The Trump Trade War Recession?

-

John Mauldin

John Mauldin

- |

- May 31, 2019

- |

- Comments

- |

- View PDF

Hoover, Smoot & Hawley

Multiplayer Game Theory

Trade Sandpile

Victim List

Lopsided Polls

The Seven-Body Problem

Publisher’s Note: John Mauldin is recovering from a minor illness. He’ll be back next week. Meanwhile, with trade disputes still roiling markets, below is a still-timely letter he wrote last year. You should definitely read it again. —Ed D’Agostino

“A conservative is someone who stands athwart history, yelling stop, at a time when no one is inclined to do so, or to have much patience with those who so urge it.”

—William F. Buckley, Jr., 1955

I will never compare myself to Bill Buckley, as a writer or anything else. He was one-of-a-kind and a personal hero who I am disappointed to say I never met but who I read a lot. The response to my recent tariff comments gives me a small hint of how it must have felt to “stand athwart history” and launch the modern conservative movement.

Many of you support the tariffs. And I understand your reasons. I really do.

Free trade used to be a core belief of the conservative movement. Hayek, Friedman, Mises, Rothbard, and numerous other economists eloquently explained why. Several liberal economists agree. Conservative politicians spent the last few decades moving us in that direction, albeit imperfectly and with some big mistakes along the way. But few disagreed with the idea.

Let me be clear on this: I do not think the tariffs on China are going to cause a recession. But if we have a recession, that is precisely what the Democrats will say. Democrats will not run against the Fed, investor sentiment, markets, Italy, or anything else that actually causes the next recession. They will be running against Trump and everything will be his fault. It will be the Trump Trade War Recession. Whether or not it is true is immaterial.

That is neither here or there because a trade war with China introduces too many variables into an already difficult situation. Let’s look at what is actually happening on the ground.

|

Hoover, Smoot & Hawley

We all wonder if Trump’s trade actions are as random as they appear or if there is a broader strategy. Some of my contacts argue that the relatively strong US economy allows the administration to take a harder line than would normally be advisable. We can ride out a trade war better than China can, the thinking goes.

This only works if the US economy keeps prospering long enough for the tariffs to make China bend. We can postpone a recession for another year or two if the trade war doesn’t intensify and Europe holds together. Since it is intensifying—with a new round of 10% tariffs taking effect this week and more to come in January—we may not get that time.

In other words, tariffs could end the conditions that justified them. Something similar happened before, during the most famous trade mistake in US and global history: the 1930s Smoot-Hawley tariffs.

Similar to today, the Roaring 1920s saw rapid technological change, specifically automobiles and electricity. This created a farm surplus as fewer horses consumed less feed. Prices fell and farmers complained of foreign competition. Herbert Hoover promised higher tariffs in his 1928 presidential campaign. He won, and the House passed a tariff bill in May 1929.

The Senate was still debating its version of the bill when the stock market crashed in October 1929. Today, we use that event to mark the Great Depression’s beginning, but at the time, people didn’t know they were in a depression or even a recession. Most economists expected a quick recovery. Stocks did recover quite a bit in the following months, though not back to their prior highs.

So, when the Senate finally passed a tariff bill in March 1930, the thinking was not that different from what we see today. They thought they could preserve and even extend the good times. But conditions worsened quickly and by 1931, unemployed men were standing in soup lines.

Photo: Wikimedia Commons

In 1932, both Smoot and Hawley lost their seats as Franklin Roosevelt beat Hoover in a landslide—57% of the popular vote. That history won’t necessarily repeat this time, but it’s surely not a good omen.

Multiplayer Game Theory

John Nash (one of the world’s great mathematicians, Nobel laureate, and centerpiece of the brilliant movie A Beautiful Mind) developed multiplayer game theory. Essentially, an equilibrium develops around the rules as they are at the moment. If somebody changes the rules, no matter how rational the rule change may seem to be to the person who’s making the change, it makes everybody else change their response.

Trump’s actions, especially in regard to China, may be perfectly rational. China is not playing fairly. But his actions change the rules and everybody else is forced to react.

Throw in NAFTA, Europe, and all the other trade negotiations, and things get complicated. Yes, we have a new trade deal with Korea. The US is marginally better off. Trump is trying to do a one-off trade deal with Japan. Abe is cautious because Trump wants to open up Japan’s markets to US agriculture.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

We pulled out of the Trans-Pacific Partnership (TPP) because it had flaws—clearly. But it served the purpose of isolating China.

Trying to do bilateral trade agreements with every one of those partners is going to be extraordinarily difficult and time-consuming, if not impossible. And so, everybody reacts to try to change the circumstances to their own benefit.

This is multiplayer game theory on a scale so vast that it is almost impossible for a human being sitting in the middle of the United States working at his job, just trying to get through the day, to understand. And so, they get angry and say we need more tariffs to protect America. Just like every other voter in every other country is trying to figure out how to protect their markets.

Trade Sandpile

Something else I keep hearing is variations of, “China is cheating, and we have to do something.” This comment from reader Justin McCarthy is typical.

I get all the handwringing and pearl clutching about trade wars. But it really appears that true free and fair trade is an illusion. China cheats. Why? Because it can. Everyone pretty much acknowledges it. But where are the projections and analyses of the long-term consequences of permitting the status quo to continue? What are the consequences of letting the balance of power shift in China's favor? I see a lot of angst about trade wars but no discussion about the effects of no action.

Justin said this nicely, but I have to disagree. He’s right that “true free and fair trade” is not what we have, nor have ever had. But trade isn’t a binary condition. Today, we see near-total isolation on one extreme (think North Korea) or at the other end extensive trade freedom, as nominally exists within the European Union. There’s lots of room in between.

China cheats in many and various ways, which I have stated are problematic. I’m not happy with the status quo, and I want to change it. The question is, are tariffs the best way to accomplish this? A second question is, even if tariffs accomplish the goal, will there be side effects that reduce or eliminate the benefits? I see a lot of unintended consequences.

A few weeks ago, I described how a sandpile can slowly grow in size, apparently stable, but in reality it has many hidden fingers of instability. At any moment, something could trigger an avalanche.

The global trade system is something like that. Of course, it’s not perfect or even optimal. Countries erect barriers to their advantage. I can point to several countries whose economic policies are mercantilist, but at least everyone knows about them. We see the fingers of instability and leave them alone, lest we trigger an avalanche whose victims are impossible to predict. It is a kind of equilibrium. Everyone’s incentive is to avoid catastrophe and make incremental improvements. That makes trade talks extraordinarily difficult.

The Trump administration doesn’t seem to care about equilibrium. Whether it’s coming from the president himself or those around him, the strategy appears to be “kick apart the sandpile and make everybody rebuild it.” And whether we like it or not, many of Trump’s supporters actually like the concept of throwing a wrench into the system.

So, it is not the case that the US has no choices. We have many choices. Tariffs are the wrong one. But then, that is just me and I am one lone voice and vote.

Victim List

Commerce Secretary Wilbur Ross is a brilliant businessman. He is proving less than effective as a public advocate for administration policy. Earlier this month, he appeared on CNBC to tell us the latest tariffs won’t be so bad.

Source: CNBC

Commerce Secretary Wilbur Ross concedes that prices in the US will increase as a result of the new China tariffs put in place by President Donald Trump.

However, Ross told CNBC on Tuesday, “Nobody is going to actually notice it at the end of the day,” because the hikes will be “spread across thousands and thousands of products.”

“If you have a 10 percent tariff on another $200 billion, that’s $20 billion a year. That’s a tiny, tiny, tiny fraction of 1 percent [of] inflation in the US,” Ross said.

That last part is true. Direct tariff impact will be a tiny part of overall inflation. But it’s wrong to say no one will notice. Plenty of people and businesses are already noticing. And when those tariffs go to 25% in a few months, $20 billion becomes $50 billion. That will be felt by the Walmart nation, and a long list of US corporations.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Cato Institute trade scholar Scott Lincicome assembled a handy list for Reason magazine. It includes 202 companies with links to local news stories that describe how tariffs hurt them. Some are large, some small. This example from the metal industry: The New Hampshire metal-service center has been forced to turn down large orders from potential customers because it can’t source material due to tariffs.

Browse the full list with source links here. Remove sharp objects from your vicinity when you do. The impact seems minor in many cases, but they add up. They spread, too: All these companies have customers and suppliers who depend on them. And we’re not even talking about the farmers who are already being hit with lower prices and higher costs. Think fingers of instability and sandpiles.

Some people say that the service sector is 85% of the economy, so tariffs can’t do that much damage. Much of that service sector serves people who manufacture stuff, buy food, and go to restaurants. It’s that sandpile thing again.

The weirdest part is that tariffs could drive some of these companies to move production outside of the US. That’s the opposite of what we want. We already see it with Harley-Davidson, which is going to make motorcycles for the European market in Thailand, thereby avoiding the retaliatory EU tariffs that would apply were they made in the US. Business-wise, that’s the smartest move Harley can make. But it will hurt US workers, not help them.

Lopsided Polls

Now, I can argue against tariffs until I turn blue, but I doubt it will have much effect. Yes, I voted Republican and that party controls both the White House and Congress. But I now find that I am in the minority. I am literally standing athwart my party yelling, “Stop.”

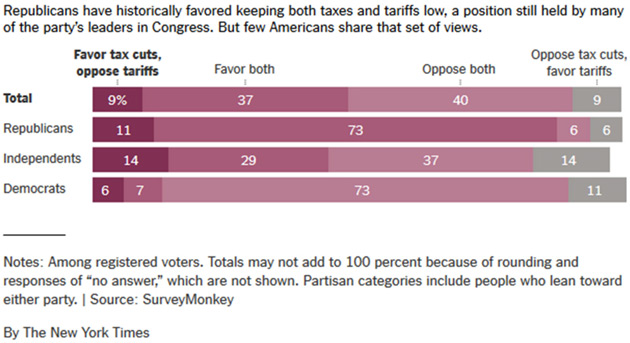

A recent New York Times poll found that 79% of Republicans favor tariffs. Dear gods, have we come to this? In this graph, 73% of Republicans favor both tariffs and tax cuts while 6% oppose tax cuts and favor tariffs. I keep talking to more and more of my friends, nominally Republican, and we agree that we no longer have a party that represents us. Certainly, the Democrats don’t. I’ve shown the data in the last few weeks that independents are an increasingly small minority. When 79% of Republicans favor tariffs, and 80% of Democrats oppose tariffs, the world has truly turned upside down.

Source: New York Times

So where is this going? Barring some titanic shift in the midterms, the president will stay on course and Congress won’t stop him. We should know in the next week or two what happens with NAFTA. Trump has a meeting with Xi in late November.

My sources in China believe that something will happen to stave off the major effects of tariffs. But if Trump is looking for Xi to capitulate or somehow lose face, he is going to be waiting forever. Xi will use it to his favor.

Further, China is growing their exports to other nations so fast that they can replace whatever they might lose to the US within a few years. Trump may think that China needs us, and to some extent they do, but we need them as well. The world works much better when everybody works together.

The Seven-Body Problem

For mathematicians, it is well known that if you have three large objects that have gravitational impact on each other, you can determine where they have been in the past, but you cannot predict where they will be in the future. It is called the Three-Body Problem. We are well beyond the three-body problem in economics.

We’re going to see quantitative easing in our future on a scale that will shock everybody.

Remember that I said it. You heard it here first.

We have at least a seven-body problem, and there is no way to predict what will happen. And Trump throws in the uncertainty of tariffs and a trade war with China.

He does this at a time when optimism on whatever index you want to look at is at an all-time high, unemployment is low, the economy is booming, and with Republicans hanging on by a slim margin with elections coming up, he could lose his ability to do or pass anything for the next two years.

Not unlike 1929. You’d better have your hedges and strategy together.

There is no reason for the US to go into recession unless a trade war begins to really impact the economy. It doesn’t have to impact a lot in order for future expansion plans by businesses to be impacted.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

I am getting nervous.

Your wondering when we get back to some kind of centrist consensus analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin