Digging a Hole to China

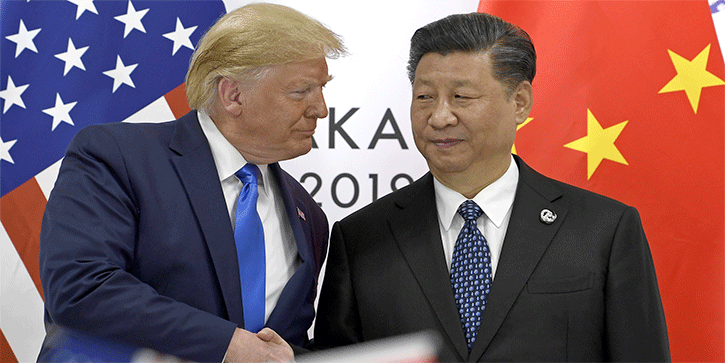

Good news: The trade war is over. No, it’s getting worse. Or maybe it is ending but it could start again tomorrow.

Confused? All of the above were true at various points in the last few weeks. Markets bounced around in reaction. And we are still no closer to knowing how it will all end.

Needless to say (but I’ll say it anyway) this uncertainty has a chilling effect on business investment. If you are considering whether to spend billions on new manufacturing capacity, opening stores, or hiring new employees, you need to know your costs and have reliable supply chains. That is all but impossible with tariff rates going up, down, or sideways depending on the day.

The saddest part is that the world trading system does, indeed, have serious problems, many of which emanate from China. We need to fix them. I fully support that goal. I am glad we have an administration that takes Chinese behavior seriously. But the tariff strategy is making the situation worse, not better, and the focus on trade deficits is entirely misplaced.

This will be a potentially incendiary letter, but sometimes things just need to be said. But first, I want to call attention to one of our gifted young writers at Mauldin Economics, Jared Dillian, and give you a chance to read him for free. That’s because, like the old potato chip commercial, I bet you can’t eat just one.

Jared writes a daily newsletter called The Daily Dirtnap. When I first heard the letter name, I thought, “Really?” But that was me not getting Jared’s Gen X humor. When I first started reading him, I appreciated the insights he was giving me. My dad would say, “Jared’s about half a bubble off dead center.” He just sees things differently. Then I realized that’s not entirely true. He’s a full generation different than me with a gift for writing and explanation and a wicked, brilliant instinct for the markets.

I urge you to try The Daily Dirtnap. For those of us of an older generation (ahem), you might need to have Google handy, as there will be some phrases and acronyms you’ve never heard of. That’s part of the fun and the learning process. It's just three pages a day—you’re through it in well under 10 minutes, but you’ll be thinking about what you’ve read throughout the day. Click here to learn more.

China and Intellectual Property

I’m going to start with a story that might fit better in the middle of the letter, but I suspect some readers will not get there. They will read my rather strong free trade biases and feel that I don’t recognize the problem China represents. Nothing could be further from the truth. While I am not happy with the way that Trump is conducting the “trade war,” I’m glad he is doing something about it.

There is a drug produced in China that works well on strokes and numerous other less devastating medical issues. It is derived from pig pancreases or human urine. It isn’t approved in the US due to justifiable regulatory issues, but it is used in Europe as well as China. It is quite expensive, both to produce and buy.

A small biotechnological firm in the US has the technology to synthesize this drug without using pancreases or urine. This would be safer and lower-cost. The Chinese company agreed to pay the US company $4.5 million upon the meeting of certain guidelines and then to purchase the drug from the company at a fraction of its Chinese production cost. For the US company, having the main distributor buy their drug without having to set up the distribution process was a good deal.

The US company spent a great deal of money and met their guidelines, providing the Chinese company with everything required under the contract. The Chinese company then said, basically, “We need to see the actual process and cell lines in order to verify the process.”

That means, in essence, “Give us your intellectual property.” With that knowledge, the Chinese company would no longer have needed the US company. When the US company had to tell shareholders that the deal fell through because they (correctly) told the Chinese company to go pound sand, their stock value plummeted. The Chinese company knew that would happen and had bet the Americans would fold. In this case, they didn’t.

This happens many times every year with Chinese companies on a hundred different fronts. Standard practice. It is why the US and other countries push back against the theft of intellectual property by Chinese companies.

Let me go just a little bit further. This is not just some widget or a better way to make a phone. This is a drug that, if it were introduced into the United States and the developed world, would allow far quicker treatment for stroke victims and save thousands if not tens of thousands of lives every year.

This is just a small part of the cost of Chinese intellectual property theft.

Binary Thinking

I have long said that protectionism is the single biggest threat to global prosperity. As we were approaching the 2001 recession, there were calls for trade protectionism. I wrote at the time that the single most destructive economic force that can be unleashed on the United States would be serious trade protectionism.

Unfortunately, I have to keep saying that because politicians keep trying it. What Trump is doing right now is not new. I wrote this back in 2007.

That is the growing mood in Congress for passing trade protection legislation that could start a series of retaliatory actions around the world that could result in a trade war, a la Smoot-Hawley in the 1930s.

Stephen Roach, chief economist at Morgan Stanley, writes a rather chilling description of his recent testimony before the Senate Finance Committee. He noted that as he entered the room, he looked up and saw a picture of Senator Reed Smoot on the walls, as Smoot was a former chair of the committee and the co-sponsor of the Smoot-Hawley Tariff Act of 1930, largely responsible for the Great Depression.

At the hearing, it was clear that a bi-partisan effort is getting ready to pass legislation that would punish China for the large trade deficit we have with that nation.

As I recall, it was Democratic Sen. Chuck Schumer and Republican Sen. Lindsey Graham who led the way worrying about trade deficits, proving mainly that neither of them knew anything about trade deficits. As we will see in a bit, trade deficits are not the issue. Fortunately, that effort fizzled, though I suspect it helped set up the 2008 fireworks.

Politicians of all parties love free trade in theory. Its benefits are clear, but they are also unevenly distributed. Which I admit is a problem.

As long as we have sovereign national governments, goods will face obstacles and delays getting across borders. We can’t have truly “free trade” unless we eliminate borders, which of course creates other problems. (Think of the US as a free trade zone. Would we be nearly as prosperous if we had to negotiate every little trade deal between various states?)

Countries that trade with each other need fair and reasonable rules governing it, and both sides must enforce the rules. Obviously, this is complicated in a modern economy. That’s one reason trade agreements take so long to negotiate. And of course, there will always be squabbles and disputes. But generally open trade is possible, as we see in blocs like the European Union and NAFTA. It works because all sides are committed to making it work.

Problems occur when a country flouts the rules or enforces them selectively, as China does. I’ve often talked about China’s rapid entry into the advanced world’s economy. In less than a few generations it went from subsistence farming to modern industry. This happened because the US and others agreed to let their domestic businesses trade with China on favorable terms.

China was supposed to reciprocate with similar terms of its own. It pretended to, but hasn’t been thorough or consistent. This is most evident in intellectual property. The Chinese government routinely extracts (or steals) trade secrets from foreign businesses that wish to operate in China. Software code, drug formulas, and other information then finds its way to Chinese companies that shamelessly copy it.

Again, this is nothing new. The same thing happened years ago when Chinese merchants pirated all manner of Western consumer goods. More recently they’ve done the same for intangible technology and sent it into overdrive. And the Chinese government does nothing to stop it.

Talks to resolve these and other problems have been fruitless. Beijing agrees to changes then fails to implement them, and gets away with it because the US and other Western democracies have these inconvenient things called “elections.” China’s rulers know they can just wait out the clock until we get a new leader with different priorities.

The Trade Deficit Is Not a Scorecard

Give Trump credit for at least recognizing the problem and trying to do something about it. Unfortunately, he has some odd ideas about what “winning” looks like. Furthermore, he gets bad advice from so-called “economists” like Peter Navarro. I deleted half this letter which was basically an exposé on Peter Navarro who I think is the most dangerous man in the Trump administration, if not the country. I know he has a Harvard PhD, but I think William Buckley had it largely right when he said better to be ruled by 2,000 random names from the phone book than by professors from Harvard.

We see this in the president’s trade deficit obsession. He seems to believe it is some kind of scorecard. If the US buys more from China than China buys from the US, the US is losing. That is not what it means at all. Both sides get what they want. China (or other exporters) gets cash, we get useful goods at fair prices (or we would stop buying them).

Better yet, since we own the reserve currency, we get to pay for these goods in dollars, which then return here as the Chinese or foreign recipients invest in US assets, namely our Treasury debt. That’s good for Americans. In fact, it’s critical. Our interest rates would be sharply higher, and our currency much lower, if not for the trade deficit, because US savers would have to cover the entire government debt. We don’t save nearly enough to do that.

And that is a very critical point. If other nations don’t want your currency, you can’t run trade deficits without severe economic problems. Valéry Giscard d'Estaing was right: The US has an exorbitant privilege as owner of the world’s reserve currency.

In fact, if you have the reserve currency, it is your obligation to run deficits so that the world has enough currency to conduct trade. No country south of the Rio Grande has that privilege. The Europeans kind of, sort of do. And the Japanese. The Chinese are working diligently to make the yuan a reserve currency, though they are not there yet.

If the US fails to run a real trade deficit, we will cease to have the reserve currency. It is that simple.

Bilateral Trade Balances—Whack-A-Mole?

Eliminating the trade deficit is not as easy as it may sound. Paul Kasriel sent out a note this week that I found compelling. Let me quote:

President Trump has imposed higher tariffs on US imports from Mainland China, in part, to narrow the bilateral trade deficit that the US runs with China. The president’s tariff policy appears to be working. As shown in Chart 1, the 12-month cumulative US trade deficit in goods with Mainland China (the blue bars) is narrowing. For example, after a reaching a record goods deficit of $419.5 billion in the 12 months ended December 2018, the US goods deficit with Mainland China narrowed to $400.7 billion in the 12 months ended June 2019.

So far, so good for President Trump’s desire to see the US bilateral trade deficit with China narrow. But, I think it is fair to say that the president believes that it is in the best interest of the US to not only reduce our bilateral trade deficit with China but our trade deficit with the rest of the world as well. And here, things are not moving in President Trump’s desired direction. Also shown in Chart 1 is the 12-month cumulative US trade deficit in goods with the world (the red line). Although the US bilateral goods trade deficit with China has been narrowing in recent months, the US goods trade deficit with the world widened to a record $886.0 billion in the 12 months ended June 2019. This seems like a game of Whack-A-Mole. President Trump hikes tariffs on imports from one country in order to reduce the bilateral trade deficit with that country, and our trade deficits with other countries widen.

Again, the trade deficit is not a problem. But even if you assume it is a problem, tariffs won’t solve it so long as the government continues to run huge and growing deficits. No one in either party has any intent of even moving toward a balanced budget. Therefore, the trade deficit is going to grow—with other countries even if not China.

The US is using the wrong weapon to solve the wrong problem and harming our own economy in the process. What would work better? I believe that Trump’s choice (which candidate Clinton said she would do as well) to cancel US participation in the Trans-Pacific Partnership was a mistake. That agreement would have set up a giant free-trade zone as a counter to China, and I think at a minimum would have forced Beijing to negotiate more sincerely. TPP had more than a few problems, but they could have been fixed. But best case, it would’ve made it much easier for companies in the US to skip over China for their supply chains.

As it stands, the other TPP nations went forward without the US and are now trading with each other on more favorable terms. Thanks to TPP, Japan increasingly imports food products from Canada instead of the US.

Navarro appears not to care, and Trump appears to agree with him. And to be fair, Trump had protectionist leanings long before he met Navarro. Some of this might be happening anyway. But the combination of Trump and Navarro is proving economically catastrophic.

There has been a series of articles for the last five months pointing out that the Trump tax cuts averaged around $900 per taxpayer. Tariffs have already eaten about $800 of that tax break, essentially nullifying the benefits of the tax cuts. JPMorgan said it again this week.

We have spent two years digging a hole to China. Will we spend at least that many years refilling it? Trade wars are not easy to win.

Should we be dealing aggressively with China on its theft of intellectual property, its lack of a fair playing field, its mercantilist policies and government subsidies of companies? Absolutely. And you can insert a few expletives deleted after that absolutely.

We can start dealing one-on-one with companies that are clearly violating intellectual property and other WTO rules. Simply ban them from doing business in the US, or take away their banking privileges. WTO should classify China as a developed market in WTO, not an emerging one. Just look at pictures of Beijing and Shanghai and dozens of other cities to recognize China has emerged.

Tariffs are hurting US consumers. China is not paying those tariffs, we are, and any economist worth their salt (other than Navarro) knows it.

Get tough with China? Damn Skippy. But don’t make Americans pay for it. If you’re going to fight a trade war then don’t point the gun at yourself.

I Need a Vacation from My Vacation

I mentioned a few months ago that my partners at Sanders Morris Harris in Houston had a particularly interesting private offering for income and appreciation. I want to call your attention to it one more time, as that offering will close within the next month or so. It is not a hedge fund that stays continually open. You really do want to get to know my friends at SMH as they have a variety of ways for accredited investors to potentially enhance their portfolio returns. You can go to my Mauldin Securities LLC website and simply fill in your name, email, and a little information. I will share it with SMH and they will contact you. You really, really want to do this. (Please note, while I personally receive compensation from SMH, neither SMH nor Mauldin Securities LLC are affiliated with Mauldin Economics.)

I know it’s kind of a cliché, but sometimes you really do need another vacation after your vacation. Maine, Montana, and New York were absolutely fabulous. Then I came back to Puerto Rico with 400+ emails in my inbox, despite trying to deal with it while on vacation, and an extra 10 pounds. I will get my emails under control before I lose those 10 pounds but I’m working at it, or actually Shane will, as she will be feeding me fish pretty much every night.

The good news is I had a really productive time thinking about the future, not only writing but about the new things we can do for you as a reader. I think you will see some changes in the next 60 to 90 days.

And with that, I’m going to hit the send button. You have a great week and enjoy the waning days of summer…

Your starting the rest of his life/diet analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Thoughts from the Frontline

Follow John Mauldin as he uncovers the truth behind, and beyond, the financial headlines. This in-depth weekly dispatch helps you understand what's happening in the economy and navigate the markets with confidence.

Let the master guide you through this new decade of living dangerously

John Mauldin's Thoughts from the Frontline

Free in your inbox every Saturday

By opting in you are also consenting to receive Mauldin Economics' marketing emails. You can opt-out from these at any time. Privacy Policy