Time to Put a New Economic Tool in the Box

-

John Mauldin

John Mauldin

- |

- July 26, 2014

- |

- Comments

- |

- View PDF

Say’s Law Makes a Comeback

The BEA Introduces Gross Output

Time to Put a New Economic Tool in the Box

First, Let’s Kill All the Regulations

Where Did the Jobs Come From?

More Videos from the Conference

Whistler, Maine, Montana, and San Antonio

[E]conomists are at this moment called upon to say how to extricate the free world from the serious threat of accelerating inflation which, it must be admitted, has been brought about by policies which the majority of economists recommended and even urged governments to pursue. We have indeed at the moment little cause for pride: as a profession we have made a mess of things.

It seems to me that this failure of the economists to guide policy more successfully is closely connected with their propensity to imitate as closely as possible the procedures of the brilliantly successful physical sciences – an attempt which in our field may lead to outright error. It is an approach which has come to be described as the “scientistic” attitude – an attitude which, as I defined it some thirty years ago, “is decidedly unscientific in the true sense of the word, since it involves a mechanical and uncritical application of habits of thought to fields different from those in which they have been formed.

– Friedrich Hayek, from the introduction to his Nobel Prize acceptance speech in 1974

Last week we took a deep dive into how the concept of GDP (gross domestic product) came about. We looked at some of the controversies surrounding GDP statistics that we use to measure the growth of the economy, and we noted that the GDP tool seems designed to reflect and serve an economic theory (Keynesianism) that prefers to focus on the demand side of economic activity. If your measurement of the growth of the economy is entirely defined by final consumption (that is, consumer spending) and government spending, then if you want to try to improve growth you are left with just two policy dials to adjust:

- How do we increase consumption?

- How much government spending should there be to stimulate growth when the economy is in a recession?

But what if there are other ways to measure the economy? Might those other measurement tools suggest a different set of policies and methods to help the economy grow? Indeed, I noted last week that the one thing – besides science fiction – that Paul Krugman and I agree on is that we need more growth. (There are actually some economists out there who don’t agree with that assessment. Go figure.)

As it happens, Mr. Krugman stumbled upon my post and wrote the following under the heading “The Horror, the Horror”:

I happened to click on this John Mauldin post, in which he informs us that GDP is a Keynesian plot, and that without it Hayek would of course have won the macroeconomic debate. Oh, kay – but that’s not the horror. It’s this:

“We have now made the Newt Gingrich and Niall Ferguson Strategic Investment Conference videos available. … This week, we are happy to provide even more material from this incredibly informative event. Newt Gingrich and Niall Ferguson were the two highest rated presenters at a conference packed with some of the finest economic and investment minds in the world.”

Oh, boy.

Well, we did feature two of Paul K’s least favorite people at the conference. (His debates with Niall are classic.) I don’t know why, but I started reading the comments to Paul’s piece from readers, some of which were quite thoughtful and showed that commenters had actually read my letter. To those who found me from that link, let me point out that we also had at the conference my good friend, über-Keynesian Paul McCulley, who, along with two or three of the other speakers, was more than capable of defending the Keynesian position. Paul has been a featured speaker at our conference for over 10 years, but I am quite sure there are many people who wonder why we would include him. As I have always maintained in this letter and in my Outside the Box letter, I think it is important to consider and try to appreciate all positions. In fact, I even featured Mr. Krugman himself in Outside the Box, back in 2009.

(At the end of this letter I offer a link to let you see our conference speeches and judge the various positions for yourself.)

All that being said, Mr. Krugman, I don’t think GDP as it is measured today is a Keynesian plot. GDP is a valuable measurement tool, if you understand what is being measured and all those asterisks with caveats that attend any such measure. But as we will see in this week’s letter, there are other ways to measure GDP that would suggest additional policy dials for spurring economic growth.

Actually, the debate on what constitutes an economy goes back much further than Keynes and Hayek. The debate was well recounted in an essay by economist Steve Hanke, a professor of applied economics at Johns Hopkins University. Let’s quote a few paragraphs:

The Classical School of economics prevailed roughly from Adam Smith’s Wealth of Nations time (1776) to the mid-19th century. It focused on the supply side of the economy. Production was the wellspring of prosperity.

The French economist J.-B. Say (1767-1832) was a highly regarded member of the Classical School. To this day, he is best known for Say’s Law of markets. In the popular lexicon – courtesy of John Maynard Keynes – this law simply states that “supply creates its own demand.” But, according to Steven Kates, one of the world’s leading experts on Say, Keynes’ rendition of Say’s Law distorts its true meaning and leaves its main message on the cutting room floor.

Say’s message was clear: a demand failure could not cause an economic slump. This message was accepted by virtually every major economist, prior to the publication of Keynes’ General Theory in 1936. So, before the General Theory, even though most economists thought business cycles were in the cards, demand failure was not listed as one of the causes of an economic downturn.

All this was overturned by Keynes. Kates argues convincingly that Keynes had to set Say up as a sort of straw man so that he could remove Say’s ideas from the economists’ discourse and the public’s thinking. Keynes had to do this because his entire theory was based on the analysis of demand failure, and his prescription for putting life back into aggregate demand – namely, a fiscal stimulus [read: lower taxes and/or higher government spending].”

The BEA Introduces Gross Output

So what other tool than GDP might we use? Conveniently, on this very day, July 25, 2014, the Bureau of Economic Analysis begins to publish a quarterly statistic called “gross output.” A good part of the reasoning behind this new statistic and the impetus to produce it comes from a book published in 1990 by my friend of 30 years Dr. Mark Skousen. The book was titled The Structure of Production, and in it Skousen forcefully argued that production rather than demand should be the basis for analyzing the strength of an economy. No less an authority on productivity than Peter F. Drucker commented in a review at the time, “The next economics will have to be centered on supply and the factors of production rather than being functions of demand. I've read Mark Skousen’s book twice, and it comes the closest to achieving this goal.”

Gross output (GO) measures the total output of an economy, including investments made by businesses in order to produce their goods, such as capital outlays on new equipment, raw materials, or other business-to-business transactions. In Structure, Skousen makes the case that modern economists downplay the importance of the business sector in the economy and overstate the importance of consumer spending. He believes that the GDP should not be used as the sole measure of economic activity.

Let’s go to the lead editorial by Mark that was published in the Wall Street Journal just a few months ago:

Why pay attention to gross output? For starters, research I published in 1990 shows it does a better job of measuring total economic activity. GDP is a useful measure of a country's standard of living and economic growth. But its focus on final output omits intermediate production and as a result creates much mischief in our understanding of how the economy works.

In particular, it has led to the misguided Keynesian notion that consumer and government spending drive the economy rather than saving, business investment, technology and entrepreneurship. GDP data at the end of 2013 put consumer spending first in importance (68% of GDP), followed by government expenditures (18%), and business investment third (16%). Net exports (-2%) makes up the difference.

Thus journalists and many economic analysts report that “consumer spending drives the economy.” And they focus on retail spending or consumer confidence as the critical factors in driving the economy and stock market. There is an underlying anti-saving mentality in this analysis, as evidenced by statements frequently made during debates on tax cuts or tax rebates that if consumers save their tax refund instead of spending it, it will do no good for the economy. Presidents including George W. Bush and Barack Obama have echoed this sentiment when they encouraged consumers to spend rather than save and invest their tax refunds.

Although consumer spending accounts for about 70% of GDP, if you use gross output as a broader measure of total sales or spending, it represents less than 40% of the economy. The reality is that business outlays – adding capital investment and all business spending in intermediate stages of the supply chain – are substantially larger than consumer spending in the economy. They make up more than 50% of economic activity.

Going back to my more visual “dials” metaphor, when you look at gross output you see that it gives us an additional and much larger dial for stimulating growth than simply trying to increase consumer spending. The real driver of the economy, as measured by gross output, is not consumer spending but private production and business spending. And indeed, we find that that is where the jobs are, and they are far higher-paying jobs than in the retail sector, which is where final consumption resides.

Let’s look at a few graphs my associate Worth Wray created for me today using the new data provided by the Bureau of Economic Analysis. You can see the actual data here. We will come back to the BEA’s tables in a little bit, as there are some fascinating insights to be gleaned about the US economy.

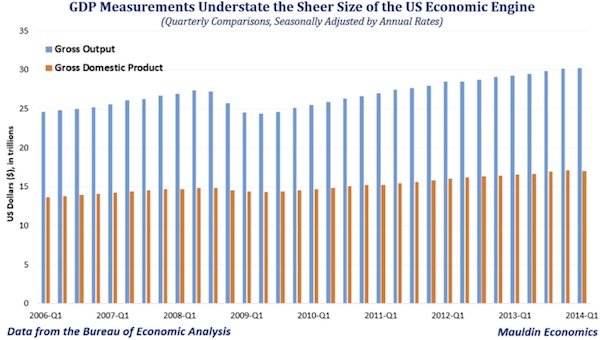

This first graph compares seasonally adjusted GDP and GO. Notice how much more sensitive gross output was to the 2009 Great Recession. Also note that measuring by gross output we find that the US economy is about $30 trillion in total production and transactions, roughly twice the amount measured by GDP.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

We might as well address one of the objections to gross output here. It seemingly “double counts” transactions to produce a final number. And there is no question that it does. But that is not the point. To ignore all of the business activity that it takes to create a product that goes into retail consumption misses the primary driver of employment and wealth creation. All along the production chain, each business adds value to what eventually becomes the final product.

I would not argue that gross output should be the primary tool in the economic measuring box. But neither should GDP. Just like a screwdriver and a hammer, they both have their uses.

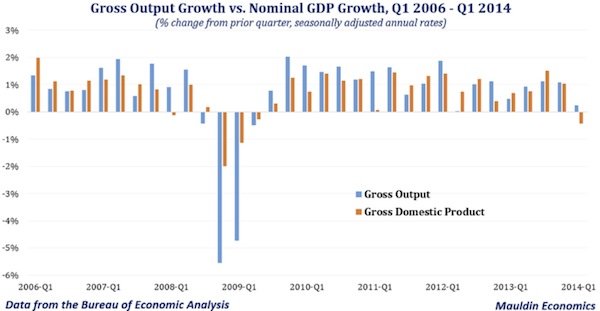

Next, let’s compare growth rates of GDP and GO for the last eight years. Notice that these numbers are not adjusted for inflation, so you see the massive falloff in production during the 2009 Great Recession. We use nominal GDP here so that we can have an apples-to-apples comparison. One other thing to note is that GO did not fall in the first quarter of 2014, although GDP did. This goes a long way toward explaining why we saw positive improvement in the employment numbers even when the economy had seemingly fallen into the doldrums if not a quarterly recession.

GO also acted as a leading indicator, at least this one time, of the Great Recession. GO might also suggest that we are not in a recession today. (Please note that this instance doesn’t prove anything, as there are only two data points, and we would need many more to actually establish a semi-predictive relationship. But it has piqued my interest.)

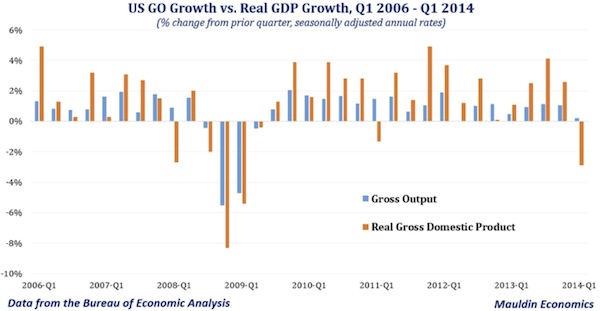

Just for the record, here is what US GO growth versus real GDP growth looks like. You can see the negative real GDP trend clearly in 2011, but again on that occasion a recession was not confirmed by gross output.

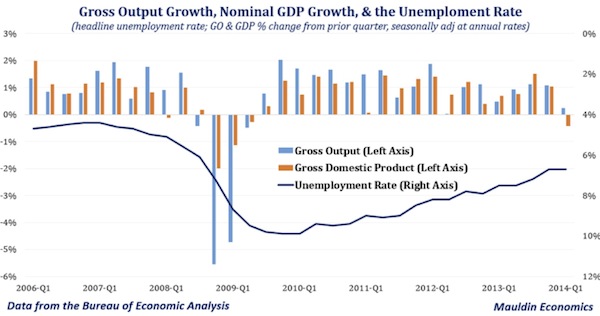

Finally, I was curious to see the relationship between the unemployment rate, GDP, and GO. We can clearly see unemployment rising dramatically during the recession (note the inverted scale on the right-hand axis) and then gradually falling along with the solid growth shown in the gross output statistic, in spite of very weak post-recession GDP numbers (in what should have been a recovery).

We also see that GO is significantly more sensitive than GDP is to the business cycle. During the 2008-09 recession, nominal GDP fell only 2% (due largely to countercyclical increases in government spending), but GO collapsed by over 7%, and intermediate inputs fell by 10%. Since 2009, nominal GDP has increased 3-4% a year, but GO has climbed more than 5% a year.

Steve Hanke’s essay on Keynes and Say (excerpted above) concludes with an enthusiastic endorsement of the new BEA gross output statistic and what it will mean for economic analysis. I personally think it will take a good long while for the statistic to work its way into the mainstream, but this is a start, and it’s a good one. Let’s rewind the tape to Steve:

But, when it comes to the public and the debate about public policies, there is nothing quite like official data. So, until now, demand-side GDP data produced by the government has dominated the discourse. With GO, GDP’s monopoly will be broken as the U.S. government will provide official data on the supply side of the economy and its structure. GO data will complement, not replace, traditional GDP data. That said, GO data will improve our understanding of the business cycle and also improve the quality of the economic policy discourse.

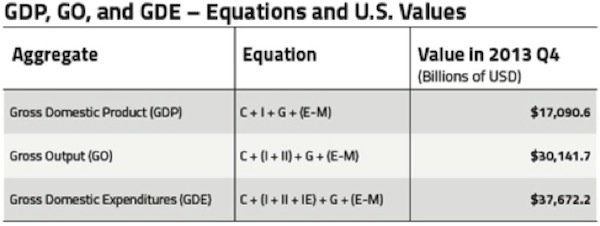

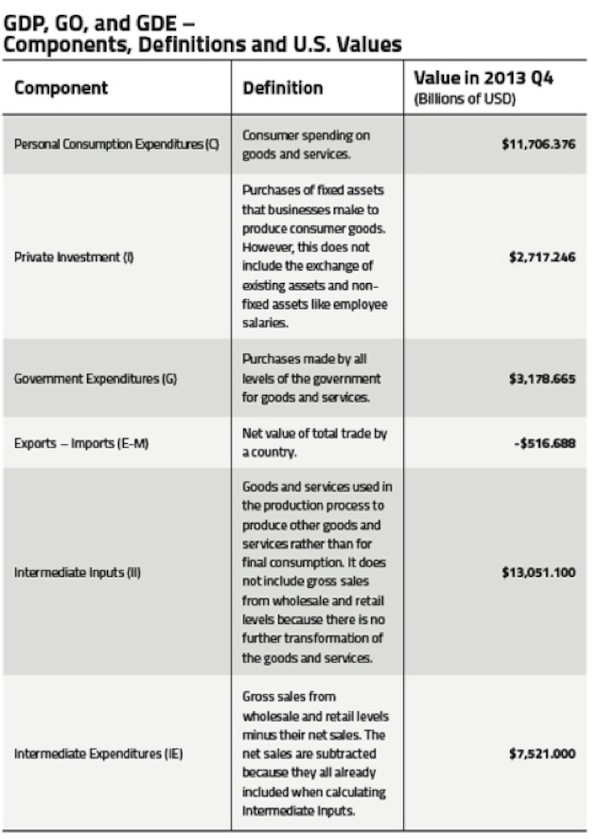

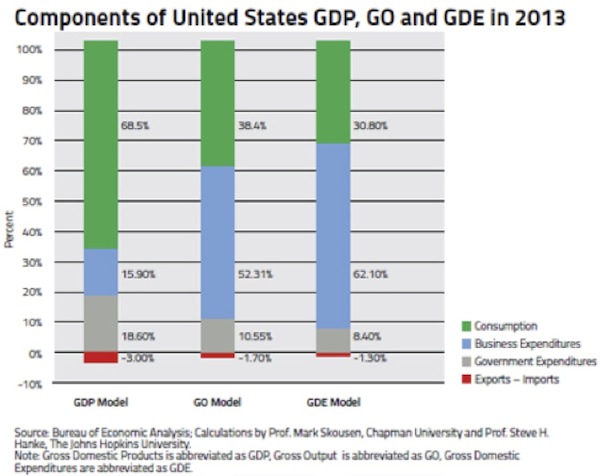

So, what makes up the conventional measure of GDP and the new GO measure? And what makes up the gross domestic expenditures (GDE) measure, a more comprehensive, close cousin of GO? The accompanying two tables answer those questions. And for readers who are more visually inclined, bar charts for the two new metrics – GO and GDE – are presented.

[I apologize for the fuzziness of the next two charts – they were this way in the original. –JM]

These changes are big – not only conceptually but also numerically. Indeed, in 2013 GO was 76.4% larger than GDP, and GDE was 120.4% larger. Why? Because GDP measures only the value of all final goods and services in the economy. GDP ignores all the intermediate steps required to produce GDP. GO corrects for most of those omissions. GDE goes even further, and is more comprehensive than GO.

Even though the always-clever Keynes temporarily buried J.-B. Say, the great Say is back. With that, the relative importance of consumption and government expenditures withers away (see the accompanying bar charts). And, yes, the alleged importance of fiscal policy withers away, too.

Contrary to what the standard textbooks have taught us and what the pundits repeat ad nauseam, consumption is not the big elephant in the room. The elephant is business expenditures.

Time to Put a New Economic Tool in the Box

That last paragraph is worth reading twice. And let’s think through what it means. That’s something I think most of us intuitively understand: that private business is the driver of the economy and jobs. If you are trying both to increase the size of the economy (growth) and to raise overall employment, the biggest policy dial, if you look at these alternative measures of the economy, becomes business activity and productivity.

Of course, it is one thing to say that we want to increase business activity and another thing to do it. Elsewhere I have shown evidence that we are now losing more companies than we are creating, for the first time in decades. We are making it so hard in the United States to create new businesses that we are losing the principal driver of economic growth and new jobs. The dual burdens of complex regulations and ever-higher taxes reduce the amount of money available to actually produce products and services for customers.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

First, Let’s Kill All the Regulations

How’s this for a catchy new policy for the upcoming presidential election cycle? I would like to see someone promise (and actually follow through with) a mandatory reduction of 20% of all federal regulations in the US. Each cabinet-level department would be required to reduce their regulation count by 5% a year for four years. They would get to choose which rules are unnecessary, duplicative, or just plain dumb. I would count as a double bonus different departments getting rid of rules that conflict with each other’s. (That happens so much that it drives businesses crazy. Such regulations mean that, no matter what you do, you’re violating somebody’s rule.)

And if we really think private production is important, then why not create policies to reward savers and investors rather than punish them? Of course that would mean appointing people to the Federal Reserve who would not suppress interest rates to the benefit of bankers and borrowers and the detriment of savers.

The counterargument will be that lower interest rates spur business growth. And those who support that position will point to charts which show that lower rates have been accompanied by business growth since World War II. I think that is a correlation without causation.

The real cause of post-recession recoveries was not low rates but rather businesses restructuring their operations to become more productive and more responsive to consumer demand. Sure, lower-cost capital is useful, but in the real world of small and medium-sized businesses the driver is productivity and investments which, coupled with proper cost-savings management, create turnarounds.

I’ve lived through a few recessions in the past almost 65 years. The one resounding theme you hear when you talk to business people during a recession is that there is not a lack of low-cost money but rather a lack of customers. So yes, final consumption (consumer spending) is clearly an important part of the growth equation. But these additional measurement tools show that consumption is not the only part, or even the most important part: we need to be just as focused on productivity as we are on consumer demand. It is not either/or. It is both/and.

I find it highly ironic that the very Keynesian economists who deride supply-side economics as trickle-down voodoo support monetary policies that are even more demonstrably trickle-down and which almost all of the research on the wealth effect says do not work. And meanwhile, trickle-down fiscal policies (increased government spending) are somehow supposed to stimulate private production on a long-term basis. All such policies truly do is distort the market and increase the national debt.

Borrowing money today for consumption (as opposed to borrowing to buy productive assets) is simply bringing forward future consumption. That money will have to be paid back in the future, at which time it will not be available for consumption. Debt is future consumption moved forward, and it simply creates current demand at the expense of future demand. Unless of course you live in an academic world where you can increase debt ad nauseum, with no restraints on spending or deficits, whether personal or public.

GDP growth in the first quarter was a disquieting -2.9%. Yet unemployment fell? How did that happen? If we go to the gross output statistics in today’s BEA release, which the BEA has broken down by industry, the answer becomes quite clear. Overall, gross output was up marginally for the quarter. But there are sectors within the economy that were humming along on all eight cylinders. Mining, which includes energy production, was up almost 15% over the last year. In fact mining was responsible for all of the growth in gross output for private industries in the first quarter. And we know that energy is where a large percentage of the new jobs are. I should note that the other driver of growth in GO was utilities.

The two main culprits responsible for the negative GDP number last quarter were healthcare and exports. Sure enough, we look in the individual BEA data and see that healthcare and social assistance spending were down.

As a business practice, you generally want to do more of what is working and less of what is not. And if energy production is producing new jobs, shouldn’t we be doing more to encourage energy production? Which will have the added bonus of lowering energy costs? That seems like a twofer to me.

Summing up, I think the BEA is to be commended for giving us another tool in our economic measurement box. GO helps make the point that productivity and private investment are essential to a growing economy. To focus only on consumer spending and government deficits as policy tools is insufficient to produce the desired results and might even sow the seeds of the next crisis, as did the Fed in the last decade.

It is hubris on the part of economists today to think we can turn a few dials and control the business cycle and the economy. There is a role for central banks and monetary policy, just as there is a place for government and deficit spending, but neither of these policy dials should be primary. The main producer of economic growth will always be private industry and individual effort. When government helps to create an environment where entrepreneurship can thrive, we will see economic growth that provides jobs and income. Hayek did not believe it was possible to spend your way out of an economic crash. He believed that genuine recovery from a post-boom crash called not just for adequate spending but also for a return to sustainable production – production purged of boom-era distortions caused by easy money.

I think it is appropriate, since we began this letter with a quote from Friedrich Hayek’s acceptance speech for the 1974 Nobel Prize in economics, to end with an excerpt from his closing thoughts in that speech (which you can read in its entirety, and I would suggest you do so, here):

If man is not to do more harm than good in his efforts to improve the social order, he will have to learn that in this, as in all other fields where essential complexity of an organized kind prevails, he cannot acquire the full knowledge which would make mastery of the events possible. He will therefore have to use what knowledge he can achieve, not to shape the results as the craftsman shapes his handiwork, but rather to cultivate a growth by providing the appropriate environment, in the manner in which the gardener does this for his plants.

There is danger in the exuberant feeling of ever growing power which the advance of the physical sciences has engendered and which tempts man to try, "dizzy with success", to use a characteristic phrase of early communism, to subject not only our natural but also our human environment to the control of a human will. The recognition of the insuperable limits to his knowledge ought indeed to teach the student of society a lesson of humility which should guard him against becoming an accomplice in men's fatal striving to control society – a striving which makes him not only a tyrant over his fellows, but which may well make him the destroyer of a civilization which no brain has designed but which has grown from the free efforts of millions of individuals.

More Videos from the Conference

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

As I noted at the beginning of the letter, we are making available a number of the videos from the Strategic Investment Conference last May. So let me take one more opportunity to call your attention to this great Mauldin Circle Member Exclusive. As I mentioned last week, we have made select videos of our highest-rated speakers available to Mauldin Circle members. There is just an incredible amount of valuable insight in these presentations from such giants as Newt Gingrich, Niall Ferguson, Kyle Bass, Paul McCulley, Ian Bremmer, and David Rosenberg. I encourage you to take the time to watch at least a few.

You can access the videos, absolutely free, just by becoming a Mauldin Circle member. In addition to these select videos, you’ll get access to summaries and presentations of many more speakers from the conference. In order to join, you must be an accredited investor. Register here to be qualified by my partners at Altegris and added to the subscriber roster. Once you register, an Altegris representative will call you to provide access to the videos, presentations, and summaries from selected speakers at our 2014 conference.

If you are already a Mauldin Circle member, simply log in to the “members only” area of the Altegris website at http://www.altegris.com. Click on the “SIC 2014” link in the upper left corner to view the videos and more. If you have forgotten your login information, simply click “Forgot Login?” and your information will be sent to you.

Whistler, Maine, Montana, and San Antonio

One of my kids reminded me just before I left town yet again that I had told them I was going to be home most of the summer. That was the original plan, but things just seem to come up. I am finishing this letter in Whistler, British Columbia, looking out over the mountains and getting ready to attend Louis Gave’s 40th birthday party (which he is celebrating over the next three days). Tomorrow, with any luck, I will be able to explore the area and maybe get in a little hiking. It seems appropriate that we talked today about the French economist Say, since I will be spending the evening with my current favorite French economist, Charles Gave, father of Louis. (By the way, Charles just put out a call suggesting it is time to short French bonds outright.)

We get home Monday afternoon, and Wednesday I leave for a stopover in New York on my way to Grand Lake Stream in Maine (via Bangor) with my youngest son, Trey. And I’m sure there will be plenty of fuel for the fires of debate to be found in my recent letters, as a couple noted Keynesian types will be there, along with the usual assortment of Federal Reserve economists and Austrian economic recidivists like me.

Later in the month I intend to go to Flathead Lake in Montana to spend some time with my friend Darrell Cain and other business partners, where we will think about the future. In the middle of September I will be at the Casey Research Summit. And while that is all that is on my schedule today, past performance is indicative that a few more outings will show up on the schedule.

In 1986, I was allowed to accompany Dr. Gary North and Dr. Mark Skousen to a small Austrian village up in the mountains near Innsbruck. There we sat down with 86-year-old Friedrich Hayek. We had traveled up there on the spur of the moment, hoping to meet him. His quite-protective wife agreed to let us talk with him for a few minutes, although she was worried about our tiring him too much. We sat down in a small room and turned on a tape recorder. Gary and Mark were not really interested in talking economics at this meeting; they wanted to talk about the “inner circle” that had gathered in Vienna around the economist Ludwig von Mises.

What ensued was interesting. When we walked into the room, we could tell that Hayek was a little weary from having met with yet another group of people wanting to discuss the economic ideas he had written about for decades. But as he realized that what Gary and Mark wanted to talk about was history that had not yet been written about – an invitation to walk back through his own memories – he visibly grew brighter and stronger. What was a promised 30 minutes stretched into three hours. I should have been taking notes, as I now remember so little of it. It’s one of the truly great opportunities in my life that I wasted. I had no idea then how special the moment was. However, getting to spend time with the man who some call the greatest economist of the last century, and to see him come alive for a few hours, was an experience that is indelibly imprinted in my mind. And to be fair to myself, there are very few conversations whose particulars I can recall 30 years on. But I do remember the moment and still feel its impact on me.

I sometimes wonder whether Mark or Gary have that recording or their notes. I keep meaning to ask.

The sun has come out, and it is a marvelous summer day in the mountains of British Columbia. I think I should hit the send button and go explore little bit before the party tonight, where we may create a few more memories. You have a great week. I’ll be ready next week from Maine, when my young associate Worth Wray and I will once again be thinking about China.

Your just enjoying the journey analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin