Bending the Inflation Curve

-

John Mauldin

John Mauldin

- |

- April 10, 2020

- |

- Comments

- |

- View PDF

Preventing Depression

Monetary and Fiscal Policy: Where We Are Today

Inflation Is Always and Everywhere a Function of Demand

The Utter Travesty of Unemployment

Thinking of the Enormity of It All

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output. … A steady rate of monetary growth at a moderate level can provide a framework under which a country can have little inflation and much growth.”

—Milton Friedman, The Counter-Revolution in Monetary Theory (1970)

“Well, maybe…”

—John Mauldin, with more than a little hubris, 2020

I am widely known as the “muddle through” guy. I describe problems then explain how we will get through them, slowly but surely.

That analogy isn’t appropriate for problems like the coronavirus, which actually kills people. The most seriously affected victims are not muddling through at all, and there are way too many of them. And those who are still waiting for government aid are certainly not muddling through. As we will see below, unemployment rates are anything but “Muddle Through.” This will be the slowest and most difficult Muddle Through of our lives.

But thankfully, we are starting to see the curves bend. The lockdowns and distancing appear to be stabilizing the number of new cases. We aren’t out of danger but this is encouraging.

Nevertheless, much of the economic damage is already done. We are not likely to see anything resembling the previous normal for a long time. I heard someone say we will emerge from lockdown to an “80% economy”—mostly back, but with big pieces missing. That sounds about right. But losing a fifth of the economy will still mean a severe recession, if not outright depression, albeit hopefully not as long as that of the 1930s.

So, our next analytical challenge will be the intersection of previous economic trends, virus-driven behavioral changes, and the policy responses to both. To this point, governments and central banks have just been keeping their ships afloat. They haven’t even started “stimulus” yet. But they will, and it will have consequences. That will be today’s topic.

The first and most important question that we will deal with is prediction of significant inflation/hyperinflation coming from many quarters because of the massive amount of Federal Reserve intervention. This is wrong-headed fearmongering.

Preventing Depression

Close to 17 million people have filed for unemployment in the last 3 weeks. It would be significantly higher if overwhelmed websites in many states were able to actually take all the claims. The glitches are maddening and they are all hitting at once. I know of one furloughed worker who is unable to even apply in Texas. The system sees his Social Security number from when he was laid off in the last recession (10+ years ago) and insists he use the email address he had back then. He can’t because it was from a company that no longer exists. So he is stuck in an endless loop. And forget about getting through by phone. Come on, guys. Texas should be better than that.

It’s not just Texas, either. I am talking with friends all over the country whose children are legitimately unemployed (like mine) and trying to get benefits. So far, I am not hearing of any successes. You would think with 17 million people who have successfully entered claims there would be a few.

Furthermore, millions of mostly younger people are (or were) working in the so-called gig economy. Often, they don’t get W-2s, at best they get 1099s, and sometimes the work is off the books. Nonetheless, they are unemployed, have no way to get any money and no way to get the paperwork which the various agencies require in order to get unemployment benefits. They are in a catch-22 situation. And because they move around so much what are the chances that the checks the government is sending out will catch up with them? See the problem?

The government has good intentions but the execution is extraordinarily difficult. We are creating massive supply and demand shocks, the rapidity of which is like nothing seen in centuries, if ever.

As I pointed out four weeks ago, this is the most massive deflationary shock of all time. The Federal Reserve has rightly intervened in order to prevent the absolute certainty of a deflationary depression.

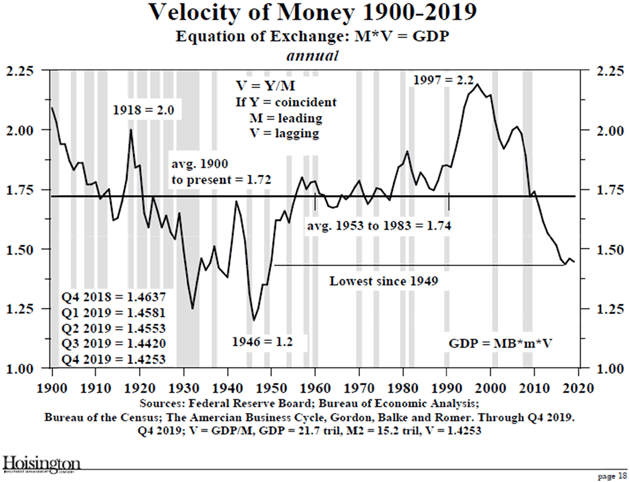

I quoted Milton Friedman above where he posits that “… inflation is always and everywhere a monetary phenomenon.” And then I said, “Well, maybe…” During the timeframe in which he and his colleague Anna Schwartz did their famous study, there was clearly a correlation between money supply and inflation. What is not often noted is that the velocity of money (i.e., the rate at which money changes hands) was stable during that time.

I am not going to do a 30-page academic study to explain why that is important. Just accept that it is. When the velocity of money is falling, monetary policy which would otherwise cause inflation doesn’t seem to do so.

Here is Lacy Hunt’s latest velocity chart. You have to go back to 1949 to find a time when it was lower than today, and it was actually rising rapidly off the postwar lows. This was before the coronavirus shutdowns. Let me crawl out on a limb and suggest that the velocity of money is now going to drop even further. Deflation is not your friend.

Source: Hoisington Investment Management

Monetary and Fiscal Policy: Where We Are Today

The US government passed a $2.2 trillion bill some call a “stimulus package.” It is nothing like a traditional stimulus package. By putting the economy in lockdown, taking away the income of multiple tens of millions, much of the CARES act simply replaces lost wages. That is not stimulus. That money doesn’t generate additional spending. The SBA loans are not stimulus in the traditional sense. The money is hopefully going to bring many businesses back from a dead stop. That will be good, but it’s not stimulus.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The Federal Reserve and Treasury yesterday announced another $2.2 trillion program to buy bonds and high-yield funds, otherwise known as junk bonds. Their lawyers, in an act of extreme contortion, designed a methodology by which the US Treasury could create a special purpose vehicle, fund it with hundreds of billions of dollars from the CARES Act as a “first loss guarantee,” and then the Federal Reserve could loan approximately 10 times that amount to the SPV.

If losses exceed the base amount, the Treasury and thus the taxpayer would have to fund those. The program will ostensibly be run by the Treasury Department, which actually delegates the operation to BlackRock or PIMCO or another company with the ability to actually do it. That adds another $4 trillion to the overall government program.

I know some are upset about a private company managing this money. I get it, but if we waited for the government to set up the systems to do it, it would take years. The people saying this don’t understand the complexity of what we are asking these companies to do. Furthermore, less has been done than you might think as both the Treasury and the companies try to figure out how to augment the proposals.

My friend Jim Bianco posted a piece on Twitter which was picked up by ZeroHedge.

“As I've argued, the Fed and the Treasury merged. Powell said this was the case today (from his Q&A):

These programs we are using, under the laws, we do these, as I mentioned in my remarks, with the consent of the Treasury Secretary and the fiscal backing from the Congress through the Treasury. And we are doing it to provide credit to households, businesses, state and local governments. As we are directed by the Congress. We are using that fiscal backstop to absorb any losses we have.

Our ability is limited by the law. We have to find unusual, and exigent circumstances and the Treasury Secretary has to agree, and we are using this fiscal backstop. There is really no limit on how much of that we can do other than meet the tests under the law as amended by Dodd-Frank.

The Fed needs the Treasury Secretary's permission to do this.

That means Trump must approve this (as the Treasury Secretary serves at the pleasure of the President). No doubt Kudlow was asked to weigh in (which would be appropriate for the National Economic Chairman to do).

So, Larry was able to know this was coming when we said two days ago:

"The Fed is sitting with the ultimate bazooka."

This program did not appear overnight. It took days, if not weeks, to figure out how to contort the laws in order to do this. Kudlow clearly knew what was coming. (By the way, these lawyers will need physical therapy to deal with the abnormal contortions needed to reach the conclusions they have.)

Let me posit right here: We are going to see more of these programs. Clearly, both the executive branch and the Federal Reserve, with the complicity of Congress, are determined to avoid a deflationary depression. This is Mario Draghi’s “whatever it takes” on serious steroids.

Lacy Hunt told me in an email and then telephone call that this last $2.2 trillion is not money printing. They are simply buying already existing bonds, not unlike QE in the past when the Federal Reserve bought US government bonds. This is not like Venezuela, Argentina, or Zimbabwe. Not even close.

Nonetheless, $8 trillion and counting of government expenditures, funded by the Federal Reserve, is nothing to sneeze at. It will have an effect on the money supply. So is Milton Friedman right? Is inflation on its way back? Let me offer Mauldin’s corollary to his famous statement:

Inflation Is Always and Everywhere a Function of Demand

We have simply destroyed demand by locking down the country. And it should be clear that we cannot turn a switch to bring it back. How soon will we feel like going back into large crowds, restaurants, movie theaters, sporting events, hotels, vacation destinations, and all the other areas where we congregate as human beings? Certainly, some of the economy will start looking normal. But how many workers will it need?

How have our buying patterns changed? We are learning that we can work from home. Zoom and other services have had their weaknesses exposed, but they will improve. This is going to make working from home easier and more common. My son-in-law’s company policies allowed working from home, but his district manager felt that productivity would drop so did not allow it. But having been forced to try, they found productivity actually rose significantly. They are now getting ready to institute this new policy more broadly.

Multiplied across thousands of large companies, that means the demand for office space will drop, which means prices for office space will drop. That is deflation, gentle reader. Even if the Federal Reserve decides to buy office space (which it won’t), that is not going to increase demand. Ditto for 100 other industries. Think about restaurant buildings. Builders and tenants go to tremendous expense to create the kitchens, which means if a restaurant goes out of business, the property owner typically has to find another restaurant. How likely is that to happen today?

At some point supply and demand will balance, but I don’t think it will be in three months. Three years? Maybe. Lacy Hunt thinks it will be a few years longer. So do some of my other economically brilliant friends. (Please ignore government cheerleaders and those with an agenda who suggest it will come back sooner.)

But whether it is three months or three quarters or 3+ years, it will happen. At that point we have the potential for an inflationary episode if the Federal Reserve keeps stimulating and the government keeps running massive deficits. If they act responsibly, inflation could rise to the 2 to 3% level and hopefully not higher. If they don’t act responsibly? All bets are off.

Sidebar: I still don’t think of gold as an “investment,” but I don’t entirely trust central banks to be independent when they need to be in the future. Thus buying gold as central bank insurance is a reasonable idea.

But understand this: Demand has to come back, and in size, in order to spark inflation. Yet in this situation people will want to save, perhaps more than they ever have in their lives. Purchases are going to be put off if they can be.

Now, many economists would not talk about supply and demand so much as about the “output gap.” As businesses go away, potential output also drops. How will that take? No one knows. We have absolutely zero idea of how the future is going to unfold because we have never seen anything like this.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

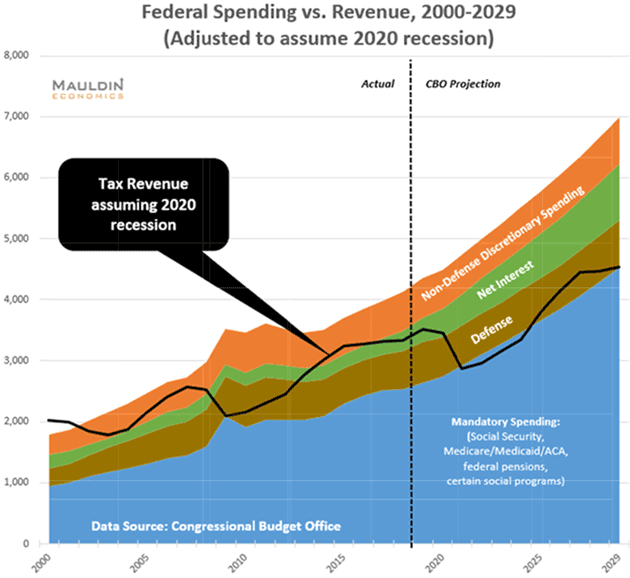

Remember this chart I’ve used a few times in the past year or two? Where I naïvely assumed a 2020 recession would result in a $2 trillion deficit?

Wow, was I an optimist. The deficit this year will likely be $4 trillion-plus. Note that we are already at $24 trillion total federal government debt in the US. Add another $3.3 trillion for state and local debt. Our debt projections only a year ago showed the US federal government debt going to $30 trillion by the middle of this decade. It turns out we will be there by 2022. The almost $40 trillion I projected by 2030? That will now happen in the middle of the decade and we will be nearing $50 trillion by the end of the decade.

I was suggesting that the balance sheet of the Federal Reserve might be $20 trillion by the end of the decade. Analysts at the Bank of America now forecast it will reach $9 trillion this year. There are other even higher projections from serious sources. I will have to do a whole letter around this, but a $30 trillion Fed balance sheet by the end of this decade and before The Great Reset is not out of the question.

The Utter Travesty of Unemployment

Mish Shedlock calculates, based on the 16.8 million initial jobless claims in the last three weeks and likely another 8 million in the next two weeks (if not more), we are roughly looking at an unemployment rate near 20%.

The highest unemployment rate during the Great Depression was 24.9% in 1933. Depending on when we move out of lockdown, the US could approach or exceed that number for a short time. Note that the “reference period” for April will be April 12–18. That means anybody who becomes unemployed after April 18 won’t be counted in the April number.

This is beyond tragic. That potential 20–25% of unemployed also represents significant numbers of children and family members who are also without money. The people that are desperately in need is well more than the 20–25% of unemployed. It is hard to wrap my head around such a number.

Have you heard of anyone getting their checks yet? I didn’t think so. My daughter Amanda (who is recovering well from her stroke, thank you!) had a $71,000 hospital bill. I did not realize they did not have insurance when her husband left to go to pilot school. The hospital “renegotiated” the bill down to $56,000, and wants them to make $5,000-a-month payments. They are both now unemployed with two children. How many times is that going to happen because of people going in the hospital for emergencies? Multiply that experience by millions for whom those $1,200 checks won’t go far.

The money being spent by the Federal Reserve and the US government is not going to create inflation in the short term. And by short term I mean 3 to 4 years. It will take longer than that to get through all of this. Are we going to force entire generations to file for bankruptcy? What about student loans which can’t be discharged in bankruptcy court?

What will landlords do when their banks want payment and their renters can’t pay? Think they will easily be able to find renters who can pay? How much bank capital will be destroyed in write-offs?

There will be a time when businesses which were not prepared will need capital to start back up, and we need to plan for the future. But for now, we have to get people back to work, with the ability to get food, housing, and the basics as soon as possible.

Yes, that is going to blow the budget out. It is going to mean even deeper deficits and even then many will be without a job. We may actually need a real infrastructure program to create jobs, spread out over several years, to fix our ailing water systems, electrical grids, roads and bridges, etc. Now that would be honest-to-God stimulus, as opposed to the mere replacement of lost income. At least we would get something real from that money.

Thinking of the Enormity of It All

It is time to hit the send button. This letter could easily run twice as long. There is so much to say and comment on. So much of the Age of Transformation is going to happen faster than we thought. That will mean social and economic shocks in and of itself. The mind simply boggles as I sit here in Puerto Rico, walking around the neighborhood when allowed. And still trying to write books and plan for a Virtual SIC sometime in May. (Details coming soon!)

I hope you enjoy your Easter weekend. It is traditionally a time of renewal and optimism. And that is something we truly need right now. Have a great week!

Your sitting at home and busier than ever analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin