Decade of Living Dangerously, Part 1

-

John Mauldin

John Mauldin

- |

- January 3, 2020

- |

- Comments

- |

- View PDF

Welcome to the 2020s. Some weren’t sure we would make it this far, but we did. Now we face a new decade and new challenges. How we handle them will determine what kind of conversation we have in 2030.

This concern for the future is one of the things that separates humans from animals. Dogs don’t worry about tomorrow, much less next year. They live completely in the present, giving it their all (an ability I sometimes envy).

Being human, I have to think about the future. And being a writer, people want to know what I think. So today and next week I’ll outline what I expect for both the year 2020 and the decade of the 2020s. My forthcoming book will have an even more detailed vision, so consider this an appetizer.

Crisis Delayed

In some ways, today’s Decade of Living Dangerously letter is a continuation of my 2019 forecast, The Year of Living Dangerously. I think the 2020s in general will be rough. But to be clear, my view of the decade is not my view of the coming year.

In summary, I expect 2020 will look like a slower version of 2018 and 2019. My base case is for no recession this year, with all the usual caveats, But it’s important to know what we should pay attention to. Some key events began to unfold last year that I think will continue in 2020. Some are hard to grasp, as I said in that letter a year ago.

In a nutshell, I expect to spend this year Living Dangerously. Yes, I’m thinking of the 1982 film starring a very youthful Mel Gibson and Sigourney Weaver, based on an earlier Christopher Koch novel. It has an Asian setting and features corrupt politics, neophyte journalists, international intrigue plus a gender-bending Chinese dwarf. If you aren’t sure how all those fit together, then welcome to 2019. We are all stuck in this craziness and can only make the best of it.

Reviewing old forecasts can be humbling, but I think that mine for 2019 held up well. I outlined several risks, all of which did, in fact, pop up during the year. Fortunately, they didn’t have dire consequences… but they also aren’t over yet.

Risk, by the way, is an often-misunderstood word. It’s the possibility something bad will happen. You take risk every time you get in your car and drive somewhere. Accidents are always possible, no matter how careful you are. The fact that you didn’t crash today doesn’t mean you can throw caution to the wind tomorrow. The risk is still there.

Similarly, the fact we got through the year without Crisis X occurring doesn’t mean the risk is gone. Living dangerously tends to catch up with you.

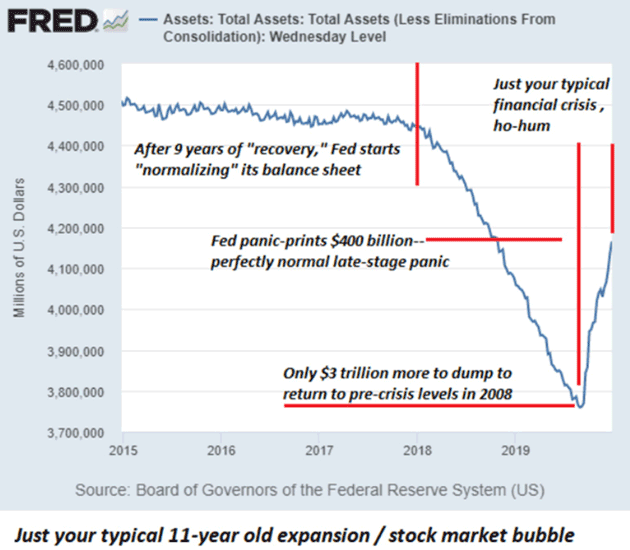

My top concern for 2019 was a Federal Reserve policy error. The December 2018 rate hike turned out to be that cycle’s last one, though none of us knew it at the time. We saw the Fed both raising rates and shrinking its balance sheet, and markets not liking it one bit. I said they should do one or the other, not both simultaneously. I said it was going to be tough.

We are in a serious pickle. The extraordinary measures central banks took to get us out of the last crisis could make the next one even worse. They seem collectively hellbent on reducing their balance sheets. Avoiding another liquidity crisis will take some seriously active management by the FOMC and central bankers elsewhere, too. I am not confident they can do it.

That liquidity crisis I feared actually happened nine months later. The repo market seized up, causing the Fed to launch a QE-like asset purchase program that is still in progress today. As I explained last month in Prelude to Crisis, the Fed’s bad choices have compounded to the point where all the options are bad.

Source: Charles Hugh Smith

I see almost zero chance the Fed will end the repo program after the six months it presently plans, because I see zero chance the federal deficit will shrink. (Chances are high it will get even bigger.) Oh, it’s possible they pause for a short time, but then we will see another Taper Tantrum and they’ll reopen the spigots. The Fed’s QE-forever mode is helping stock and other asset prices for now. It may continue into 2020, but not forever.

Market valuations are a little bit stretched, to say the least. Last December we had a 20% correction and the CNN Greed and Fear index went to 1. A year later it was back at 97. In the meantime, the Federal Reserve reversed its balance sheet reductions, cut interest rates and generally accommodated the market’s and Trump’s desires.

If we get anything like the correction we saw a year ago, I think the Fed will respond with another interest rate cut or two, while continuing the current QE and maybe even increasing it. As Milton Friedman famously said, “Nothing is so permanent as a temporary government program.”

Circling the Drain

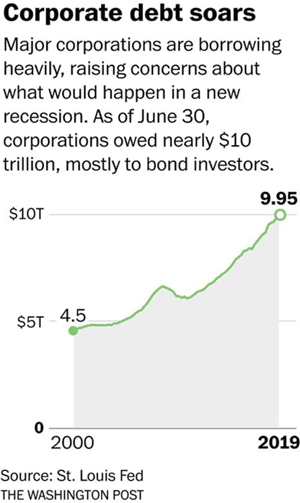

Another potential 2019 crisis, avoided so far but still with us, lies in the corporate bond market, especially its high-yield segment. Companies continued levering up last year and yield-hungry investors helped them do it. That might be less worrisome if they were using this borrowed money to make capital investments or otherwise generate additional value. Instead, much of it goes to buybacks that prop up share prices but don’t make the company any more valuable. It shifts the capital structure away from equity in favor of debt. It mainly helps option-holding management at the expense of shareholders.

Source: The Washington Post

Yet another problem is this debt tends to be short-term and has to be constantly rolled over. This is the same challenge the federal government faces. Congress and the Trump administration are spending more money, forcing the Treasury to sell more paper. This rising demand for liquidity is one factor behind the repo crisis, to which the Fed is responding with QE (or whatever you call it).

Both the Treasury and corporate borrowers compete for the same capital. Each has attractive features it can offer. Treasury has safety but low yields. Corporates have credit risk but higher yields. Low-rated corporates have even more credit risk and even higher yields. But they all have limits.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

At some point, junk bond issuers can’t offer high enough yields to compensate for the additional risk they have over Treasury debt. That’s getting harder, not easier, as the federal deficit sucks up more of the available liquidity.

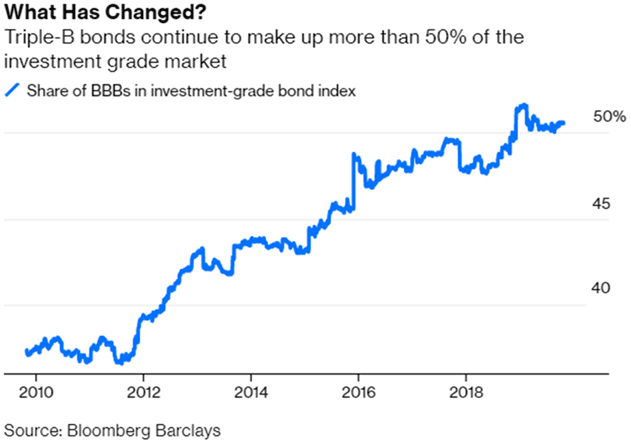

And the quality of the debt just keeps getting worse. BBB bonds now make up more than 50% of investment-grade corporate debt. That is worrying enough. But the spreads over Treasuries are dropping as investors reach for yield with both fists. This was dangerous last year and it is just as dangerous this year. When (not if) there is a recession this market is going to break badly. Investors and index mutual funds chasing this yield could see losses well over 50%.

Source: Bloomberg

I’m fairly conversant with the high-yield/junk bond space, but my go-to guy is really Steve Blumenthal. He thinks investors in some funds could lose as much as 70%+ because so much of the paper is either “covenant lite” or has no covenants at all. Literally nothing backs this paper except the issuing company’s goodwill and promises.

You know how exits clog when everybody tries to leave the theater at the same time. When the bond show ends, there will be nobody on the other side of the trade to buy those bonds in anything like a timely fashion. It will be one of the ugliest and most devastating investment events of our lifetime.

That being said, the bottom of that market will also be the buying opportunity of a lifetime. Patience, grasshopper.

The Fed is trying to manage this and doing a good job so far. Its task could suddenly get way harder if we see any major corporate debt defaults, as is likely if the economy weakens and possible even if it doesn’t. Rates might rise to a point at which already-leveraged companies can’t roll over their existing debts, much less issue more. And then it gets sticky.

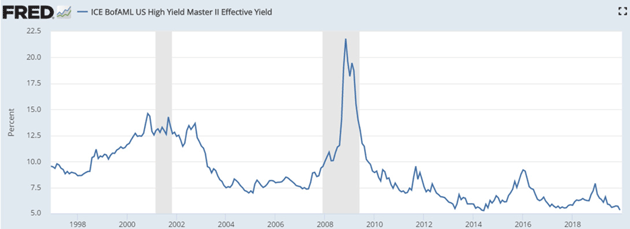

And then think about what happens if we have a recession. This chart from the St. Louis Federal Reserve FRED database shows that during the last recession, high-yield rates rose to 21.8%. When that happens next time?

Source: St. Louis Fed

Let’s look at one fund from Vanguard (I’m not picking on them. This was literally the first chart I found, and dozens of funds would show the same). Notice the cliff-like sheer drop in late 2008. Nowhere to run, nowhere to hide. Your NAV was down well over 30%. Buying somewhere close to the bottom would have brought monster returns in a fairly short time. As they say, timing is everything.

Source: Yahoo Finance

Where might this start? Your guess is as good as mine. But like a nuclear explosion, you don’t have to be at Ground Zero to get hurt. The shock waves are hard to escape. Debt defaults bring layoffs at both the defaulting company and maybe its suppliers, losses for bondholders, and it gets worse from there. Recession can easily follow.

Or perhaps it will be the other way around, with the recession causing the debt crisis. Either will be bad.

Corporate credit may well be a bigger risk than the federal government’s fiscal woes. The Fed can help the Treasury. Supporting private companies is trickier, both legally and practically. They may find ways to do it, as we saw in 2008 with TARP etc., but that will be tough in the present political environment.

I know many readers will say we should have let nature take its course in the last debt crisis. In a strict free market sense, that is the right choice. “Creative destruction” is what enables long-term growth. People and businesses that make bad decisions need to feel market discipline.

Unfortunately, that is a tough sell when people and communities are hurting. Finding the right balance is a big leadership challenge—and I’m not confident present leaders would handle it well.

Tax and Spend

All this will happen against two important backdrops.

First, whether we like it or not, government and central bank decisions now drive most of what happens in the economy and markets. That’s not ideal but it’s where we are. Yes, over long periods market forces will win. But as Keynes famously said, in the long run we’re all dead. Meanwhile, these outside forces will get what they want.

Second, what they want is increasingly unclear and subject to change. That would be the case even if 2020 weren’t an election year but, with candidates at all levels whipping up emotions, it will be even more so.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

On the key economic issues, it doesn’t particularly matter who controls Congress or the White House. They’re going to tax and spend regardless, differing only in the details. But perceptions matter, and we will probably see a lot of volatility as investors grapple with how the perceived winners will manage those details.

Wall Street is putting a lot of hope in the “Phase 1” China trade deal to boost growth. Count me skeptical. Yes, China agreed to some helpful changes. The US dropped some (not all) of its current and planned tariffs. But those aren’t the real problem. The real problem is that businesses still can’t be confident policy will remain stable, and thus are unable to make growth plans. I think we will keep seeing this in capital investment numbers, and there’s really no good solution. The trade war genie is out of the bottle.

Worse, this trade war may be producing the opposite of its intent. Last week Tesla (TSLA) delivered the first vehicles made in its new Shanghai factory, built specifically to avoid trade barriers. Instead of incentivizing US export production, tariffs are making US companies shift what would have been export production to other countries. We will see more of this. It may be good for those companies but not for American workers.

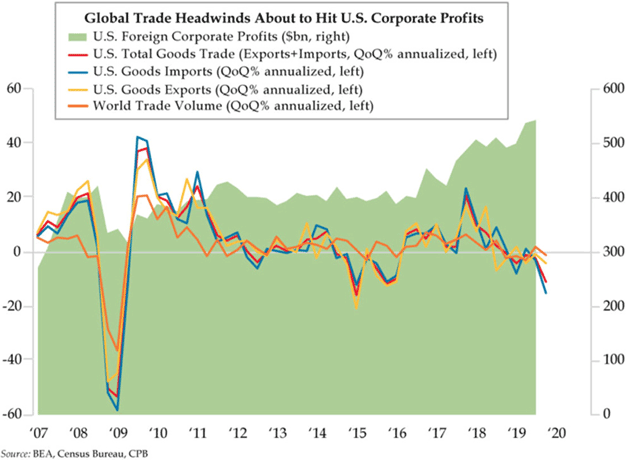

Profits from overseas operations are one of the primary reasons for sustained and high US stock valuations. The chart below (courtesy of Danielle DiMartino Booth) shows many of the components of said profits are not growing year over year. That needs to change.

If the China deal at least changes the mood for international corporations and global trade flows, then we’ll have more reasons for a positive outlook. Continued decline in global trade flows would be a serious headwind. This is something we really have to pay attention to. It is a top risk for my otherwise rather benign view of 2020.

Source: Quill Intelligence

Get Ready

While 2020 could bring any of several potential crises to a boil, I think we will more likely have a lot of noise but little real change. I expect more of the same: slow but steady GDP growth in the 1.5% to 2% range, widespread dissatisfaction and polarized opinions on both the economy and politics.

Next week we’ll look further into the coming decade and, as you’ll see, the outlook darkens considerably. This is actually good news, in one narrow sense. We have time to prepare for what’s coming. I personally intend to use 2020 to realign my portfolio, get more liquid, and try to get my businesses in position to take advantage of new opportunities.

We will all be tempted to think that electing our desired candidates will fix everything. I assure you, whatever your orientation, it will not. Bigger things are happening and at this point most are beyond political solutions. The elections will be important in many ways but they won’t change the economic trajectory. That chance is gone.

What isn’t gone is your chance to get ready. My goal this year is to help you do it. One important part of preparation, I believe, is to surround yourself with high-quality people. That goes for your business circles as well as for your personal life. When times get tough, having a support system—financially and emotionally—is priceless.

That said, in a few weeks we’ll reopen the Alpha Society, our exclusive Members’ Club, for a very short time... and we’ll have some big surprises for those who become members. More on that soon.

Writing, SIC Planning, and More Writing

A small request: I’m looking for an introduction to Andrew Yang, and I wonder if someone out there has a connection. If so, please contact my staff here. (That’s not an endorsement of his presidential campaign. I just think he has some interesting ideas and I want to learn more.)

My travel plans are strangely wide open right now. I know I will have to get to New York, but have no idea when. Philadelphia is likely soon and Tokyo is becoming a possibility. But I am feeling more and more personal pressure to get this book written and off my to-do list. It’s fun but if I ever take on a project this big again, I hope someone slaps the side of my head two or three times.

The Mauldin Economics team and I are heavily into planning this year’s Strategic Investment Conference, which will be in Scottsdale, Arizona, May 11–14 at The Phoenician. Please register as soon as possible when you get your invitation. At the request of many long-time attendees who want a more intimate atmosphere, we are significantly reducing the number of seats. I expect to fill them quickly.

Aside from writing and researching, I spent the last few pleasant days talking to friends on the phone, just wishing them Happy New Year and catching up. We had a quiet Christmas with just two boys coming for a few days. New Year’s Eve would have been even quieter except that Puerto Ricans go all out on fireworks. We saw occasional flashes throughout the evening and then at midnight the display turned spectacular. Some of my close neighbors had quite professional fireworks presentations. Shane and I got to stand outside and basically just enjoy the show. It was actually quite fun. And it was not just our community, but all around us. I didn’t hear any fire engines, so it seemed relatively safe.

I am now well into my 20th year of writing this letter. Each week we get new readers and to you I say welcome. And everywhere I travel, I meet readers who have been with me since the beginning. To all of you I wish a very prosperous and happy new year. Thanks for being one of my closest friends. I treasure each and every one of you.

Your optimistic about the future analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin