- October 3, 2025

Big Debt Cycles

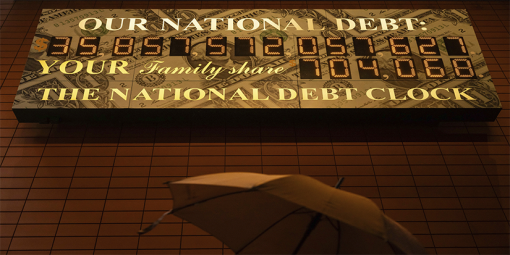

Debt is a curse that can also be a blessing, depending on how the borrower uses it. Sadly, human nature seemingly ensures we often use debt unproductively—and not just as individuals. Governments have their own special way of using debt to buy benefits (and votes?) today that future generations will pay for.

Read more