- October 10, 2025

Big Debt Cycles, Part 2

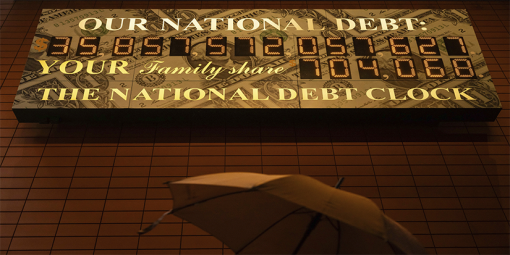

Today we continue reviewing Ray Dalio’s latest book, How Countries Go Broke. If, like me, you fear that you may soon live in such a country, Ray’s work reads like a guidebook to the future. But in fact, this future is just the latest iteration of a well-known debt cycle, one that is almost natural in its regularity.

Read more