Waving the White Flag

-

John Mauldin

John Mauldin

- |

- May 12, 2012

- |

- Comments

- |

- View PDF

Waving the White Flag

Viva Los Rescates Financieros de los Bancos

Contagion is Real

It Doesn’t End With Spain

New York, Atlanta, and Philadelphia

A common mistake that people make when trying to design something completely foolproof is to underestimate the ingenuity of complete fools.

- Douglas Adams, The Hitchhiker's Guide to the Galaxy

For quite some time in this letter I have been making the case that for the eurozone to survive, the European Central Bank would have to print more money than any of us can now imagine. That the sentiment among European leaders was that they were prepared for such a move was clear – except for Germany, which is haunted by fears of a return to the days of the Weimar Republic and hyperinflation.

When Germany agreed to a fixed monetary union and a European Central Bank, it was with the clear understanding that it would be run along the lines of the German central bank, the Bundesbank. The members of the Bundesbank and the German members of the ECB were most outspoken about the need for a conservative monetary policy that would keep a clamp on inflation.

However, as I have previously noted, the Bundesbank was a toothless tiger. Germany has two votes out of 23 on the ECB, and the loud drumbeat from most of Europe, which is experiencing the difficulty of austerity accompanied by too much debt, is for a far more accommodating ECB.

The simple fact is that Mario Draghi, the Italian president of the ECB, created €1 trillion euros to help fund European banks, which promptly turned around and bought their respective countrys' sovereign debt. Germany's Angela Merkel forced the Bundesbank to "play nice" and go along with what was seen as the only way to solve a growing banking crisis in Europe. Everyone breathed a sigh of relief, thinking that this at least bought a year during which things could be sorted out. But it turns out that a trillion euros just doesn't go as far as it used to. The "relief" lasted about a month. The last few weeks have presented yet another budding crisis, as least as large as the last one. Where to get the next trillion?

This week the German Bundesbank waved the white flag. The die is cast. For good or ill, Europe has embarked on a program that will require multiple trillions of euros of freshly minted money in order to maintain the eurozone. But the alternative, European leaders agree, is even worse. Today we will look at the recent German shift in policy, why it was so predictable, and what it means. This is a Ponzi scheme that makes Madoff look like a small-time street hustler. There is a lot to cover.

At the end of the letter I will mention a few upcoming speaking engagements, in Atlanta, Philadelphia, and a webinar I will be doing next week. Now let's jump over to Europe.

Waving the White Flag

It is the world's worst-kept secret: Germany does not want inflation but wants to abandon the European Union even less. And as we will see, the eurozone simply does not have enough money to keep itself together without massive ECB intervention.

"Cry havoc," wrote Shakespeare in Julius Caesar, "and let slip the dogs of war." The military order "Havoc!" was a signal given to the English military forces in the Middle Ages to direct the soldiery (in Shakespeare's parlance "the dogs of war") to pillage and incite chaos.

The cry is much the same in Europe today, though it is not the dogs of war that will ravage the land but the hounds of inflation. The English edition of Spiegel Online today carries a story with the headline "High Inflation Causes Societies to Disintegrate."

Spiegel Online explains:

"'Inflation Alarm!' reads the front-page headline in Bild, Germany's biggest selling newspaper. "How quickly will our money be eaten up?" the paper continues on page 2. "Millions of Germany [sic] are worried: Inflation is returning!" Just in case the message wasn't clear enough, the article is illustrated with a picture of a 1-trillion-mark note from 1923, the high point of German hyperinflation.

"The fact that Bild, arguably Germany's most influential newspaper, chose to run with the story in its Friday edition shows just how deep-rooted Germans' fears of inflation are. Nine decades later, the hyperinflation of the early 1920s still haunts the country.

"The panic-mongering was prompted by a statement by a senior official from the Bundesbank, Germany's central bank, to the finance committee of the German parliament earlier this week. Jens Ulbrich, head of the Bundesbank's economics department, said that Germany is likely to have inflation rates 'somewhat above the average within the European monetary union' in the future and that the country might have to tolerate higher inflation for the sake of rebalancing national economies within the euro zone.

"Ulbrich did not give concrete figures in his statement, saying only that it was important that inflation in the euro zone as a whole continues to remain stable, even if it rises in some countries and falls in others. Observers believe the Bundesbank may be reckoning with an inflation rate of around 2.5 or 2.6 percent."

If only they could be assured that inflation would be so mild. It is already at 2.1% in Germany. On Thursday, Finance Minister Wolfgang Schäuble, heretofore an inflation hawk of the old Bundesbank school, told reporters that inflation could go as high as 3 percent. "As long as we are ... in a corridor between 2 and 3 percent …we are in an area that is still acceptable," Schäuble said.

Bild wrote in the actual editorial:

"For 10 years, the euro was very stable and had lower inflation than the deutsche mark. But now the worst part of the financial and euro crisis is coming: creeping currency devaluation and inflation which could possibly continue for years. That's how counties want to wash away their debts. But it mainly affects (blue-collar) workers, employees and retirees. They are precisely the people who have borne the burden of solving the crisis and who have kept a cool head. That's unfair….

"Inflation gnaws at our trust in money, in our most important institutions, in politicians and in the central banks, which in German are dubbed 'guardians of the currency' for a good reason. Because they experienced it so bitterly, Germans know that in the end high inflation causes societies to disintegrate. It robs the individual of trust in the future, without which no country can thrive."

What brought on such a remarkable display of German forbearance? The threat of a complete eurozone collapse, brought on not just by Spanish banks (the present culprit) but what appears to be the dawining realization that this is about more than just Spain or Greece or Portugal or Ireland.

Viva Los Rescates Financieros de los Bancos

I have been writing for almost two years about the fact that the cajas, or Spanish regional banks, are worse than bankrupt. US banks are shut down when their nonperforming loans are at 5% of their capital. Spanish banks are at 20% and rising rapidly. My coauthor Jonathan Tepper and I spent a whole chapter in Endgame on Spain, at the end of 2010. This week the Spanish government basically nationalized Bankia, the nation's 4th largest bank, which had been cobbled together from seven failed cajas and given a large government guarantee and a €3 billion public-offering equity infusion. Only roughly half of its real estate loans are generating returns, and that is the number for public consumption.

"Aside from creating a financially unsound bank, the government also demanded an additional 30 billion euros worth of write-downs on loans – valuing 84 billion euros in total, when combined with the original requirement of 54 billion euros in write-downs. The combined write-down program is, however, unlikely to be sufficient to address the close to 180 billion euros in toxic assets held by Spanish banks. Furthermore, many of Spain's struggling banks will be unable to maintain the core tier-one capital ratio required by EU regulations without the government's assistance. Spanish banks will require an estimated 100 billion-250 billion euros in recapitalization later this year to reach this capital ratio target – a significant percentage of which will have to be shouldered by Madrid.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

"The government takeover of Bankia is a clear policy reversal for the conservative administration of Prime Minister Mariano Rajoy, who for months insisted that no additional public funds were needed for the banks. Intervening on Bankia's behalf demonstrates the failure of Spain's banking consolidation strategy." (Stratfor)

We are talking the need for new Spanish-government debt amounting to roughly 25% of GDP that will be needed just this year, and that's if things don't deteriorate beyond present assumptions in their real estate sector. Care to make a wager on how sound those assumptions are? About as sound as Rajoy's assessment, only a few months ago, that no public money would be needed, perhaps?

Let's do some basic math. Spanish banks took down some €352 billion in the LTRO (created by the ECB), or over 1/3 of the total amount. They have about €80 billion left after deposit outflows and buying sovereign debt. Which will be needed to buy yet more Spanish government debt, so they can be bailed out.

As near as I can tell, Spain is guaranteeing about $20 billion of the new IMF funds that will be used for a European bailout. Spain already has $332 billion of liabilities to the ECB, $125 billion to the stabilization fund, another $99 billion for something called the Macro Financial Asset Fund, and various guarantees for other bank and European funds, all of which totals over $600 billion, give or take. Their public debt-to-GDP ratio is only 69%, but add in these other guarantees and commitments and you get over 130% debt-to-GDP. And that is before they start bailing out their banks, and before any additional debt from their fiscal deficit, which is running at 8%.

(Yes, I know they say it will be around 5%; but they are in a deepening recession; unemployment is rising at an alarmingly high rate, which lowers revenues and increases government spending; and their bond costs are rising. Care to take the over/under bet on, say, a 7% fiscal deficit? You get to be the under. Hmmm, I don't see many hands out there.)

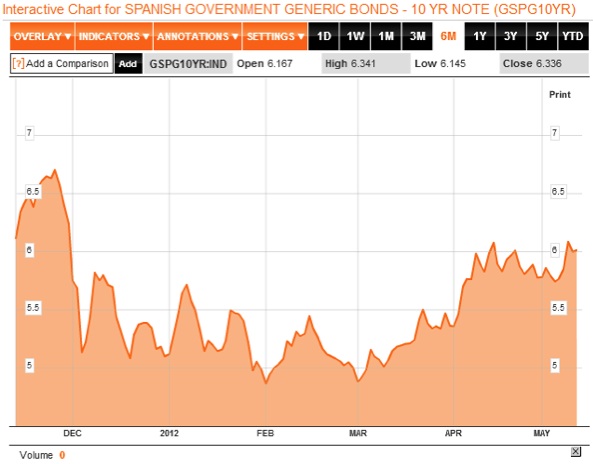

Look at this chart of ten-year Spanish bonds:

Notice that rates came down when the LTRO was issued and Spanish banks had the money to buy Spanish government debt. Why would they buy it? Because they got to borrow money from the ECB at 1% for three years and could make a very fat spread. Making a "free" 4% is a tried and true way to garner profits that can be used to offset losses.

Once the LTRO was done, Spanish interest rates began to climb. Note that they only briefly dipped below 5%.

I think I have this straight. Spain wants to guarantee more bank debt that the banks will use to get more money from the ECB, which will in turn be invested in Spanish bonds that will provide the money to run higher deficits, which will…

This is somewhat like a destitute bar patron guaranteeing his friend's tab so his friend will buy him more drinks. The ECB is the bartender. European taxpayers are the bar owners. We know who pays the tab in the end.

Contagion is Real

It seems quaint that only a few years ago the concern in Europe was that there would be "contagion" risk resulting from a Greek default. So worried were they that we had almost-daily pronouncements that Greece would not be allowed to default, that there was no need for a Greek default, the developed countries no longer defaulted, etc. Now that Greece has defaulted, the line in the sand is "That was just Greece; no other country will need to default."

But just in case, European leaders created all sorts of funds, guaranteed joint and severally, to help bail out nations in trouble. First Greece, then Ireland and Portugal. Even with all the money that was raised, it was not enough to prevent a Greek default. And the "new" debt is trading at around 10% of what the original was … as I was predicting two years ago.

The austerity that was forced on Greece has resulted in a backlash from Greek voters. The two ruling parties, basically run by two families, had traded control of the government back and forth for 50 years. Last week they could not even get 33% between them. In fact, no coalition can be cobbled together from any of the splinter parties. There will now be new elections, probably in June. Looking at the early polls, it is probable that a coalition will form that will reject the enforced austerity. Which will of course mean that Greece will not get the European funds it needs to be able to pay for even the austerity programs. Which will make things worse and hasten the departure of Greece from the euro.

Europe and the euro can survive without Greece. They could even make it without Portugal. Ireland will merely default on the debt it incurred from the ECB to bail out its banks, but will want to stay in the eurozone.

But the euro needs Spain, to maintain a credible standing, or so Germany evidently believes.

It Doesn't End With Spain

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The next usual suspect is Italy. And indeed Italy will soon be paying 5-6% of GDP just to cover the interest on its debt. If it were not for interest, they would have an actual government surplus. While they are making progress, a European recession is not going to make it any easier.

Let's move on from Italy. Let's consider France. They just had an election, and to no one's surprise they voted a Socialist into the office of president. And it appears likely he will get a majority in the legislative branch as well, giving Hollande control of the government. What he says he will do is get things under control by raising taxes to cover about 40% of the deficit and cutting spending to cover the other needed 60% – although he has not said what he will actually cut. He has pledged higher taxes on business and top earners (75% taxes on earnings over €1 million), subsidies for companies taking on younger and older workers, a partial reversal of the rise in the retirement age to 62, a promise to hire 60,000 new teachers, and he will take longer to get the budget under control than the current agreement with the EU allows.

Brussels issued a rather stern warning today, asserting that France must comply with the agreed-upon budgetary terms, which will require a lot more taxes and/or cuts than Hollande is willing to do. And whatever he decides, he has no easy task. France's acknowledged, official debt-to-GDP is 86%; but when you include their various commitments to the ECB, the ESFS, ESM, EIB, etc., the number rises to about 146%. Not all of that requires France to make the interest payments, but just to cover any losses in case of a default. But that 86% number is rising rather rapidly.

And their problems are not a short-term cyclical issue. They have committed to relatively larger entitlements and pensions than even here in the US! And those bills are coming due in the same time frame as in the US. It does not get any easier, and the French are notoriously unwilling to accept cuts in pensions or labor conditions. Want to touch agricultural subsidies? Want to see more tractors and burning tires on the Champs-Élysées? Just saying.

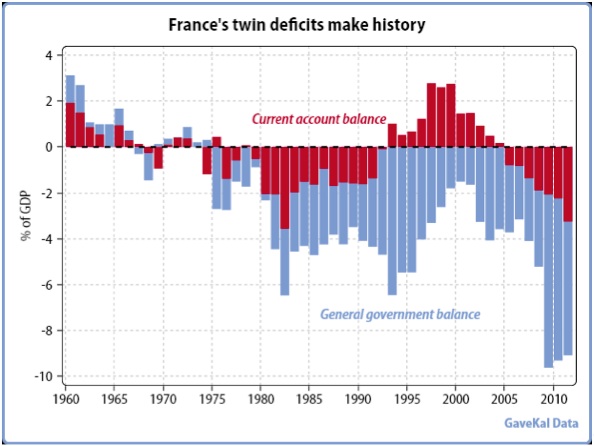

France has not balanced its budget since 1974. Note that the budget deficits are over 8% for the last few years (but not as bad as US deficits!), and now they have a negative trade balance. (chart from my friends at GaveKal)

Hollande campaigned explicitly on an anti-austerity platform. Angela Merkel campaigned for his opponent, Sarkozy. Not exactly the basis for a lasting friendship. And the rest of Europe is watching closely to see how this all works out. What will Germany do? Louis Gave (living in Hong Kong but still very French) writes:

"Assuming this program [Hollande's pledges to increase spending, raise taxes, etc.] ends badly, then France will need friends. Fortunately, the head of the IMF happens to be French, though this may be a double-edged sword, as Christine Lagarde cannot be seen giving France a privileged deal. In light of this rhetoric, and his promise of more spending, it is hard to think that Hollande and Angela Merkel will become fast friends. Meanwhile, Hollande's promise that his first act will be to pull France's troops out of Afghanistan is unlikely to endear him to the US administration. In short, France will soon need friends, but those may be as rare as an interesting French presidential candidate. Meanwhile, we have to hope that, like Groucho Marx, Hollande is a man who will declare 'These are my principles and if you don't like them, I can change them.'"

The Economist recently wrote:

"Although one ratings agency has stripped France of its AAA status, its borrowing costs remain far below Italy's and Spain's (though the spread above Germany's has risen). France has enviable economic strengths: an educated and productive workforce, more big firms in the global Fortune 500 than any other European country, and strength in services and high-end manufacturing.

"However, the fundamentals are much grimmer. France has not balanced its books since 1974. Public debt stands at 90% of GDP and rising. Public spending, at 56% of GDP, gobbles up a bigger chunk of output than in any other euro-zone country – more even than in Sweden. The banks are under-capitalized. Unemployment is higher than at any time since the late 1990s and has not fallen below 7% in nearly 30 years, creating chronic joblessness in the crime-ridden banlieues that ring France's big cities. Exports are stagnating while they roar ahead in Germany. France now has the euro zone's largest current-account deficit in nominal terms. Perhaps France could live on credit before the financial crisis, when borrowing was easy. Not anymore. Indeed, a sluggish and unreformed France might even find itself at the center of the next euro crisis."

The banks of France are over 4 times the size of French GDP. The markets have been punishing the larger banks, with some of them down almost 90%. Look at this graph for Societe Generale:

While French banks are not the problem that Spanish banks are, they are far larger relative to the size of their home country. Even a small problem can be large for the country. And French banks have very large exposure to European peripheral debt. A default by Spain would push them (and a lot of other European banks) over the edge. Which is one reason that Sarkozy was so loudly insistent that any bank problems should be treated as a European problem and not the problem of the host country. (Interesting idea if you are Irish!) France simply cannot afford to deal with any problems in its banks while it is running such large deficits. And not while it is guaranteeing all sorts of European debt, which is at the heart of the problem. Germany needs France to help shoulder the financial burdens of Europe. And as long as France can keep its AAA rating, Germany has a partner. But if France loses that rating, then any European debt it guarantees clearly loses that rating as well.

S&P has already taken France down one notch to AA+ and still has a negative outlook. Moody's has warned of a possible downgrade to France. Italy now has a BBB+ rating, just below that of Spain. When you look at the actual balance sheet and total debt, France is not all that far from further downgrades, unless it embraces a new budget ethic, which is precisely what Hollande has said he will not do.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

That would be a real crisis for the eurozone. German voters might not be willing to shoulder the European burden without a full partner in France. And if France had to guarantee a great deal more pan-European debt, while it continued to run deficits and, God forbid, had a crisis in one or more of its banks, it would be putting its credit rating at risk.

Is there any wonder about the timing of the Bundesbank retreat? They looked at Greek and French elections and then at the ongoing Spanish crisis, which is trending from very bad to awful with a risk of horrific. They glanced at the balance sheets of their own banks and those of French banks vis-à-vis sovereign debt from peripheral Europe, then took a peek at German-voter polls and flipped through their own balance sheet, and decided that the only entity with enough money to stem the crisis was the ECB. And that means a "little" inflation.

I think the vast majority of Germans (and to be fair, the entire world) have no idea how many trillions of euros are going to be needed to keep patching the leaky ship that is the eurozone. It is even possible that most German politicians actually think it might only be 3% inflation.

Spain is too big to save and too big to fail. The only way for Spanish debt to remain at 6% is for the ECB to basically buy it (or lend to Spanish banks so they can buy it, or whatever creative new program Draghi and team can think up). When Spain goes, it is just a matter of time before we lose Italy and then, yes, even France. The line must be drawn with Spain. And the only outfit with a balance sheet big enough that can also do it in a politically acceptable manner is the ECB, and the only way they can do it is with a printing press.

Will it buy time? Yes, but time for what? To fix government deficits? To deal with bank debts? Sovereign debt? To somehow solve the massive trade imbalances between Germany and the European periphery? To force voters to accept a fiscal union? In the midst of a crisis? If there is some conspiratorial cabal that has a secret plan, they have kept it well hidden. Because from here it looks like they are making up the "plan" as they go along.

Their actual intentions are no secret. They will do whatever it takes to keep the European Union and eurozone together. And whatever it takes is a very open-ended plan. But it is going to cost them trillions of euros.

Someone is going to have to pay that bar bill. And there's going to be one helluva hangover.

New York, Atlanta, and Philadelphia

I will be in Connecticut on Monday and Tuesday morning for a Pitney-Bowes corporate meeting . They have a fascinating line-up of speakers to give them some ideas about problems and opportunities as they plan for the future. Then I give a speech Tuesday night and do media and meetings all day Wednesday and Thursday before I head home in time to write another letter to you.

The next week I fly to Atlanta to be with my good friend Cliff Draughn of Excelsia, where I will speak at a noon gathering on May 23rd. You can learn more at www.excelsia.com. I will be in Philadelphia on June 4-5 with partner Steve Blumenthal of CMG for their annual Advisor Forum. He has assembled an outstanding group of speakers. Details to follow, but if you are an investment advisor you should consider coming. You can call CMG at 610-989-9090.

This has been a whirlwind two weeks. First the Casey conference in Florida, then my own Strategic Investment Conference in California, and then on to Tulsa to watch my daughter Amanda graduate from college, followed by a quick trip to Chicago. I saw so many friends everywhere – and sadly gained a few pounds, with so many great meals and not enough gym time. I will need to work those off soon. And for those who are interested, we are going to make some of the speeches from the SIC available over time. The response from those who attended was overwhelmingly positive.

While back home I got to have dinner with my friend and dentist, Dr. Gary Sanchez, who works in Albuquerque. Gary is the inventor of the Health Chair, which I found in my search for a better chair to help my back. And it has. If you are like me and sit a long time each day, then you might want to take a look at www.thehealthchair.com. He has upgraded his website to be more consumer-friendly (nice video). The chair is not cheap, but I it is definitely one of the better investments I have made.

I am looking forward to Mother's Day. My mother will be 95 this August. She reminds me to stay young at 62! And it is time to hit the send button. The sun is coming up, and I have been sitting too long in this chair, not matter how great it is! Have a great week.

Your ready for a vacation in Tuscany analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin