Bull in the China Shop

The production of souls is more important than the production of tanks.... And therefore I raise my glass to you, writers, the engineers of the human soul.

Joseph Stalin, 1932

[Our purpose is] to ensure that literature and art fit well into the whole revolutionary machine as a component part, that they operate as powerful weapons for uniting and educating the people and for attacking and destroying the enemy, and that they help the people fight the enemy with one heart and one mind.

Mao Zedong, 1942

Art and literature is the engineering that molds the human soul; art and literary workers are the engineers of the human soul.

Xi Jinping, 2014

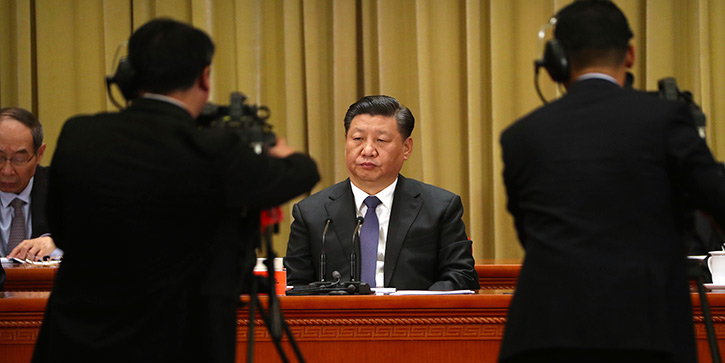

This week’s letter focuses on China’s economy. We’ll look at some numbers showing the challenges China faces, but they don’t explain something important. The way China will meet those challenges is going to be substantially different than we would see in the West. So I want to start with a little context.

When European Central Bank President Mario Draghi promised to solve the financial crisis with “whatever it takes,” central bank policy was his only tool. Xi Jinping has a vastly larger toolbox. It is hard for us in the Western world to understand that. Xi not only has every tool a top-down government can have, he has experts to wield them, all of whom are 100% aligned with his goals.

I used the “Bull in a China Shop” pun for this letter’s title to create an image in your mind. A bull tears up the proverbial china shop because it can’t comprehend the porcelain is expensive, easily broken, and hard to repair. It perceives the shelves as threats to its own freedom and so tries to escape, destroying them in the process. But that won’t unlock the door, so the bull stays stuck.

Similarly, many in the West misunderstand China and react counterproductively, breaking things and still not solving the problem.

The Stalin, Mao, and Xi quotes above have a common theme. “… engineers of the human soul.” Mao venerated Stalin, and Stalin’s books sold massively in China. Now Xi Jinping frequently quotes or alludes to Mao and Stalin. “Socialism with Chinese characteristics” has been the case since Deng Xiaoping.

I spent a few hours with Mark Yusko here in Puerto Rico this week. Mark is a good friend and every time I hear him talk about the opportunities he has found in China, it makes me want to get my checkbook and fly to Shanghai or Guangdong. The country has enormous investment opportunities, and an atmosphere where entrepreneurs can create almost anything they envision.

However, you must realize this comes with a level of government intrusion unfathomable to us in the West. In the US, we’re debating the data collected by corporations like Facebook and Google. Their Chinese equivalents are encouraged to collect such data and share it with the government. Moreover, in every interview that I have heard, the overwhelming majority of Chinese simply don’t care, at least not publicly.

These same Chinese companies will extend their practices along the One Belt, One Road initiative, and where do you think that data will end up? By the way, OBOR is a brilliant strategy from the Chinese point of view.

Xi Jinping is intent on having China once again recognized as an equal global superpower and, at some point, even the leader. The Chinese leadership are all students of Chinese history. They know where they came from, and want to regain what they consider their proper place. They are playing a long game—decades long.

China is investing at least as much in artificial intelligence, robotics and Big Data as the West is, much of it controlled, directly or indirectly, by the Chinese military. So when US and European military planners get, let’s just say, nervous about China’s growing capabilities, it is not without reason.

China fully intends for the Yuan to be a global reserve currency. One requirement for that status is willingness to run trade deficits. It is no accident China’s large trade surpluses are beginning to dwindle. That is a feature, not a bug. It is by design.

As for intellectual property and patent rights, the Chinese are rapidly creating their own. China graduated 4.5 million, not counting software developers, mathematicians and other scientists. The vast majority of artificial intelligence patents filed last year were Chinese. Their interest in protecting that property is replacing the former practice of stealing the IP shirt off your back.

But China faces numerous challenges, too. Simon Hunt, who has been going to China for 25+ years and knows the country better than any non-Chinese person I’ve ever met, put it this way.

What should be clearly understood is that China’s economy is facing multiple changes in its structure. They include:

- Exporting companies relocating overseas because of rising domestic costs and American tactics (which won’t reduce the total imports, just the origination of those imports!)

- A shrinking labour force.

- A focus on high-tech

- The need to build infrastructure to accommodate the migration of another 150 million from the countryside to the urban community [in addition to the almost 300 million that have already moved in the last 40 years, in the largest single migration in human history]

- The need to focus development on the lower-tiered cities and rural villages

- Whilst continuing the process of deleveraging the economy.

I talk often about how big China is and how fast it is growing. Often I mention it is the world’s second-largest economy after the US. I may have to modify that practice soon.

Standard Chartered Bank said this month China will likely become the world’s biggest economy at some point in 2020, using nominal GDP and purchasing power parity. Gentle reader, 2020 is next year. This isn’t the far future.

Now, this won’t be the end of the world. It is simply math. GDP growth is a function of the number of workers and their productivity. China has more workers (as in four times more) who are getting more productive. At some point, their large numbers outweigh the higher productivity we have in the US and Europe. This is inevitable.

And that rise won’t happen without some hiccups. I noted last week in Something Wicked This Way Comes that the US and Chinese economies are co-dependent in ways we can’t change quickly. Problems in either country will hurt the other, and both currently have problems.

Demand Pulled Forward

The 2008 financial crisis and recession hit China hard, as it did everyone else. Not every country responded like China did, though. Most couldn’t do what China did because they lacked either the financial resources or the political ability. China had both, and so launched a stimulus program of mind-boggling proportions. Beijing compelled local governments and state-owned enterprises to take on massive debt for giant infrastructure projects, huge capacity expansions, and pretty much anything else they could imagine that would put people to work and bolster public confidence. Yes, they built ghost cities.

(Incidentally, the classic ghost city was in Mongolia, literally vacant for a time but now well on its way to being fully occupied or bought. Long game and deep pockets, indeed.)

Not coincidentally, China has doubled its debt relative to GDP since the beginning of the century, and the bulk of that was after 2009.

But it’s how they grew that debt I find amazing. We must remember that the Chinese economy is managed from the top down. The Chinese government is very aware of how its shadow banking system operates. Half of the total debt is from the nonfinancial (i.e., shadow banks) sector. And while Simon Hunt talks about deleveraging, when I talked with him what he really means is that the Chinese government is trying to move from Wild West shadow banking to more traditional bank financing. Central bankers sometimes accompany private bankers to meet loan-seeking businesses. Chinese characteristics, indeed.

In my research for this letter I came across several mentions that China is planning to move another 150 million rural citizens to urban areas, many into so-called second-tier cities. Only in China can a second-tier city have five million people. And people moving from the country into the city becomes far more productive in terms of GDP. And China is beginning to focus on upgrading the infrastructure and the rural cities as well.

As the entire world will come to realize in the middle of the next decade, the debt which financed that infrastructure does have a carrying cost. Even in a top-down economy. Yes, much of it is internal but our first concern is China’s enormous amount of dollar-denominated debt. Here’s Christopher Balding with the numbers:

According to official data, short-term debt accounted for 62 percent of the total [of almost $2 trillion in debt] as of September, meaning that $1.2 trillion will have to be rolled over this year. Just as worrying is the speed of increase: Total external debt has increased 14 percent in the past year and 35 percent since the beginning of 2017.

External debt is no longer a trivial slice of China’s foreign-exchange reserves, which stood at just over $3 trillion at the end of November, little changed from two years earlier. Short-term foreign debt increased to 39 percent of reserves in September, from 26 percent in March 2016.

The true picture may be more precarious. China’s external debt was estimated between $3 trillion and $3.5 trillion by Daiwa Capital Markets in an August report. In other words, total foreign liabilities could be understated by as much as $1.5 trillion after accounting for borrowing in financial centres such as Hong Kong, New York, and the Caribbean islands that isn’t included in the official tally.

So, China could owe non-Chinese lenders as much as $3.5 trillion, much of it in USD which are more expensive to acquire than they used to be. This is why a trade war is so threatening to China. Revenue from exports to the US helps pay that debt.

So that’s one problem, but the internal debt is not exactly benign. Yes, a state-dominated economy like China’s can deal with debt in its own currency. It has many ways to extend and pretend. But they have limits and don’t work forever. It has to be worked off.

Job Jitters

Leverage is fun. It lets you do things you otherwise couldn’t. Deleveraging is the opposite of fun because you must do things you would rather avoid. This is a particular problem for the Chinese government, which must keep a large population fed, housed, and otherwise content. Thus the drive to improve the conditions or move 150 million people from the poverty of rural China to the cities.

Beijing has many tricks up its sleeve but China’s labor market has its own dynamic.

From my friends at Gavekal Dragonomics, written by Ernan Cui:

China’s job market is proving to be an early casualty of the US-China trade conflict. Layoffs in manufacturing accelerated over the second half of 2018 as US tariffs fell into place, and job losses have now matched the pace seen during the economic slowdown of 2015-6. But the situation is arguably worse this time, as the service-sector employers that previously absorbed many laid-off workers are now being squeezed by tighter regulations. Government officials are trying to adjust and soften policies to help employment, but the outlook for household income and consumer spending in China in 2019 is clearly worsening.

Consumer spending had already slowed in 2018, but most of the deterioration came from a decline in auto sales. [Which still total 27 million cars sold.] That was largely the result of the end of several years of favorable policies that had front-loaded vehicle purchases; spending on services and other consumer goods actually held up fairly well. But China looks to be headed for a more broad-based slowdown in consumer spending in at least the first half of 2019. The employment components of the PMI surveys, both for manufacturing and non-manufacturing sectors, started to deteriorate sharply in September. These are decent leading indicators of household income growth (see chart), so a further slowdown in income and consumption in the next couple of quarters is almost guaranteed.

Now, we should note that Chinese economic data is questionable in the best of circumstances. The last thing Beijing wants is to give the public rigorous data proving how hopeless its job-hunting is, or how unlikely its income is to grow. Fortunately, we have alternative sources like Gavekal, China Beige Book, and others with on-the-ground presence and access to non-government data.

Gavekal in their broad-based research found an amazing data point, too. The graph below shows an index of Chinese internet searches for the word “layoff.” Notice where it is now compared to 2008 and other recent economic slowdowns.

Now, this doesn’t mean Chinese employers are actually conducting layoffs. It means people are looking for information on the topic, and I think it’s fair to call that a sign of worry. What is causing this concern? Do Chinese workers see something that bullish Western analysts are missing?

Credit Intensity

Economic weakness is relative. Like anything else, coming down from a level to which you are accustomed is hard, even if you land in a place that isn’t so bad in absolute terms.

Assuming (for discussion’s sake) the official numbers are right, China’s GDP growth has been around 4% at worst going all the way back to the 1980s, and usually much higher. The US has struggled to achieve anything near that. So a decline from the 6.9% growth seen in 2017 to, say, 6%, is a big deal to the Chinese. And that’s what the government apparently expects. Reuters reported on January 11 that in March the government will announce a 2019 growth target goal in the 6-6.5% range… and China always hits the target. Funny how that works.

Here in the US we would celebrate 4% growth. (I think by the end of 2019 we may be wishing for even 2% growth.) In China, they will hit the proverbial panic button at anything south of 6%. Look for the government to respond with even more debt and infrastructure spending to try and stimulate the economy and maintain growth in the 6% range.

The problem is, like a medicine to which the body adapts, debt is no longer having the same kind of effect. An IMF study last year measured China’s “credit intensity” over time.

I’m sorry that picture is fuzzy—it’s that way in the original, too. Here is how they explain it. I bolded the important part.

However, over the last five years, domestic nominal credit to the nonfinancial sector has more than doubled, and the domestic nonfinancial sector credit-to-GDP ratio rose to about 235 percent of GDP as of end-2016. During this period, the efficiency of credit expansion has increasingly deteriorated, pointing to growing resource misallocation. In 2007-08, about RMB 6½ trillion of new credit was needed to raise nominal GDP by about RMB 5 trillion per year. In 2015-16, it took more than RMB 20 trillion in new credit for the same nominal GDP growth.

So in less than a decade, the amount of debt needed to produce a given impact on GDP more than tripled. I’ve cited data from Lacy Hunt showing a similar trend in the US but it’s nowhere near that magnitude.

That tells us something important: In the next downturn, slowdown, or whatever you call it, Beijing may not be able to borrow its way out of the hole. Or if it does, the amounts could be astronomically high.

But absent debt stimulus, what else can they do? As noted, Xi Jinping has many tools. Some are more pleasant than others. I seriously doubt he has any way to restore growth to what everyone wants without massive adjustments (i.e., more debt). And it will be painful not just for Chinese, but Americans, too.

Rushing the Process

That being the case, now is not the best time for a trade war between the US and China. Yet we find ourselves in one. Let me again give my requisite disclaimer, since I always get letters saying, essentially, “China bad! Must do something!”

Yes, China hasn’t played fairly in a number of ways. I get that. We have issues and problems that need resolution. Prior efforts haven’t worked. I get that, too. We have national security concerns about China, totally apart from our trade disputes. Granted on all counts.

It does not therefore follow that slapping tariffs on Chinese imports is the right answer. We have to fix these things, but without shooting our own feet. American and Chinese businesses have spent the last two decades integrating supply chains and developing markets with each other. Every one of us benefits from that integration every single day.

Could we reverse the integration and become less interdependent? Yes, of course. It’s happening already, simply due to technology that is letting production move closer to consumers. That’s a natural process that will continue. Rushing that process, while probably possible, would have a cost.

Last week I mentioned the US microchip companies that in some cases get half their sales from China. Some are one tariff away from being out of business. Gone, kaput. Stock zero, all employees jobless, all their small-business suppliers, bondholders, and bank lenders left to fight over the scraps in bankruptcy court.

This is one of my greatest short-term fears: that the Trump administration’s hardline tactics will push China into recession, which for them is less than 4% growth. The president himself seems to relish the prospect. He’s talked proudly of the way Chinese markets fell due to his policies. Maybe he thinks the threats will make Xi back down. I don’t think they will. We are pursuing a high-risk policy that will have massively negative consequences if it fails.

I titled this letter “Bull in the China Shop” because that is what we need to avoid. Running around breaking things may be satisfying in the moment, but the cleanup isn’t fun at all.

An Insane Travel Schedule

Next week I go to Tampa Bay for two days, then Baltimore for a few hours, then New York on Sunday, and then back to Palm Beach the following Tuesday. My schedule has changed so much in the last 24 hours it is really insane. I don’t even want to write about it, much less see that many airports and train stations. But it is what it is, and comes with the territory.

I had lunch this week with Harry Dent. He has been in Puerto Rico for several years, and bought property here 20 years ago. I always enjoy my times with Harry and now that we are almost neighbors, there will be more of them. I’m finding that I know many people in Puerto Rico and I’m meeting many more. And Shane loves it. What’s not to like?

My editors are going to have problems getting the word count down, so I think I will help them and just go ahead and hit the send button. You have a great week!

Your hoping we get the China issues resolved analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Thoughts from the Frontline

Follow John Mauldin as he uncovers the truth behind, and beyond, the financial headlines. This in-depth weekly dispatch helps you understand what's happening in the economy and navigate the markets with confidence.

Let the master guide you through this new decade of living dangerously

John Mauldin's Thoughts from the Frontline

Free in your inbox every Saturday

By opting in you are also consenting to receive Mauldin Economics' marketing emails. You can opt-out from these at any time. Privacy Policy