Why Americans Want Socialism

-

John Mauldin

John Mauldin

- |

- February 21, 2020

- |

- Comments

- |

- View PDF

The Decade of Living Dangerously

What’s the Appeal?

Affordability Crisis

Social Contract

Rigged System

As I write this, a self-proclaimed “democratic socialist” is leading the race for one of our major parties’ presidential nomination. The fact that so many Americans (especially young Americans) support Bernie Sanders ought to tell us something. A Quinnipiac poll out this week showed Senator Sanders with 54% support among Democrats age 18–34. Meanwhile, 50% of adults under 38 told the Harris Poll last year that they would “prefer living in a socialist country.”

I don’t believe they really want socialism. Few even understand what it is. What they want is change. They see little hope for improvement in their situations, no matter how hard they work and sacrifice. They don’t see anyone in authority trying to help them. So, when someone offers what sound like easy answers, they jump aboard. As Harvard professor Ed Glaeser says (my paraphrase), people think of socialism as “hyperredistribution.” They are not looking to control the means of production per se, just redistributing the fruits of that production.

In one regard, Sanders is similar to Trump in 2016—an outsider whose message activates previously neglected voters. Trump went on to win. If Sanders gets the nomination, it’s easy to imagine scenarios where he wins, too.

That the US could plausibly swing from someone like Trump to someone like Sanders in the space of four years says, to me at least, that something bigger is happening. Until we fix it, desperate people will keep making desperate choices.

This week’s letter will be a little bit different in that I want to focus on why so many of our fellow citizens find socialist ideas attractive. And why, even in the face of that, I am a long-term optimist. For those paying attention, there has never been a time so potentially dangerous but still offering so many incredible opportunities. But first…

The Decade of Living Dangerously

Because of the frustrations of so many, both left and right, I think volatile swings between radically different political choices could become de rigeur for at least the next three election cycles, if not longer. The simple fact is that no political solution can deliver economic nirvana. But until something happens (like The Great Reset) to force unwelcome change, the cycle will continue. And that is a reality we as investors have to face.

That theme of “The Decade of Living Dangerously” is my focus for the 16th annual Strategic Investment Conference, May 11–14 in Scottsdale. It is a thinking investor’s conference. We will be looking at the entire investment landscape: technological, political, geo-political, private and public investments, from seemingly prosaic real estate to the latest new inventions, casting our eyes around the globe, looking for what the smartest investors in the world are doing to avoid danger and find opportunity.

Every year for the last 15 years, SIC attendees have walked away saying, “How could you ever top this?” And last year was special, with record-breaking attendance and over-the-top presentations. The closing day was amazing.

The SIC is my art form. I craft the experience to fit the needs of the time. Each SIC is different because we are looking at different overarching questions. I can honestly say it will be simply the best conference of the year for addressing the problems we face, along with the potential. The lineup of speakers, many of whom are provocative thought leaders, is designed to make us evaluate how our current portfolios will meet the challenges of the next few years and indeed the decade.

Among the already-confirmed faculty are investment legends Sam Zell, Leon Cooperman, and Felix Zulauf. Joining them are some of the smartest people I know… in market analytics, in investment strategy, geopolitics, fixed income, hard assets, evolving technologies, and more, including Ben Hunt of Epsilon Theory… political pollster Michael Barone… market analyst Jim Bianco… venture capitalist David Blumberg… Bain’s head of Macro Trends Karen Harris… DC insider Bruce Mehlman… economist Samuel Rines… longtime friend Barry Ritholtz… China expert Jonathan Ward… Technology wizard Cathie Wood plus heavyweight real estate analysts Ivy Zelman and Barry Habib.

Then there are SIC favorites Louis Gave of Gavekal, economist David Rosenberg, bond expert Lacy Hunt, geopolitical expert George Friedman, and the always popular money manager Mark Yusko.

As you may have heard, this year we are reducing the number of attendees by 40%, at the request of long-time attendees. Over half of our attendees have been to five SICs or more. We believe it will make for a more collegial and intimate conference experience, one you will not want to miss.

So please do yourself a favor and join us for one of the most exciting SICs ever. Don’t procrastinate. I am very sure we will sell out and you know you want to be there. So click the link and prepare to experience the most fulfilling three days of your investment life.

And now to our regular program…

What’s the Appeal?

To my generation, “socialism” is the second “S” in USSR. We grew up being taught the Soviet Union was a mortal foe bent on world domination. We didn’t have to wonder if this adversary had nuclear weapons; we knew it could drop them on us any time. Remember “duck and cover” drills?

Thankfully, the threat of imminent nuclear war receded, and attitudes changed in those who didn’t grow up with it. A 1974 poll showed 75% of Americans aged 25 to 34 thought the US had “moved dangerously close to socialism.” Now 50% of young Americans want to embrace what they think of as socialism.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Its meaning isn’t entirely clear to older generations, either. This Mises Institute article does a good job outlining the ideologies we call “socialism.” Broadly speaking, they involve various degrees of collectivizing property and redistributing wealth. Those can sound pretty attractive if you have no property or wealth, and threatening if you do.

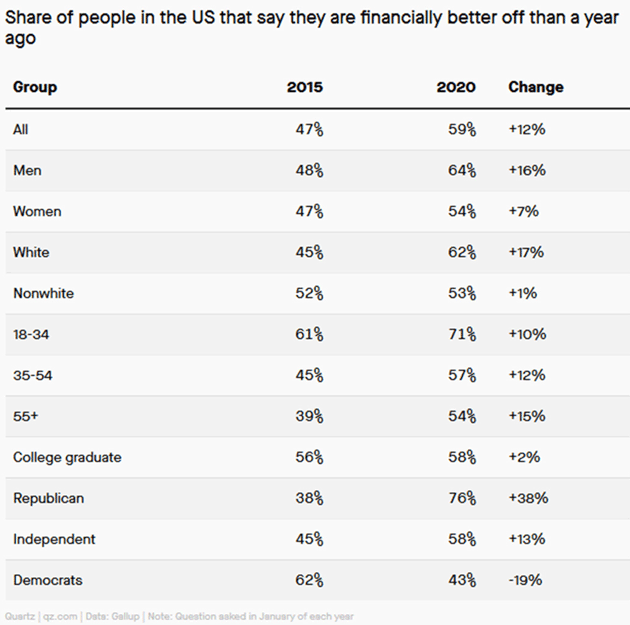

This raises a question: If the US economy is performing so well, and the rising tide is lifting all boats, why is socialism getting any traction at all? Public opinion data says this shouldn’t be happening. Polls from Gallup and others find solid majorities saying their financial condition improved in recent years, or at least got no worse.

I see two answers to that. One is in the question itself. Your financial condition can be better than it was but still not where you think it should be. If you are no longer drowning and are instead treading water with no lifeboat in sight, then yes, your condition has “improved.” But you’re still looking for answers.

The broad “better or worse” responses are heavily weighted by political affiliation. Republicans say both their own condition and the economy are better. Democrats say both are worse. They can’t all be right.

Source: Quartz

Polls that ask more specific questions find a considerably less rosy scenario.

For instance, a December 2019 Bankrate.com survey found half of US workers didn’t get any kind of pay raise in the last year. Gains in average hourly earnings may have been heavily weighted toward a smaller number of workers who got much larger raises.

Another survey by Salary Finance of 2,700 US adults working at companies with 500+ employees found 32% saying they ran out of money between paychecks. That’s consistent with the Federal Reserve’s annual “SHED” survey, which last year found almost 40% of US adults would need to borrow money to cover a $400 emergency expense. It also found an additional 18% of Americans considered themselves “just getting by” and 7% “finding it difficult to get by.”

Perhaps not coincidentally, the Fed reported this month that household debt balances hit $14 trillion, an all-time high. This was actually low as a percentage of disposable income, but disposable income is again highly weighted toward the top. Many at the bottom are in debt up to their eyeballs. And we’re not even in recession yet. Hence the dark humor like this.

Source: Twitter

From what I see, it may be true that most Americans are in “better” financial condition. But I think Ray Dalio is right when he divides the country into a bottom 60% and top 40%. More than half the country is in various degrees of trouble, and they are open to anything they think might help them, including what they think of as socialism.

Affordability Crisis

Last week I quoted from an article by Annie Lowrey in The Atlantic, The Great Affordability Crisis Breaking America. We who watch macroeconomics tend to focus on aggregate numbers—unemployment rate, GDP growth, and so on. We can overlook the “micro” world hiding inside those numbers. Let me quote Ms. Lowrey at length because she says this well.

In the 2010s, the national unemployment rate dropped from a high of 9.9 percent to its current rate of just 3.5 percent. The economy expanded each and every year. Wages picked up for high-income workers as soon as the Great Recession ended, and picked up for lower-income workers in the second half of the decade. Americans’ confidence in the economy hit its highest point since 2000, right before the dot-com bubble burst. The headline economic numbers looked good, if not great.

But beyond the headline economic numbers, a multifarious and strangely invisible economic crisis metastasized: Let’s call it the Great Affordability Crisis. This crisis involved not just what families earned but the other half of the ledger, too—how they spent their earnings. In one of the best decades the American economy has ever recorded, families were bled dry by landlords, hospital administrators, university bursars, and child-care centers. For millions, a roaring economy felt precarious or downright terrible.

Viewing the economy through a cost-of-living paradigm helps explain why roughly two in five American adults would struggle to come up with $400 in an emergency so many years after the Great Recession ended. It helps explain why one in five adults is unable to pay the current month’s bills in full. It demonstrates why a surprise furnace-repair bill, parking ticket, court fee, or medical expense remains ruinous for so many American families, despite all the wealth this country has generated. Fully one in three households is classified as “financially fragile.”

Along with the rise of inequality, the slowdown in productivity growth, and the shrinking of the middle class, the spiraling cost of living has become a central facet of American economic life. It is a crisis amenable to policy solutions at the state, local, and federal levels—with all of the 2020 candidates, President Donald Trump included, teasing or pushing sweeping solutions for the problem. But absent those solutions, it looks certain to get worse for the foreseeable future—leaving households fragile, exacerbating the country’s inequality, slowing down growth, smothering productivity, and putting families’ dreams of security out of reach.

For many and maybe most Americans, life is a constant struggle to make ends meet. They see prices rising for the things they need to survive even as the president says there’s no inflation. The central bank that supposedly works for them actually wants more inflation, not less.

This hasn’t always been the case. Not so long ago, you could work your way through college with a part-time job, afford a small home or apartment in a city or suburb where jobs were available, see a doctor if you got sick, and send your kids to decent public schools. Those are now out of reach for millions. And while some certainly made poor choices, it is not entirely or even primarily their fault.

Many people perceive, with some justification, that the economy is rigged against them. Correct or not, that perception opened the door for Trump in 2016. We have seen significant improvement since then, but clearly not enough. The door is still open for anyone who can present a convincing argument their way is better. If “their way” is somewhere on the socialist spectrum, millions will be receptive to trying it.

There is a way to close that door, and it’s pretty simple: solve the problems that are making socialism seem attractive and capitalism seem evil. Unfortunately, I don’t see much interest from the people who would need to do it.

What I do see is a belief, not entirely wrong, that more economic growth will fix everything. The problem is it will take time and people are hurting now. And for reasons I have outlined in previous letters, our debt-burdened society has borrowed growth from the future. That Pied Piper of current growth is getting ready to be repaid.

Take healthcare. It is not the case that everything was fine before Obamacare. There were serious problems. For one, people under 65 with preexisting conditions were effectively uninsurable, unless they had employer coverage. Now health insurance is “available” to all but only at staggering cost.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Bernie Sanders, Elizabeth Warren, and others keep talking about a “wealth tax” to fund national health care, student loan forgiveness, and other benefits. Others talk about much higher income taxes. Or a return to higher corporate taxes. These are terrible ideas but I get why people want them.

It is gallows humor to note that the impulse to pay for the redistribution of income and wealth with higher taxes seemingly comes from the desire to balance the budget. We can pick death by higher taxes or bigger deficits. There are no other choices.

|

||||||

|

||||||

Social Contract

Humans may be social creatures but today’s societies didn’t come easy. It took millennia of precarious survival-of-the-fittest to arrive at the “social contract” that defines human relations. The norms of how we treat each other, and how the state treats people, are incredibly important. And they are breaking down.

That’s not a pleasant thought but it is growing harder to deny. The McKinsey Global Institute has a new report, The social contract in the 21st century: Outcomes so far for workers, consumers, and savers in advanced economies. It is bleak reading. McKinsey’s findings in summary (my emphasis in bold):

… [W]hile opportunities for work have expanded and employment rates have risen to record levels in many countries, work polarization and income stagnation are real and widespread. The cost of many discretionary goods and services has fallen sharply, but basic necessities such as housing, healthcare, and education are absorbing an ever-larger proportion of incomes. Coupled with wage stagnation effects, this is eroding the welfare of the bottom three quintiles of the population by income level (roughly 500 million people in 22 countries). Public pensions are being scaled back—and roughly the same three quintiles of the population do not or cannot save enough to make up the difference.

These shifts point to an evolution in the “social contract”: the arrangements and expectations, often implicit, that govern the exchanges between individuals and institutions. Broadly, individuals have had to assume greater responsibility for their economic outcomes. While many have benefited from this evolution, for a significant number of individuals the changes are spurring uncertainty, pessimism, and a general loss of trust in institutions.

This isn’t imaginary and it is not solely about individual responsibility. Society really has changed in important, structural ways. Achieving stability, much less success, is far more difficult for younger generations than it was for me and my Boomer peers.

We can and should discuss how to ease those challenges without causing even greater harm in the process. But pretending they don’t exist, or telling people to pull themselves up by bootstraps they don’t have, isn’t the answer.

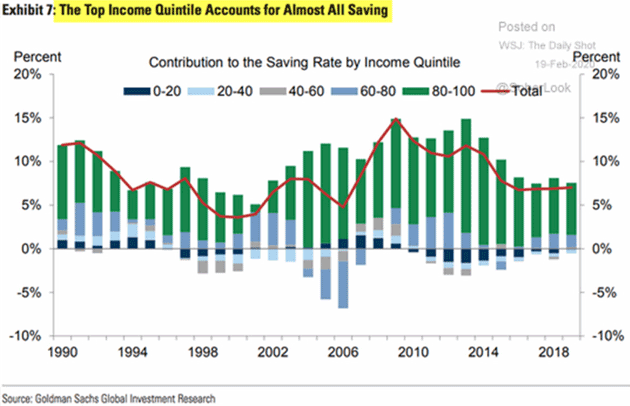

Urging people who live paycheck to paycheck to save more is not realistic. They have no money left after those fast-growing expenses. Almost all saving occurs in the top 20% and certainly in the top 40%. The lowest quintiles have negative savings, i.e., are going into debt.

Source: WSJ

If you work for minimum wage, or even $20 an hour with a family to support, and someone comes along and promises you $1000 a month, or to cover your student debt or medical services or child care? That solves a problem you have right now. The fact that giving even 40 million people $1000 a month would be a $480 billion additional tax-and-spend which would significantly impact the economy is just not in your personal equation.

For many, it’s already an easy choice. After a recession? And deeper economic malaise?

Rigged System

The “financialization” of the American economy has led to increasing income and wealth disparity. As much as it pains me to say it, the “system” really is rigged. Whatever the good intentions of the Federal Reserve in particular and the US government in general have been, it has distorted the economic feedback loops that balance a true market-based economic system.

The fact is we already have “socialism” today. It’s not the socialism we feared in 1974. We have socialized the risks of capitalism, to the benefit of a small portion of the country, while a larger portion struggles.

That’s why Bernie Sanders may be on your ballot this November, and why he could win if the economy worsens. And there’s a chance it will. I long ago said Japan was a bug in search of a windshield. Maybe I should have said China. In either case, it’s beginning to look like virus COVID-19 could be the windshield against which the global economy meets its maker.

I am not being gloom-and-doom. I really believe the world is getting better and I see opportunity everywhere. However, if there is a recession, and thus more people in pain… if we haven’t given people better answers, they may choose socialism by default.

Coupled with socialism by central banking and bureaucracy?

It’s late and time to hit the send button. Let me close quickly by saying that these questions will be on the SIC agenda. Have a great week!

Your swear I am an optimist analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin