt. Taxation is a complex issue, but let’s see if a few word pictures can help us understand what we face.

Two quick notes to begin with. The full video interview with David Krone and Rob Lehman, the chiefs of staff for Senate Majority Leader Harry Reid (D-NV) and Senator Rob Portman (R-OH), two of the key figures in the current budget negotiations, is now available online. This was not a debate but a thoughtful exchange of ideas and positions that occurred as part of our recent Post-Election Economic Summit. It is helpful to recognize that negotiations over the fiscal cliff were being conducted weeks before the election. Everyone knew what was coming, and the very professional staffs that are charged with coming up with a reasonable resolution to the issue were already hard at work, knowing that there would be a lot still to do after the election. Krone and Lehman are two men at the very center of that debate.

If you want to get some real insight into the congressional process, this is an excellent way to do it. I’m grateful that they agreed to sit down for this rather unprecedented sort of interview. You can watch the full interview. You can also view an edited version of the entire Post Election Summit, with Mohamed El-Erian, Dr. Gary Shilling, Rich Yamarone, Barry Ritholtz, Jim Bianco, Barry Habib, and myself. It has been getting rave reviews, and I trust it will be worthy of your time.

I’m also pleased to announce that my very good friend Dr. Lacy Hunt has agreed to do a special Fireside Chat with me on December 4. Regular readers of Outside the Box are quite familiar with Lacy. As always, we will cover a wide variety of topics, but I’ll make a point of getting his views on where the economy will be going for the next few years. Lacy is one of the finest economists I know. I am always amazed at the breadth of his knowledge and the depth of his insight. This webinar will be available to members of the Mauldin Circle. If you have already joined, you will get a notice of the event details. If you have not yet joined, you can go to www.mauldincircle.com. This webinar is sponsored by my partners at Altegris Investments and is for accredited investors. (In this regard I am president and a registered representative of Millennium Wave Securities, LLC, member FINRA.) Now, shall we dive off the fiscal cliff?

Your Perception Is Your Reality

There’s a very interesting article in The Atlantic this week, called “How Partisans Fool Themselves Into Believing Their Own Spin.” While the author, Alesh Houdek, engages in some spin of his own, he makes some very good points that we should keep in mind not only as we look at the potential effects of a tax increase but as we tackle new ideas and accompanying “facts” in general. And he has pointed us to a very interesting study, or at least it’s interesting for those of us who are fascinated by behavioral psychology and behavioral economics:

We weigh facts and lines of reasoning far more strongly when they favor our own side, and we minimize the importance and validity of the opposition's arguments. That may be appropriate behavior in a formal debate, or when we're trying to sway the opinion of a third party. But to the extent that we internalize these tendencies, they injure our ability to think and see clearly. And if we bring them into the sort of open and honest one-on-one political debates that we'd like to think Americans have with each other, we strain our own credibility and undermine the possibility of reaching an understanding.

A defense attorney presents the best case for his client's innocence in court, but he's realistic with himself about what he believes the truth of the matter is. Too often in political arguments we have drunk our own Kool-Aid.”

A recent report on three psychological studies by professors from the University of California, Irvine confirms this bias, and points out that it's pervasive across a wide range of human situations. Where our moral judgements come into conflict with evidence, we look for ways to dismiss and minimize the evidence:

Quoting from the report:

“While individuals can and do appeal to principle in some cases to support their moral positions, we argue that this is a difficult stance psychologically because it conflicts with well-rehearsed economic intuitions urging that the most rational course of action is the one that produces the most favorable cost-benefit ratio. Our research suggests that people resolve such dilemmas by bringing cost-benefit beliefs into line with moral evaluations, such that the right course of action morally becomes the right course of action practically as well. Study 3 provides experimental confirmation of a pattern implied by both our own and others' correlational research (e.g., Kahan, 2010): People shape their descriptive understanding of the world to fit their prescriptive understanding of it. Our findings contribute to a growing body of research demonstrating that moral evaluations affect non-moral judgments such as assessments of cause (Alicke, 2000; Cushman & Young, 2011) intention (Knobe, 2003, 2010), and control (Young & Phillips, 2011). At the broadest level, all these examples represent a tendency, long noted by philosophers, for people to have trouble maintaining clear conceptual boundaries between what is and what ought to be (Davis, 1978; Hume, 1740/1985).”

This next paragraph is critical. Read it twice.

The studies further show that this effect is stronger in well-informed, politically engaged individuals. The more information we have, the higher our propensity to cheat with it. I've been talking to a lot of people on both sides of the election, and the thing I'm often struck by is an inability to find any validity in the opposing side's arguments. By blocking our ability to have meaningful conversations, this effect is actually harming political discourse.

Given that my readers are just about the most well-informed and politically engaged group of people anywhere, we have to make a special effort to think through controversial topics. I make the effort to constantly question my assumptions and to read people I don’t agree with. That is why Outside the Box (which highlights the writing of other analysts and thought leaders and is now published in Friday afternoon) features such a wide variety of thinking. And few things are more controversial than the coming tax increase. So let’s walk through a few ideas now and come to some conclusions independent of our biases.

Growth = Population Growth + Productivity Increases

It would be hard to find someone who does not agree with the proposition that we need more jobs. The dismal unemployment rate is at the forefront of any debate on the future of the economy, and everyone has a plan to stimulate job growth. And while government jobs are “real” jobs, they require taxes from the private sector or borrowing from future growth in order to pay salaries. By definition, then, when we say we want more jobs what we really mean (or should mean) is that we want more private-sector jobs.

Private-sector jobs do not appear by magic; they require someone to produce a good or service that other people will pay for. Typically, that requires putting in place some form of equipment and/or capital goods so that people can produce the new good or service. To do what I do, I need a computer, an internet connection, web servers, editors, production staff, and a coffee maker. While I typically sit alone and write, it takes a horde of people to produce all the goods and services that make it possible for me to run my business. Where would I be without American Airlines? Telephones? Email? I expect 1,000 things to work seamlessly so that I can sit and write my letter and eventually hit the send button and expect it to pop into your inbox.

The same is true for millions of businesses worldwide, both small and large. And while I hope that my own small part of the economy will grow faster than US GDP, the mathematical reality is that we’re all in this together. Individual businesses will fail or succeed on their own, but overall growth is by definition a joint venture. An economy that is growing is an economy that is producing more jobs. To produce more jobs requires an investment of time and materials on the part of individuals and/or businesses. That takes money. Whether it comes from your own savings or those of family or friends, or from a bank or your friendly vulture capitalist (that would be me, when I get the chance), starting and maintaining a business requires capital. In a very real sense, capital is the engine of growth. And whatever manifestation it may take, capital is essentially savings in one form or another.

Let’s do a very quick review. Long-time readers know that there are two, and only two, ways to increase gross domestic product and grow an economy. You can increase your population or you can increase productivity. That’s it. That’s the recipe for the secret sauce that all politicians seek.

Jeremy Grantham (one of my favorite analysts) wrote in his recent client letter:

The demographic inputs peaked around 1970 at nearly 2% a year growth (there are many ways to do these calculations, each yielding slightly different results). They fell to about 1% average growth for the last 30 years and demographic effects are now down to about 0.2% a year increase in man-hours where they are likely to remain until 2050, with possibly a very slight downward bias. Unusually for things economic, these estimates are much more likely than the typical estimates to be quite accurate, for much is derived from the existing population profile and social trends, which, like birth rates, change very slowly. The only variable that is quite likely to jump around unpredictably is the U.S. immigration policy.

Sidebar: This is why I have written that at some point in the future even politicians will realize that the most valuable import we can find is young, educated immigrants. Second would be young immigrants willing to work. The current immigration policy of the US, continued under multiple administrations, is puzzling and pointedly anti-growth. We need to give anyone who gets a degree from a US university a green card with his diploma. And our embassies should be making it easy for the best and brightest to find a way here. And a dozen other things need to be done. But that is another letter.

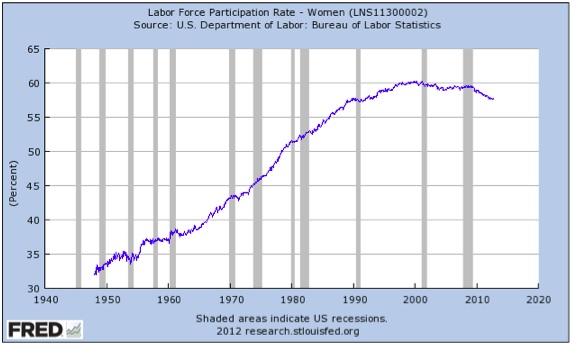

Grantham noted that a large part of our productivity growth has come from the increased participation of women in the labor force, an increase that begin to decline in 2000, not coincidentally, he says, with the decrease in average annual GDP growth. Here is a chart of the labor participation rate of women, from the FRED database:

Couple that demographic reality with a declining number of hours worked (which feeds into productivity), and you begin to partially account for and understand why the growth of GDP has been less than 2% for the last 12 years, a far cry from the 3.25% it had been for the previous few hundred years. Throw in a deleveraging economy, and you have even more headwinds to growth. Leverage on the way up helps add to the capital base, but decreasing leverage slows growth. Grantham does his work to suggest that the growth of US GDP will be less than 1% over the next 18 years. I am not so pessimistic, but neither do I think we will attain 3% growth for quite some time to come. Given the current realities, I would be happy with 2%.

Now, let’s talk about capital formation and tax increases. It seems that a number of people agree that taxes should be raised on millionaires. I’ve been on several panels and in numerous conversations where participants adamantly maintained that raising taxes on the “rich” would have no impact on the economy. I want to do a thought experiment with you and let you decide if there will be an impact.

Please note that this is not an argument for or against raising taxes. It may very well be in the common interest to raise taxes from where they are today. Remember the report on psychological bias we looked at briefly at the beginning of this letter. If you start with the assumption that raising taxes is either bad or good and then look for facts to support your belief, you will not help come to an unbiased conclusion.

Let’s start with your typical millionaire individual. For the ease of our math, let’s round off the numbers. The top federal tax rate is 35%, plus Medicare and property taxes, sales taxes, state and local income taxes, school taxes, etc. Depending on whether the individual owns a business, he or she may pay both sides of the Medicare tax. Let’s assume our millionaire pays 40% “all in” on his $1 million income. That leaves him with $600,000. Note that in some states and cities this could be much closer to $500,000. And some people will pay less. The numbers will change somewhat, but the logic will remain intact.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Let’s assume that our intrepid millionaire spends $300,000 maintaining his lifestyle, leaving him with another $300,000 to save and invest. (I’m also assuming he doesn’t have seven kids in private school, but that’s another story.)

Now, let’s raise his taxes by 5%, which is somewhat less than the likely increase in income taxes and Medicare taxes currently being discussed. Clinging gamely to his lifestyle, our millionaire now has $250,000 to save and invest. This still sounds like a lot to most people, and it is. But the economy now has $50,000 less in gross national savings.

Whether his taxes are 45% going to 50% or 55% going to 60% (think NYC), our millionaire will accumulate less capital over time. And that has to make a difference. How can it not?

Whether or not our individual millionaires decide to put her savings into bonds or to plow them back into her personal small businesses or any of a hundred other things she could choose to do with this money is immaterial. In the aggregate, when you add all the millionaires together, there is now less money available for capital formation. To think that their actions will be exactly the same as they would have been with 20% more money is ludicrous. They may still put money back into their businesses or invest in other businesses, but the simple fact is that they have less money to do whatever it is they want to do.

If they cut back on spending in order to maintain their savings and investment portfolios, then the merchants who sold them goods and services will have less. Yes, that money will be spent by the government on other goods and services, and to that extent it will show up in GDP. But to argue that there will be no impact on savings and investment and thus capital formation simply makes no sense.

As I’ve repeatedly written, the preponderance of academic literature suggests that there is a hit to the growth of GDP from raising taxes. That is different from saying that the raison d'être for all taxes should be their effect on GDP growth. Certain taxes (and spending) may very well be worth the resultant lower growth in capital formation and thus GDP. Healthcare comes to mind.

Given the high correlation between the growth of the stock market and the growth of GDP, as investors it behooves us to pay attention to things that affect GDP. At the very least, our long-term expectations for GDP growth should affect our investment decisions. But without knowing the exact amount or nature of the tax increases to come, whether they will be from actually raising rates or from eliminating deductions, it is hard to say what the effect on the economy will be. Not all taxes have the same multiplier. Income taxes seem to have a higher multiplier than consumption taxes, as an example.

That being said, increasing taxes will drag down GDP growth in both the short and long term. The longer-term effect will be a decrease in available capital. That $50,000 that our millionaire does not have this year? Over ten years it becomes $500,000, and even more if the money is well-used. But if those funds cannot be invested in productivity-enhancing tools, services, and businesses, there will be fewer jobs and reduced consumption down the line. There are consequences. As a country, we must decide whether to pay that price.

But for sure, an increase in taxes will lower the savings rate. If it does not, then it will lower consumption. Either is bad for the economy. But let’s focus on capital formation.

Reduced Capital Spending

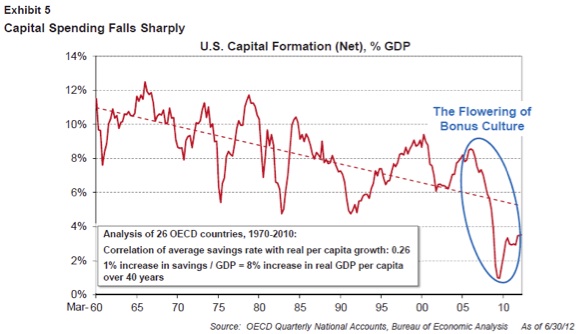

I want to quote one last section from Grantham’s letter. It is part of his work explaining why he expects less growth over the coming decades than we have seen in the past. He notes the reduced capital spending and capital formation in the developed world. Let me hasten to add that he does not say anything about tax increases, nor does he draw the conclusions I have. What he does speak to is the importance of capital formation and productivity:

Typically I see less significance than others in debt and monetary factors and more in real factors. When someone says that China is building its trains and houses on debt I think, “No, they are built by real people with real bricks, cement, and steel and whatever happens to the debt, these assets will still be there.” (They may fall down but that’s a separate story; you can build a bad high rise with or without debt). So I take the quality and quantity of capital and people very seriously: they are the keys to growth and a healthy economy. A badly trained, badly educated workforce is a problem we will get to, but reduced, abnormally low capital investment, particularly in the U.S., is the current topic. My friend and economic consultant Andrew Smithers in London has a theory deserving much more attention in my opinion, and that is his concept of the “Bonus Culture.” When I was a young analyst, companies like International Paper and International Harvester would drive us all crazy, for just as the supply/demand situation was getting tight and fat profits seemed around the corner, they and their competitors would all build new plants and everyone would drown in excess capacity. The CEOs were all obsessed with market share and would throw capital spending at everything. It might not have been the way to maximize an individual company’s profit but it was great for jobs and growth. Now, in the bonus culture, new capacity is regarded with great suspicion. It tends to lower profitability in the near term and, occasionally these days, exposes the investing company to a raider. It is far safer to hold tight to the money and, when the stock needs a little push, buy some of your own stock back. This is going on today as I write, and on a big scale (approximately $500 billion this year). Do this enough, though, and we will begin to see disappointing top-line revenues and a slower growing general economy, such as we may be seeing right now.

My colleagues have put together Exhibit 5, which shows the long-term history of capital spending for the U.S. (The savings and investment rate has a 25% correlation with long-run GDP growth.) Mostly the data in Exhibit 5 reflects a lower capital spending rate responding to slower growth. The circled area, though, suggests an abnormally depressed level of capital spending, which seems highly likely to be a depressant on future growth: obviously you embed new technologies and new potential productivity more slowly if you have less new equipment. This currently reduced investment level appears to be about 4% below anything that can be explained by the decline in the growth trend. If this decline is proactive, if you will, and not a reflection of earlier declines in the growth rate, then based on longer term correlations it is likely to depress future growth by, conservatively, 0.2% a year.

All the participants in last week’s Post Election Economic Summit were either calling outright for a recession next year or were not optimistic. Count me in the latter camp. It is clear that taxes on every worker will go up, because the “tax holiday” of 2% of the total Social Security payment is going to be removed. That is $1,000 per year for someone making $50,000. This tax cut was put in place because everyone agreed it would stimulate the economy. While no one is talking about it, the effects are just as great in the downward direction when the tax comes back. They just are. The total is about 0.75% of GDP. Given your academic view on tax multipliers, that the total effect can be anywhere from 0.75% to more than 2% of GDP.

Anyone arguing that tax increase has no effect now should have said publicly that cutting that tax would have no effect two years ago. Just saying.

Add in whatever other tax increases or spending cuts will accompany the Social Security tax increase (you can call it what you want), and an economy that is barely growing at 2% could be in for a very slow period. Not the stuff that job growth is made of. Further, businesses will have increased costs under Obamacare. Some costs kick in quicker than others.

ANY further hit from Europe or Japan could call into question global growth. We are an interconnected world, and what happens in those nations will affect us. While I might feel differently if I were a German or Dutch or Finnish voter, those of us in the US should stand up and applaud whenever the eurozone postpones a crisis. At our Summit, Mohamed El-Erian was very clearly worried about the crisis in Europe. (He was on fire. We will post his entire portion of the Summit later this week. I will let you know. You do want to watch it.)

Any hit to Europe will likely push the US into recession. It is an uncomfortable place to be when you need Europe not to have a crisis in order for your own economy to keep growing. I keep wondering how long Europe can keep kicking that can.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

All of which feeds into a theme that Barry Ritholtz brought up. He was more concerned about what he called an “earnings cliff” than a fiscal cliff. And earnings are part and parcel of GDP. We know what happens to earnings in a recession. And to employment and to budget deficits. We have only to look at Europe to see what happens when too much austerity is applied too fast. Slow and steady should be the rule. I am deadly serious about going on a fiscal diet; I just don’t want to try and lose it all at once.

Bismarck, DC, New York, and Europe

I will be going to Bismarck, North Dakota this week to speak to the clients of BNC National Bank. I will be speaking on Friday, but Greg Cleveland, the president and CEO of BNC, has graciously offered to take me on a tour of the Bakken oil and gas fields on Thursday. The tour guide for the day will be Loren Kopseng, majority owner of United Energy Corporation and one of the foremost experts on the Bakken. They have chartered a helicopter for the day, and I intend to take notes and report back to you. Maybe there will be a few pictures as well. This is one of the truly great economic stories of the past decade. Shale oil in the US has contributed (by Grantham’s estimate) about 0.3% of growth to GDP, and he expects that to rise to 0.5%. That’s a large chunk of the growth we have recently seen. If we really unleashed the tiger with a proactive energy policy, we could do even more. And natural gas is far kinder to the environment than coal. And then there are the knock-on effects of allowing all sorts of other industries to thrive.

I am taking my middle son, Chad, with me, and he will explore job prospects in Bismarck while I take my tour. He likes the idea of working in the oil fields and seems to think the cold won’t be that bad. I think the oil fields are one place where there will be jobs for quite some time. We’ll see how that works out.

On Friday, if all the flights go off on time, I will be back in Dallas to hear Andrea Bocelli. His music can transport me to a place of peace and quiet joy. For those who don’t know Bocelli, he lost his sight at age 12 but continued to grow as a singer. Since 1994 Bocelli has recorded thirteen solo studio albums, of both pop and classical music, two greatest-hits albums, and nine complete operas, selling over 80 million records worldwide. He is the biggest-selling solo artist in the history of classical music and has helped the core classical repertoire to "cross over" to the top of international pop charts and into previously uncharted territory in popular culture.

If you haven’t had the pleasure, get his first greatest-hits album. I have been to one of his concerts and was blown away. I bought tickets the first hour when this one came up in Dallas. Here is one of my favorites, “Con Te Partiro”: http://www.youtube.com/watch?v=tcrfvP11Hbo.

And here is a link to a quick interview I did with Deirdre Bolton on Bloomberg this week. I thought it came off well.

I am off to Europe in January, with the first week in Oslo, Copenhagen, and Stockholm for Skagen Funds. Quite the tour, and I get a few hours in Oslo to play tourist, hopefully when the sun is up! J Then it’s off to Ireland to be with that raconteur masquerading as an economist, David McWilliams. Three days of laughs and fun meetings, then on to London for a day of meetings and to attend the Societe Generale conference and perhaps have dinner with a few friends. Then off the next day to Greece with Dylan Grice (of Soc Gen), before ending up on Sunday back in Geneva. It will be interesting to contrast Ireland, the good “problem child,” with Greece, the bad boy. Just saying.

Time to hit the send button. Somehow, I manage to schedule meetings on days when I write this letter. It’s 4 AM and I will need a little sleep. You have a great week. Think of me trying to stay warm, and smile.

Your how can the Mavs be so good and so awful in one week analyst?

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin