The Worst Ten-Letter Word

-

John Mauldin

John Mauldin

- |

- February 23, 2014

- |

- Comments

- |

- View PDF

Robber Barons

The World’s First Trillionaire

Houston, Los Angeles, Miami, Washington DC, Argentina, South Africa, San Diego, Brussels, and Geneva

“Inequality has emerged as a major issue in the US and beyond. A generation ago it could reasonably have been asserted that the overall growth rate of the economy was the main influence on the growth in middle-class incomes and progress in reducing poverty. This is no longer a plausible claim.

“The share of income going to the top 1 per cent of earners has increased sharply. A rising share of output is going to profits. Real wages are stagnant. Family incomes have not risen as fast as productivity. The cumulative effect of all these developments is that the US may well be on the way to becoming a Downton Abbey economy. It is very likely that these issues will be with us long after the cyclical conditions have normalized and budget deficits have at last been addressed.”

– Lawrence Summers (in the Financial Times)

“Cyberpunk is a postmodern science fiction genre noted for its focus on ‘high tech and low life.’ It features advanced science, such as information technology and cybernetics, coupled with a degree of breakdown or radical change in the social order. ‘Classic cyberpunk characters were marginalized, alienated loners who lived on the edge of society in generally dystopic futures where daily life was impacted by rapid technological change, an ubiquitous datasphere of computerized information, and invasive modification of the human body.’”

– Lawrence Person (Wikipedia)

A new word is achieving ubiquity. The word has always been with us and at times has been a beacon to attract the friends of liberty and opportunity. But now I’m afraid it is beginning to be used as a justification for social and economic policies that will limit the expansion of both liberty and opportunity. The word? Inequality. More specifically, the word has become problematic when used in close proximity to the word income. There are those who believe that income inequality is the proximate cause of the Great Recession, if not the imminent demise of Western Civilization, pushing us into a dystopian world that will come to resemble the one depicted in the movie Blade Runner.

(Note: Blade Runner exemplifies a genre of science fiction called cyberpunk, defined above.)

This week we begin what will probably be a multi-week series on the subject of income inequality. Over the years, I’ve written many times about the lack of income growth for the middle class in the developed world. We have also looked at the growing spread between the top 1% or 5% or 10% and those further down the income scale. The widening spread is an undeniable fact. But what should be done about it? Do we take money from the more well-off, or do we increase opportunities for all? How do we increase opportunity without social expenditures for education and healthcare, and where will the money come from? What trade-offs do we get for the lost productivity and reduced savings that result from increased taxes? What institutional and policy barriers are there? These are all fundamentally important questions.

What spurred me to start this series was a recent paper from two economists (one from the St. Louis Federal Reserve) who are utterly remarkable in their ability to combine more bad economic ideas and research techniques into one paper than anyone in recent memory. Their even more remarkable conclusion is that income inequality was the cause of the Great Recession and subsequent lackluster growth. “Redistributive tax policy” is suggested approvingly. If direct redistribution is not politically possible, then other methods should be tried, the authors say.

So what is this notorious document? It’s “Inequality, the Great Recession, and Slow Recovery,” by Barry Z. Cynamon and Steven M. Fazzari. One could ask whether this is not just another bad economic paper among many. If so, why should we waste our time on it? And this week we’re actually not going to lay the paper out on the slab and dissect it; we’re just going to prepare for the post-mortem by getting up to speed on the issues it tries to address.

The problem is that the subject of income inequality has now permeated the national dialogue not just in the United States but throughout the entire developed world. It will shape the coming political contests in the United States. How we describe income inequality and determine its proximate causes will define the boundaries of future economic and social policy. In discussing the multiple problems with the paper, we have the opportunity to think about how we should actually address income inequality. And hopefully we’ll steer away from simplistic answers that conveniently mesh with our political biases.

I am pretty certain that by the end of the series I will have been able to offend nearly every reader, and some of you multiply. That’s OK – it means we’re thinking outside our boxes. I will admit to having been forced, of late, to change some of my more reflexively conservative positions with regard to the structural causes of income distribution trends and, even more importantly, the distribution of opportunity. It is the latter concept that should command our particular attention, and a fair distribution of opportunity should appeal to both libertarians (I more or less think of myself as one) and progressives.

The unfair distribution of opportunity is not an injustice that can be redressed simply by composing erudite paeans to free markets or social justice, even though politicians will try. The problem is far more complex than that. Are we in fact, as Larry Summers suggests, on the road to a Downton Abbey economy – or, even worse, a Blade Runner-like dystopia?

I should note that Professor Summers’ op-ed is a not entirely uneven discussion of the problem. “Given the widespread frustration with stagnant incomes, and an increasing body of evidence suggesting that the worst-off have few opportunities to improve their lot, demands for action are hardly unreasonable. The challenge is knowing what to do.” We will address Summers’ conclusions later in this series, but for now let’s think about how to approach the challenge of income inequality.

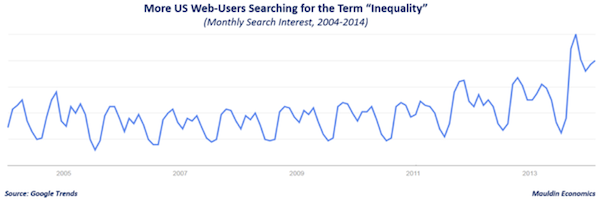

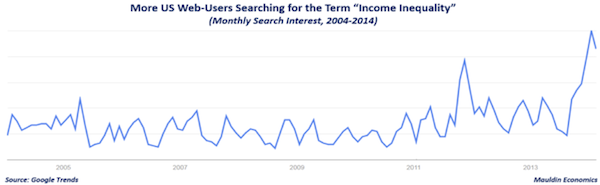

A quick search for the word inequality in Google Trends reveals that the general public is starting to take a lot more interest in the concept. Monthly searches for the word inequality have more than doubled in the past year or so. (Odd trivia fact: Indiana is the state with the highest search interest in inequality, ahead of college liberal Massachusetts.)

Of the underlying or related searches, income inequality is the most frequently searched term. It spiked to all-time highs after President Obama’s State of the Union address in January.

We have to take this data with a grain of salt, but it clearly shows that inequality is becoming a more popular search term. And if it is becoming a more popular search, that is clearly because people are thinking and talking about it a lot more. And if people are thinking and talking about the subject of income inequality a lot more, then my readers, who are by and large thought leaders in their respective worlds, have a serious responsbility to inform that discussion.

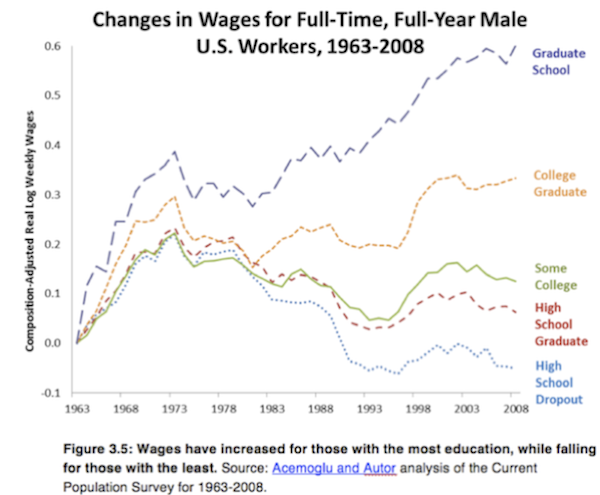

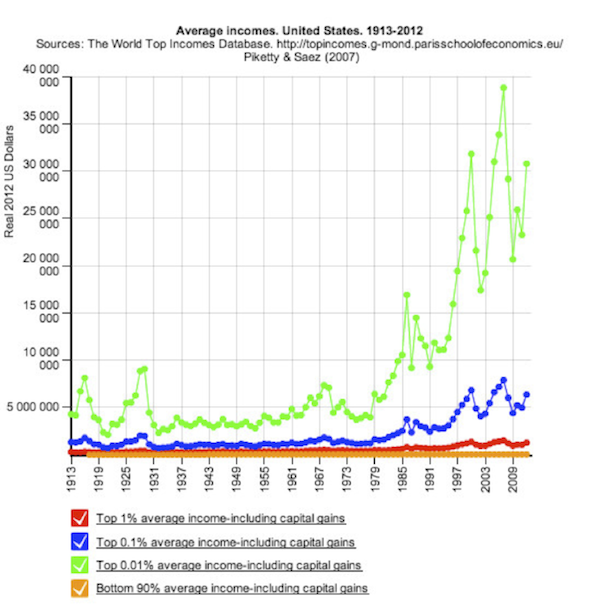

The fact that incomes of various segments of our society are diverging is not really disputable. There are many ways to sort for the reasons for income differentials, but one of the ways is by education level, where the income differences have become rather stark over the last 40 years. Note in the chart below that incomes for all segments of the population generally rose in tandem up until the beginning of the Information Age in the early ’70s, and then the disparity began to grow. Those with more education saw their incomes increase while those with less education saw their incomes fall.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

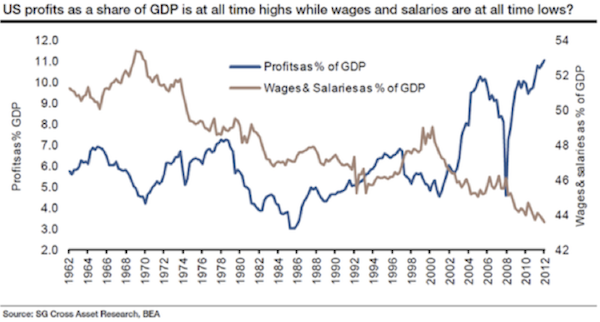

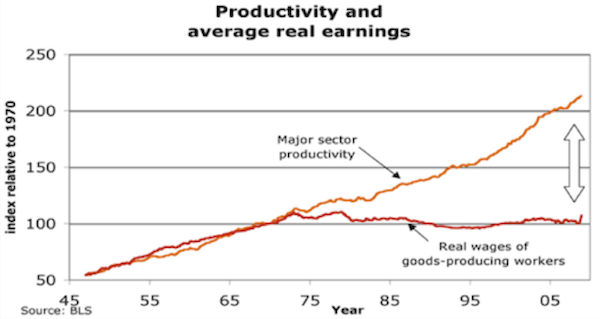

As Summers noted, a rising share of GDP is going to profits as opposed to wages. This is a trend that started at the beginning of the last decade.

One other odd bit of information that I came across while researching this topic is that between 1979 and 2002 the frequency of long work hours (more than 50 hours a week) increased by 14.4 percent among the top quintile of wage earners but fell by 6.7 percent for the lowest quintile. And those extra hours translate into extra income. (You can see the NBER study here.) I don’t know about you, but my hours have significantly increased since 2002. Not sure that is relevant, but just saying.

Let’s take a somewhat philosophical and less databased approach to income inequality. Mainstream economists and policy makers are still thinking of inequality through the lens of 19th and early 20th century experience, when robber barons like Carnegie, Rockefeller, and Vanderbilt supposedly lined their pockets by withholding reasonable wages from the working poor.

This is precisely what Larry Summers was getting at in this week’s Financial Times op-ed:

The share of income going to the top 1 percent of earners has increased sharply. A rising share of output is going to profits. Real wages are stagnant. Family incomes have not risen as fast as productivity. The cumulative effect of all these developments is that the US may well be on the way to becoming a Downton Abbey economy.

That thinking assumes that if income inequality is rising, the top 1% is getting richer at the expense of the working class, because it assumes production still heavily exploits the relatively unskilled labor that most Americans can provide through hard work. It does not discriminate between value-added labor and value-added information and innovation.

As I argued three weeks ago, the gains from the Information Age have been unevenly distributed throughout the economy. This is a structural problem in the sense that the productivity gains from the first two Industrial Revolutions are essentially thoroughly distributed through the economy. All workers saw their incomes increase along with increasing productivity for the 200 years of the Industrial Revolutions. Yes, entrepreneurs, innovators, and knowledge workers saw their incomes rise faster, but a rising tide of productivity lifted all boats.

The same phenomenon is playing out now in developing markets, where much of the basic infrastructure of industrial revolution is still being built. I would expect that the same income inequality issues would develop in those markets in conjunction with the full rollout of industrial revolution and the shift to a knowledge-based economy.

Another observation that I did not make three weeks ago but have subsequently come to embrace is that knowledge workers have indeed seen their incomes increase because of their ability to put their knowledge to work more productively. Goods-producing workers have by and large not seen much rising productivity in the last 30 years due solely to their work and thus have not seen an increase in their incomes. To the extent that workers have skills, their incomes rise.

(Please. I get that it is more complicated than this. Increased foreign competition for lower-skilled jobs and the bursting of two major bubbles have also put a dent in US incomes.)

That being said, the top 1% is getting richer either by (1) allocating capital to the right places (which all right-thinking people want to see happen), or (2) by employing skills that most of the American work force does not have – because production increasingly depends on the hard work of creative workers with hard-earned skills gained through education and experience.

Today, a much smaller percentage of our labor force is responsible for a much greater percentage of economic output. Their wages are rising because their productivity is rising.

The trouble with conventional wisdom about income inequality is that it is so fails to factor in productivity and the sources of productivity.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

While populist politicians, mainstream economists, and envious market watchers would like to brand billionaire inventors like Tesla CEO and PayPal Founder Elon Musk, Facebook CEO Mark Zuckerberg, or eBay cofounder Pierre Omidyar as modern-day robber barons, they haven’t really robbed anyone. The emerging class of billionaires is creating value that did not exist before they arrived, and they’re doing it with relatively small teams of highly skilled knowledge workers. And they deserve every penny they earn.

On the flip side, a growing majority of our labor force is responsible for a much smaller percentage of economic output. Their wages are stagnant because more people are competing for a shrinking number of jobs.

The World’s First Trillionaire

I have brought to your attention before a very important book by Mark Buchanan called Ubiquity, Why Catastrophes Happen. I HIGHLY recommend it to those of you who, like me, are trying to understand the complexity of the markets. It’s not directly about investing, although he touches on that subject. Rather, it’s about chaos theory, complexity theory, and critical states. It is written in a manner any thoughtful layman can understand. There are no equations, just easy-to-grasp, well-written stories and analogies.

Buchanan talks about power laws and critical states. He wraps up his opening chapter like this:

There are many subtleties and twists in the story ... but the basic message, roughly speaking, is simple: The peculiar and exceptionally unstable organization of the critical state does indeed seem to be ubiquitous in our world. Researchers in the past few years have found its mathematical fingerprints in the workings of all the upheavals I've mentioned so far [earthquakes, eco-disasters, market crashes], as well as in the spreading of epidemics, the flaring of traffic jams, the patterns by which instructions trickle down from managers to workers in the office, and in many other things. At the heart of our story, then, lies the discovery that networks of things of all kinds – atoms, molecules, species, people, and even ideas – have a marked tendency to organize themselves along similar lines. On the basis of this insight, scientists are finally beginning to fathom what lies behind tumultuous events of all sorts, and to see patterns at work where they have never seen them before.

Now, let's think about this for a moment. I’ve written about the sand pile game where researchers created a computer simulation of the sand piles that we built as kids at the beach. In their simulation of the sand pile, they found that as the number of grains of sand involved in an avalanche doubled, the likelihood of an avalanche was reduced by 2.14 times. We find something similar with earthquakes. In terms of energy, the data indicate that earthquakes become four times less likely each time the energy they release is doubled. Mathematicians refer to this as a “power law,” a special mathematical pattern that stands out in contrast to the overall complexity of the earthquake process.

As I noted a few weeks ago in Outside the Box, we are indisputably living through the greatest era in human history. Humanity is immeasurably richer than it was 100 or 50 or even 20 years ago. And along with everyone getting richer, we’ve seen a rising number of super-rich. But as the Huffington Post noted a few weeks ago, even the super-rich are getting left behind by the uber-rich.

Eighty-five people have as much money as do the poorest 3.5 billion. The top 1% have almost half the liquid wealth that has been accumulated in the world. There are 1,426 known billionaires, and gods know how many additional kleptocrats and people who have managed to maintain some semblance of privacy.

I’ll bet you a great dinner at your favorite restaurant that the distribution of the world’s wealth very clearly follows a power law similar to the one that describes the distribution of earthquakes and other phenomena. (There is an economics paper in there somewhere. Send it to me when you’ve written it!)

Thought experiment: if world GDP grows at 3% compounded for the next 100 years, world gross domestic product will be 16 times greater than it is today. That’s simple math. But if the future is anything like the past, the distribution of that enormous increase will not be even throughout the population. Not everybody will be 16 times richer, and some people will be fabulously richer. Unbelievably richer. Off-the-charts and mind-bendingly richer.

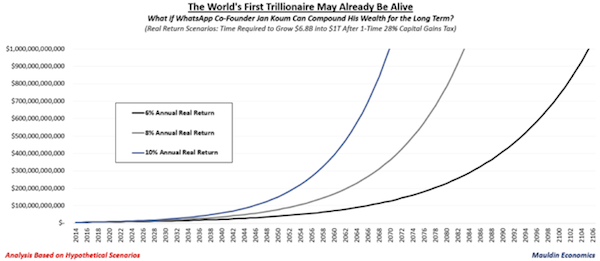

Someday, and with the real possibility of its happening in our lifetimes, we will see the world’s first trillionaire. This week we awakened to the fascinating story of WhatsApp cofounder Jan Koum selling his company to yet another of the elitist uber-rich, Mark Zuckerberg, founder of Facebook. Theoretically, the 37-year-old Koum walks away with about $6.9 billion – after starting out as a refugee from Kiev some 20 years ago, living on food stamps. He created this fabulous wealth with a partner and less than 70 employees in just a few years on the strength of an idea, a lot of chutzpah, and venture capital from the very firm that Zuckerberg spurned less than 10 years ago (Sequoia Capital – and that in itself is a great side story you can learn about on Google).

Of course that is not yet $1 trillion, but that is not how we get to the world’s first trillionaire. Many of the young men and women who are billionaires today are going to be living to the end of this century. What if a few of them are able to compound their wealth at 6%, 8%, or even 10% a year? Below is a chart of what Jan Koum might see his wealth become if he were inclined to continue the chase.

Zoum has almost as much net worth today as Elon Musk, founder of PayPal and Tesla Motors ($10 billion). As noted above, there may be as many as 2,000 billionaires in the world, with more being created every day. I can think of half a dozen ideas that could generate more than $10 billion for their creators. A cure for cancer could easily be worth $100 billion. A new, clean, localized energy source could create multiples of that. There are already five family groups with over $50 billion each. At 6% compound returns they could top $1 trillion within 50 years, although several are giving away most of their wealth.

The point? It is not a matter of whether someone will be worth $1 trillion or whether they even deserve it. It is simply going to happen at some point. Quite frankly, I don’t care. I hope they take their capital and put it to productive uses that make the world richer and a better place to live while they themselves are getting fabulously rich. As long as they do it on an even playing field, “good on them.”

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Income inequality is not going away. Visually, and given the realities of the unfolding Age of Transformation, we may even see greater disparities.

I do agree with Summers on one point: “It is very likely that these issues will be with us long after the cyclical conditions have normalized and budget deficits have at last been addressed.”

What else can we expect as long as we continue to rely on a 20th century education system to equip 21st century workers? When we allow crony capitalism to create an unequal playing field with special benefits for some? When businesses successfully lobby to create barriers to entry for future competition so that they can maintain their profits without having to compete? When we give tax benefits that help a relative few so that we are forced to tax those who are productive at ever higher rates?

Instead of obsessing over the rising income inequality that has always accompanied great periods of innovation (it took decades for the first and second Industrial Revolutions to be reflected in productivity numbers as well as overall wages), Larry Summers, Paul Krugman, and other “big league” mainstream economists should be advising President Obama, the House, the Senate, and every voter who will listen about the importance of aggressive reforms in education, entitlements, and tax/regulatory policy.

They should be asking why knowledge workers are moving ahead, while more of the labor force is left behind. And they should be formulating policies that can empower and encourage more unskilled workers (or workers with outdated skills) to become highly skilled knowledge workers in the coming decades. But such questions don’t suit their political agendas. These are not questions with easy answers. They demand hard work not only on the part of politicians, but also from the people wanting the benefits. The Age of Transformation will require constant education and updating of skills.

There is no way for a government to protect its citizens from increasingly accelerating change without ultimately destroying the benefits delivered by that change. The focus has to become on how to help people adapt and prosper in an environment of unremitting change. What sort of government and what economic policies will foster an environment that increases productivity and income for everyone?

Next week we will in fact get to the actual economic paper which kick-started me into this line of thinking, and we’ll also look at a remarkable study which shows that income mobility in the United States is still roughly where it was 40 years ago. As I will point out, that’s not good enough. Many countries (such as Denmark) do much better, and perhaps we should learn why and how. We will learn that trying to stimulate demand may not be the best monetary policy, and in fact it may be producing the actual environment in which income inequality is increasing. Ideas have consequences, and bad ideas typically have bad consequences. But all that’s for next week.

Houston, Los Angeles, Miami, Washington DC, Argentina, South Africa, San Diego, Brussels, and Geneva

I'm enjoying my longer than usual respite from travel, but tomorrow I will see my schedule pick up aggressively. I will be in Houston tomorrow night, then back home for a day before I go to Los Angeles, then fly cross-country to Miami for a speech for my friend and partner Darrell Cain. Then we’ll enjoy a fabulous Saturday evening soirée on the beach, when Patrick Cox, editor of Transformational Technology Alert, will come over from the West Coast of Florida for the evening to join us.

From Miami I will head to Washington DC for a few days of meetings. Then it's back home for almost two weeks before I head to Argentina for a few weeks. (Those of you interested in learning more about what's going on in Argentina and at La Estancia de Cafayate, where I'll be spending close to two weeks in the second half of March, might enjoy an article David Galland recently penned (he is such a beautiful writer), entitled “Argentine Diary: A Day in the Life on the Front Lines of a Crisis.”

From Argentina I’ll fly more or less directly to South Africa for a week. I’ll spend the first few days at a game resort and then jump into a speaking tour that will take me to Cape Town, Durban, and Johannesburg at the behest of Glacier by Sanlam, a very-full-service financial firm. I am looking forward to that trip.

After that, I am home for a little over two weeks before I head out to Brussels and Geneva (and perhaps another European city or two) and then head back home to prepare for my Strategic Investment Conference in San Diego, May 13-16. This is a fabulous conference, and you really should make plans to attend.

One of the people I will be meeting in DC is my old friend George Gilder. I was talking to him yesterday about schedules, and he noted that he came really close to not being able to … stay on schedule. It seems he was involved the day before in a head-on collision that totally destroyed both cars, but everyone in the cars walked away due to air bags and the marvelous collapsing design of recent-vintage cars. I am grateful for that new technology, because we need minds like George Gilder around for a lot longer to help us think about how to deal with the age of accelerating change. Not to mention that I would miss him personally. DC is shaping up to be an interesting few days, and I will report back to you.

It is time to hit the send button. I really do have to get a better handle on the timing of my trips. I will be leaving Dallas when the weather is perfect but have nothing scheduled for August when 100° days are typical. But then that is why God invented air conditioning. Have a great week!

Your wondering how his kids will adapt analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin