Forecast 2013: Unsustainability and Transition

-

John Mauldin

John Mauldin

- |

- January 14, 2013

- |

- Comments

- |

- View PDF

Unsustainability and Transition

One Bubble to Rule Them All

The Year of the Windshield

Godzilla Redux: Disaster A or Disaster B

France Is the New Greece

US: The Crisis Games

Entitlement Unsustainability

London, Athens, Geneva, Toronto, and New York

“There are decades when nothing happens and there are weeks when decades happen.” – Vladimir Ilyich Lenin

"People only accept change when they are faced with necessity, and only recognize necessity when a crisis is upon them." – Jean Monnet

"If something cannot go on forever, it will stop." –Herbert Stein

As we begin a new year, we again indulge ourselves in the annual (if somewhat futile) rite of forecasting the year ahead. This year I want to look out a little further than just one year in order to think about the changes that are soon going to be forced on the developed world. We are all going to have to make a very agile adaptation to a new economic environment (and it is one that I will welcome). The transition will offer both crisis and loss for those mired in the current system, which must evolve or perish, and opportunity for those who can see the necessity for change and take advantage of the evolution.

This is my most-read letter of the year, by the way, and if you’re not yet a subscriber you can join my “one million best friends” and receive both Thoughts from the Frontline and my other weekly letter, Outside the Box, as well as Grant Williams’ rollicking Things That Make You Go Hmmm…, all for free, by simply entering your email address on my site: http://www.mauldineconomics.com/go/bwbsl/MEC

Unsustainability and Transition

Think back to 2001. It was the opening of a new millennium. While that was auspicious enough, several events then ensued that shaped the future for decades to come. China was admitted to the World Trade Organization, leading to a revolution in its production and global trade. The euro was launched with much fanfare – and a minor chorus of criticism. We are now in a midst of a great trial that will determine whether the euro will be a brief experiment or a durable currency. This has dramatic implications not only for Europe but for the world. And, of course, the tragic events of 9/11 shaped a new global perception of what constitutes threats to democracy and security.

Also as the century opened, a secular bear market had just begun, which diminished returns for retirees. Economic activity in the developed world has yet to recover to the pace of the previous century; and many analysts, as we saw in the last letter for 2012, predict an even slower pace of global growth for the rest of this decade. A fear of deflation prompted Alan Greenspan to lower interest rates to levels that eventually created a housing bubble and encouraged Congress, through lower debt costs, to run up huge deficits prior to the economic collapse of 2008. Since then, our deficit and debt have only gotten worse since.

You can read all sorts of economic predictions for this year. Some expect a return to the growth rate of last century and a new bull market. Some see a recession, a major downturn. But no matter what your view of the next 12 months, there is a pervasive sense that the current system of swelling government debt and entitlement promises cannot be sustained. Politicians may persist in kicking the can further down the road, but anyone with third-grade math can see that the system is unsustainable. The US cannot pay an estimated $200 trillion (and growing) in entitlement obligations (Burns and Kotlikoff, The Clash of Generations), although others say that we owe a “mere” $80-plus trillion. Japan cannot continue to borrow 45% of its government budget at 1% when debt is at 230% of GDP and rising over 10% a year. Europe cannot postpone the consequences of an unequal currency union forever.

We live in an unsustainable world. To extend the thought of Herb Stein, we must change the world to one that will be more sustainable. That has been an implicit theme in this letter for years, but this year it will be an explicit theme that we will visit often. That transition to a more sustainable world is going to involve uncomfortable changes for many, if they do not prepare for it.

At the outset, let me state that this “unsustainability” is not a reference to the Malthusian arguments that the world is running out of food, energy, or the other necessary commodities to insure economic progress for a growing world. I reject those arguments. I have a great deal more faith than that in our ability to transition to new forms of food and energy production. I am in fact quite optimistic about the future of the world. No one will want to go back to the good old days of 2013 in 2033. Our age will seem a quaint time of poor health care (“Can you imagine, people died of cancer back in those days?”), scarcity, and a soul-sappingly dreary manufacturing system. The transition we are undertaking to a new world of innovation and technology will be unsettling to many people, but those changes are by and large positive ones, and they will be welcome.

As I was finalizing this letter, my friend Barry Ritholtz at The Big Picture sent this note:

The deficit scolds have been warning for years that hyperinflation is imminent. I have been hearing these ominous warnings my entire adult life. “This is unsustainable! Inflation is about to explode!” But inflation has been rather tame, and we are not experiencing anything remotely like hyperinflation. They keep using that word “unsustainable,” but with all due respect to Inigo Montoya, I do not think that word means what they think it means.

I am definitely in the deficit (and debt!) scold camp, but I give little credence to the US hyperinflation believers. Very different animals. I also believe that we can get the deficit under control if we so choose – or the market may force us to do so.

One Bubble to Rule Them All

The unsustainability I refer to is that of the largest bubble in human history: government debt in tandem with government promises that cannot be fulfilled. And unlike 1993 when only the developed countries of Canada and Sweden had to deal with unsustainable debt, bloated budgets, and unrealistic promises, this time the bubble countries comprise the largest economies and the majority of global GDP.

This is not a short-term matter. There are three distinct economic ecologies that will have to change and will do so on their own timetables. And owing to their size and the significant abilities of a committed establishment to resist change, no matter how inevitable, we are talking years of transition, not months.

The economic ecologies I refer to are of course Europe, Japan, and the United States. One could argue that a fourth center of unsustainability exists: China. However, I am not convinced that anything more than the usual garden-variety recessions are in store for China.(I’m not forecasting Chinese recessions, just pointing out that not even the Chinese can repeal the business cycle forever).

We will not get into detail on each of the three economies mentioned but will touch on each. And I’ll end with a note on where investors should look to make the transition a new era of sustainability. Let’s start with Japan.

The Year of the Windshield

Back in late November and December I commented in several radio and TV interviews that the title for my annual forecast issue would be “The Year of the Windshield.” I changed the actual title only recently as I thought more about the upcoming year in its totality, but perhaps the most dramatic shift this year will be that Japan at last begins its descent into that dark night, from the twilight that has been its economy for 20 years. The subtitle comes from my book Endgame, where I whimsically titled a chapter “Japan Is a Bug in Search of a Windshield.”

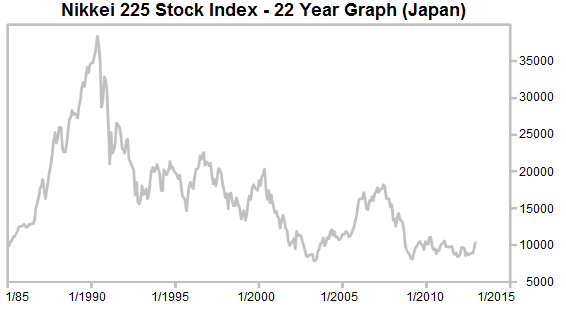

The problems, which we will look at briefly in a few paragraphs, are well known. Yet Japan has soldiered on, borrowing yet more massive amounts of money, never bringing its budget into line, spending huge amounts on stimulus and infrastructure, and muddling through with an economy that is no bigger today than it was 20 years ago. Japan’s stock market is still down some 75% (give or take) over the last 23 years, though some were celebrating a 23% move last year. Given the frustration that investors have endured from the Nikkei over that time, I suppose you take solace when and where you can. The chart below is current as of this week. You can get more details on the index performance over the last two decades at http://www.forecast-chart.com/historical-nikkei-225.html.

Japan now has a breathtaking 230% ratio of government debt to GDP (the last estimate I have seen), and it is growing at 10%-plus a year. The government will borrow almost 45% of its budget this year. Has there ever been a more clear disaster in the making? Yet shorting the Japanese bond has been called “the widow-maker.” I think it was Soros who once quipped that you can’t call yourself a global macro trader until you have lost money shorting JGBs (Japanese government bonds).

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The new Japanese government, led by Prime Minister Abe and former Prime Minister and now Minister of Finance Aso, have very explicitly demanded that the Bank of Japan target 2% inflation. They have made clear their intention to replace the governors of the current BoJ board with members who agree with this policy. They have the political clout to do so. Whether at the upcoming meeting or after April, when a new head of the BoJ is appointed, that is going to happen. These moves mean there will be a massive printing of yen. In response, the yen has already weakened by over 10%.

You can control the quantity of money or the price of money but not both. (Yes, I know that one influences the other, but I am referring here to large-scale printing of money.) One has to assume that the law of gravity will not be repealed and that investors will want something more than 2% on the ten-year bond if inflation is at 2%. If the ten-year bond were to rise by 2%, Japan would soon be spending over 50% of its tax revenues on the interest carry alone. I submit that this is not a workable business model.

Why now and not sometime during the past ten years? I see a number of factors coming together this year:

1. The Japanese had a 15%+ savings rate in 1990. That is now down below 1%. (Exact numbers are difficult, because Japanese data on this topic has severe lags, and thus my number is an extrapolation but a reasonable one, I think.) Due to the nature of their retirement system, they have channeled the vast bulk of these savings into JGBs. When the savings rate goes negative or is no longer sufficient to buy all the issued debt, the choice will be to monetize the debt or cut spending. The latter choice does not appear to be part of their national conversation. Cutting spending by the amount required will mean a serious recession and further deflation, an option the new government explicitly rejects.

2. Both the trade deficit and the current account have recently turned negative. The vaunted Japanese export machine seems to have hit a wall, and this will limit options in controlling the price of the yen, even if the government wants to. Understand, inflation targeting is also currency-valuation targeting. They clearly want the yen to devalue. I have been writing for years that the yen would eventually be 125, then 150, then 200 to the dollar. It has been 300 in my lifetime, and unless the Japanese change direction, there is no reason it can’t get there again. This means that Mrs. Watanabe will see her energy bills double. This will call into question the Japanese decision to close their nuclear energy plants – something that Abe is already reconsidering.

Think the Koreans will be happy when you can buy a Lexus cheaper than you can buy a Kia? (Disclosure: I love my Japanese Infiniti, the first “foreign” car I have bought, except for a two-month dalliance with a disaster of a Volkswagen 30 years ago.) Think Samsung and LG will be happy when Panasonic and Sony can eat their lunch pricewise? Welcome to the era of real currency wars.

Today this note is worth about $11. In the future? Not so much.

Godzilla Redux: Disaster A or Disaster B

Japan is now committed to either Disaster A or Disaster B. Remember those really bad Japanese “horror” movies of the ’50s and ’60s? Godzilla first released in 1954, and there were dozens of remakes and follow-on movies. It seemed endless. And while the current government policy will not trash downtown Tokyo, it will seriously damage the savings and buying power of two generations. Disaster A is monetization, which is clearly not good when the Japanese want to buy anything not made in Japan (like energy, steel, commodities, a lot of food, etc.) Disaster B is the deflationary depression that budget balancing will yield. Which leads us to the next factor:

3. Once the government is committed to the new strategy, any retreat will cause a market upheaval. This is not a short-term commitment. It seems to me that the Japanese truly believe that their lack of economic growth can be solved through inflation. Their politicians seem to be channeling their inner Paul Krugman, or at the least taking Bernanke’s advice from 2000, when he published a paper called “Japan’s Slump: A Case of Self-Induced Paralysis?”

When your debt and deficit are as massive as Japan’s, the only way to resolve the issue is to inflate away the debt or willingly enter into a depression. They obviously think they can control both the debt and inflation.

This means you should NOT run out and short Japanese government bonds. Repeat, NOT. The only way for the Japanese to make their plan work without having to battle the Godzilla of a destitute bond market is for the BoJ to move out the yield curve and monetize the debt. They will eventually hit all bids on JGBs. For all intents and purposes, the BoJ will become the yen bond market. You will get all the yen they promised when you bought those bonds … but the contract never stipulates what those yen will actually buy.

The plan is evidently that, with a little inflation, they will jump-start the economy; and with growth they can eventually balance the budget and return to a normal bond market. Rots of ruck, guys.

Just a couple years ago this letter seemed as if it was All Greece, All the Time. Since Japan is, say, about 100 times more important than Greece, we will be revisiting it at length in the coming months. But before we move on,three notes:

First, some full disclosure. Even though I have been suggesting that Japan is a “bug in search of a windshield” for almost three years, I have not actually put any money on the table. Until this month. I have now invested a sizeable portion of my pension funds into a short Japan strategy (not simply a short yen and clearly not a short JGB strategy) and will increase that position as time goes on. This is going to be a long-term trade, so no need to rush out and short the yen this morning. Please don’t. Think about this. There is little difference between 90 yen to the dollar and 100 yen, with a target of 200 or more – at least if I am right. If I am wrong, which is quite possible, then the name “widow-maker” will once again be appropriate. I am not suggesting that you do anything, just start your investigation. I will be writing more soon. And for the record, I will be putting this trade on slowly, because the yen market and the Nikkei have moved a lot already. I think this may be one of the most asymmetrical trades I have seen, but this will require endurance, not speed..

Second, the results of this whole Japanese central bank kabuki theater piece will serve as a warning to other governments (especially the US Fed and Congress) not to attempt to reproduce this strategy. Right now, though, it seems to them like a good idea. And this is precisely the policy urged by Paul Krugman. Conveniently, Japan is getting ready to conduct a massive experiment based on Krugman’s ideas. While Krugman has only his reputation on the line, there are 127 million Japanese who have real skin in the game. If Krugman does not think that monetization is appropriate, he should publicly say so now. No Monday-morning quarterbacking allowed. And since I am in Spain tonight, I request that he show some huevos. Go explicitly on the record.

It would be nice to know just how much monetization Krugman thinks is enough. At what point should the Japanese stop? Four percent inflation? Six percent? 200 yen to the dollar? 250 or 300? Should they continue until the economy is growing at 2%? 4%? How should they then withdraw from monetary stimulus? Will withdrawal cause a recession when they do? Do deficits matter at all? Is there a theoretical limit to monetization and stimulus if the economy is sputtering? Of if withdrawal of monetary stimulus is likely to cause a recession and economic hardship, should it be continued past “normal” bounds? What are those boundaries?

If the Japanese strategy (as I think I understand it) is successful, then I will have to lay my right hand on a copy of the General Theory and convert to the gospel according to John Maynard Keynes, as interpreted by his disciple Paul Krugman. If the facts change then I suppose I must change, too. But the jury is out on this one. The world will be watching.

And finally I should note, all humor aside, that I recognize this is not a B-grade disaster movie. This is as real as it gets for Japan and its people. The Japanese are hard-working and clearly brilliant business people. They are not doomed. They will be forced to adapt, but they have done this before, as have many countries. I wish them well, I truly do.

France Is the New Greece

Four years ago I wrote about Greece, and two years ago I wrote about Spain (in detail in Endgame). I was early both times. I was looking at the math of their budgets and only saw the numbers, staring me in the face. For the record, France is on its way to becoming the new Greece. Not in the same way, of course: France will blaze its own path to economic chaos. Hollande seems to have a good mental map for that journey and a good head start. I am early again, but unless something very new and different unfolds, the die is cast.

If Greece causes heartburn for European politicians, what will economic chaos in France mean? There seems to be no polite word for even a soupçon of austerity in the French language.

The French are not going to meet their budget forecasts. They will lose their AAA rating, which they will claim is a conspiracy against them and completely unjustified. And when their interest rates climb by 2% they will demand that the ECB buy their debt, just as the ECB is doing for Spain and Italy. Watch the screaming when their rates climb above 4%. We will be told, “Four percent is clearly a temporary lack of market understanding and simply not rational.”

It is going to be interesting to watch how the Socialist government of Hollande tries to maneuver in the coming months and years. Will they try to cut spending? Where? Agricultural subsidies? Pensions? Move retirement (temporarily, of course) back to 62? (Zut alors!) Try and force the economy to grow with more deficit spending and borrowing and hope the ECB intervenes? Will French workers and farmers quietly accept austerity? Will Germany want to subsidize France? Is France a bridge too far for European solidarity? Stay tuned.

Paris was recently ranked as the most expensive city to live in. I can attest that the city is trop cher. I must admit that Paris is one of my favorite places in the world, especially in spring. I love going to my friend Bill Bonner’s place in Ouzilly, in the deep countryside of France. It is extraordinary. The only good thing that will come out of this debacle the French government is creating is that Paris is going to get a whole lot cheaper. Well, that and the total discrediting of socialist policy.

Europe has its own sustainability issues, which I have chronicled in the past, and we will of course visit them again. This will be a source of serious volatility in the coming year.

US: The Crisis Games

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

In my opinion 2013 is a make or break year for the US. If we are going to get the deficit on a glide path to balance, then it needs to happen this year. (I should note I have been saying 2013 since 2010.) 2014 is an election year, and it will be muy difícil to get anything of substance done then. Will Obama be any more willing to compromise in 2015? At that point I think it is too late and the bond market, having watched Japan and France and much of Europe descend into chaos, will simply begin to demand higher rates, no matter what the Fed does. If it doesn’t happen even sooner.

This American fiscal issue is first of all going to mean crisis after crisis if the Republicans are serious at all about the deficit. Will they blink, or will they allow the government to shut down? It was shut down twice in the 1990s. The world survived. I wish we had a more collegial system. Who knew we would be nostalgic for the era of Clinton and Gingrich?

Again, this letter is getting long and we all know the problems. I will write more on all this in future letters. But before we leave the issue, let me offer a suggestion to House Republicans and some thoughts on the unsustainability of entitlements.

First, let me humbly suggest that the House pass two budgets. Not one, two. First, pass one that assumes that current tax policy remains intact, but that puts us on a glide path to a balanced budget in seven years. Then pass one with the same goal but with sweeping, pro-growth tax reform. Like a 15% corporate tax but no deductions for anything. Total elimination of tax expenditures. Maybe get crazy and substitute a VAT for the Social Security tax. No halfway measures. Get radical.

Then send both budgets to the Senate with a note that says you will be glad to vote to extend the debt ceiling for a period of time, when they pass a budget the president will sign. After all, they have 55 Democratic senators. They do control the Senate. They have not passed a constitutionally mandated budget for three years. What’s to think they can pass anything? Stop negotiating with yourselves and make them put something on the table that the president publicly agrees with.

The debt ceiling then becomes the problem of the Senate and the president. They can get an increase any time they pass a budget that they can find just five Republicans to vote for. It doesn’t have to be one of your two options, but it does have to be something that is public. The Senate is supposed to be where compromises happen. So let them compromise, and then and only then sit down to talk.

In the meantime pass true immigration reform. Go the extra mile on this one. It is good policy and good politics. Pass any House Democratic proposal that makes even a little sense. Show some true bipartisanship. And no negotiating on the budget until the Senate passes a bill that Obama will sign. Then get serious and get it done.

A few final thoughts on the US. The tax increases are going to add up to more than advertised in the mainstream media, perhaps as much as 1.5% of GDP. This is not going to make for a robust first half. A quarter or two of outright recession is quite possible. At the least, growth will be very weak. And the hidden tax of increased healthcare insurance costs as a result of “Obamacare” will be more than 1% in the latter half of 2013, as insurance companies adjust to rising mandates and costs in 2014. Insurance companies are announcing major increases in premiums. My own company healthcare costs are up an eye-shocking amount. And for labor-intensive businesses? Workers are going to be left to the tender mercies of the new healthcare system.

Obamacare is going to be the mother of all bureaucratic nightmares to implement. I am in sympathy with the need for change in the healthcare system, but how we think we can radically adjust 15% of the US economy with no collateral damage to it is beyond me. On top of the tax increases, Obamacare will mean a very lackluster year for the US economy.

Entitlement Unsustainability

One of the things foremost in my mind is the unsustainability of entitlements, especially healthcare. We all know that Social Security can be resolved rather quickly, but healthcare is going to be difficult. Not the least of the problems is that Americans live manifestly unhealthy lifestyles. Data suggests we are actually 40% sicker than our European counterparts, which explains why healthcare costs so much more here in terms of GDP. Further, healthcare policy was formed in an era of big business and labor unions, and that time is passing.

As I was discussing this with Pat Cox tonight, he mentioned that Michael Barone used nearly those exact words in his op-ed today. I stopped and read it and found myself nodding in agreement. He noted a repeating 76-year cycle in American politics (only modestly forced) that suggests a new era is upon us. Not too far off from Neil Howe’s Generations cyclical thesis. You can read the whole column here. Let me quote from the ending:

The original arrangements in each 76-year period became unworkable and unraveled toward its end. Eighteenth-century Americans rejected the Colonial status quo and launched a revolution, then established a constitutional republic.

Nineteenth-century Americans went to war over expansion of slavery. Early-20th-century Americans grappled with the collapse of the private-sector economy in the Depression of the 1930s.We are seeing something like this again today. The welfare state arrangements that once seemed solid are on the path to unsustainability.

Entitlement programs – Social Security, Medicare, Medicaid – are threatening to gobble up the whole government and much of the private sector, as well. Lifetime employment by one big company represented by one big union is a thing of the past. People who counted on corporate or public-sector pensions are seeing them default.

Looking back, we are as far away in time today from victory in World War II in 1945 as Americans were at the time of the Dred Scott decision from the First Inaugural. We are as far away in time today from passage of the Social Security in 1935 as Americans then were from the launching of post-Civil War Reconstruction.

Nevertheless our current president and most politicians of his party seem determined to continue the current welfare state arrangements – historian Walter Russell Mead calls this the blue-state model – into the indefinite future.

Some leaders of the other party are advancing ideas for adapting a system that worked reasonably well in an industrial age dominated by seemingly eternal big units into something that can prove workable in an information age experiencing continual change and upheaval wrought by innovations in the market economy.

The current 76-year period is nearing its end. What will come next?

I can see multiple paths, but all must inevitably lead to some form of sustainability. Avoid the rush. Go ahead and begin adapting now!

By the end of this decade and probably much sooner we will have transformed the unsustainable current system into something more manageable. The secular bear market will have ended. Healthcare and medicine are due for a radical upgrade, and science-fiction-like technologies await.

The new era (I am searching for a name to call it) will be most welcome if you make plans to transition from where we are to where we are going. And this letter will chronicle the journey. Stay with me. For those of you who are interested in alternative investments to address the kinds of challenges we’ve covered here, I’ve written a piece on the global macro environment, which you can access at http://www.altegris.com/MauldinGlobalMacro. (In this regard I am president and a registered representative of Millennium Wave Securities, LLC, member FINRA.)

London, Athens, Geneva, Toronto, and New York

I am in the Costa del Sol of Spain tonight, where I decided to spend the weekend talking to the locals and exploring. Tuesday I fly to London for meetings and a rather cool gathering that is one of my favorite things to do: a dinner with interesting people. Then I fly off to Athens where I will meet Christian Menegatti, the managing director of research at Roubini Global Economics. We are going to spend three days meeting with business leaders, politicians, bankers, and just regular people, getting a feel for what’s happening on the ground. Drop a note if you want to meet later in the evenings at my hotel in Athens.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

All that, coupled with what I learned as the guest of Skagen Funds in our tour of Scandinavia, will be the topic of next week’s letter, which I will write from Geneva, amidst meetings with clients. (Which is why I stayed in Europe rather than going back to Texas just to return to Switzerland a few days later. And this “tour of duty” does not exactly amount to hardship.)

I will be in Toronto on January 28 for a speech with my Canadian partner, Nicola Wealth Management. Lots of media (times later) and meetings with long-time friend Rick Rule and Sprott Management. And of course a lengthy confab with Rosie (David Rosenberg). I will learn a lot, I am sure. Then it’s on to NYC on the 29th and possibly DC later that week before returning home for a time. You gotta love it.

I was in Sweden speaking to about 200 investors and money managers (lots of pension money) for Skagen Funds over lunch last Friday. Sweden, as noted above, went through its own crisis in 1993. I have talked with many Swedes involved in the markets at the time. I have not met anyone who enjoyed it, although when I asked that question during lunch I did see one person raise his hand. I found out later that he was a government bond trader.

I also asked, “Did anyone here propose in 1988 anything resembling what eventually became the difficult compromises of 1993?” I saw no hands raised this time. And if the US does not make the difficult choices today, then we will be forced to make disastrous choices not very far down the road. Taxes will be raised and healthcare and other spending cut far more than any of us can imagine. That is the time-honored pattern, and there is no reason to think the US is any different.

It is very early in the morning and time to hit the send button. Have a great week. I will take notes and report back to you.

Your feeling the need to learn Spanish analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin