Never Smile at a Crocodile

-

John Mauldin

John Mauldin

- |

- March 10, 2015

- |

- Comments

- |

- View PDF

“High debt levels, whether in the public or private sector, have historically placed a drag on growth and raised the risk of financial crises that spark deep economic recessions.”

– The McKinsey Institute, “Debt and (not much) deleveraging”

Never smile at a crocodile

No, you can't get friendly with a crocodile

Don't be taken in by his welcome grin

He's imagining how well you'd fit within his skin

Never smile at a crocodile

Never tip your hat and stop to talk awhile

Never run, walk away, say good-night, not good-day

Clear the aisle but never smile at Mister Crocodile

(From the staff: This week’s letter is a shortened Thoughts from the Frontline. While he was writing the letter, Mr. Mauldin had a personal situation develop that required his attention, but he wanted us to pass on these already-written notes. For those of his friends who are interested, he shares some thoughts at the end of the letter.)

As I sit here on Friday morning, beginning this week’s letter, nonfarm payrolls have just come in at a blockbuster 295,000 new jobs, and unemployment is said to be down to 5.5%. GDP is bumping along in the 2%-plus range, right in the middle of my predicted Muddle Through Economy for the decade. US stocks are hitting all-time nominal highs; the dollar is soaring (especially after the jobs announcement); and of course, in response, the Dow Jones is down 100 points as I write because all that good news increases the pressure for a June rate hike. Art Cashin pointed out that, with this data, if the FOMC does not remove the word patient from its March statement, they will begin to lose credibility. The potential for a rate increase in June is back on the table, but unless we get another few payrolls like this one, the rather dovish FOMC is still likely to wait until at least September. Who knows where rates will be end of the day, though? Anyway, what’s to worry?

Well, judging from the contents of my inbox, I’d say there is plenty going on to make us nervous. We will briefly survey my worry closet today before resuming our series on debt, in which we’ll encounter Paul Krugman’s lament that “Nobody understands debt.” Warning: this letter is going to be long on charts but hopefully shorter on words – perhaps a little heavy on philosophy. At the end I’ll make a few surprise announcements about speakers for our upcoming Strategic Investment Conference in San Diego, April 29 through May 2. You really want to try to join us for what are going to be a fabulous few days.

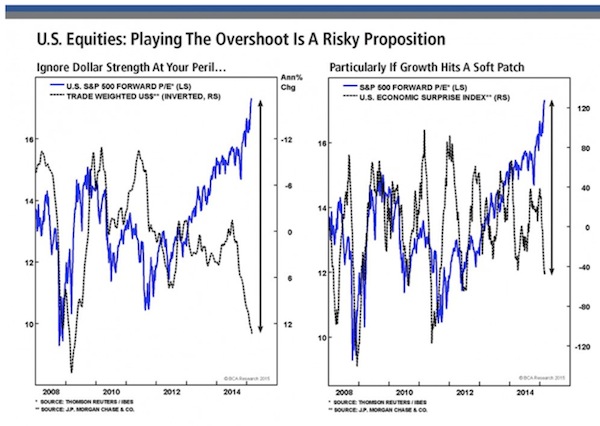

The following two charts from Bank Credit Analyst found their way to my inbox last week. They are nothing if not the most gaping pair of crocodile jaws I’ve seen in many a moon. This should make you somewhat cautious in your long-only portfolios. You need to have a plan to avoid a classic crocodile trap. (And unless you are young, also avoid listening to the Peter Pan song in the YouTube link cited at the top of the letter. Those of us of a certain generation will not be able to get it out of our heads.)

Let’s look a little deeper into the payroll report. You have to like what you see on the surface, as 11.5 million more people are working now than at the February 2010 low. What’s not as rosy is that wages increased by only 0.1%, which is understandable when you realize that 66,000 of the 295,000 new jobs were in leisure and hospitality, with 58,000 of those being in bars and restaurants. (As Joanie McCullough pointed out, full employment now means three fingers of whiskey in the glass, neat.) Transportation and warehousing rose by 19,000, but 12,000 of those were messengers, again not exactly high-paying jobs. The oil industry is still shedding jobs, though not as fast as many of us thought it would. This employment report was very long on low-paying jobs.

Finally, the labor force declined by 178,000 and the Labor Force Participation Rate declined 0.1% to 62.8%. You have to go back a full 36 years to March, 1978, to find a similar rate. Yes, some of the dropoff was Boomers retiring and some of it may have been due to weather, but it is just a reinforcement of the trend that began in 2000.

Nearly all of my kids have worked in the food-service industry at some point in their lives, as did I, and we are keenly aware how fast those jobs can both appear and disappear in a downturn, not to mention how tips can get a little thinner in tougher times (which prompts me to suggest you think about bumping your tip percentage up a point or two here and there. Your waitperson is somebody else’s kid who needs all the help they can get.)

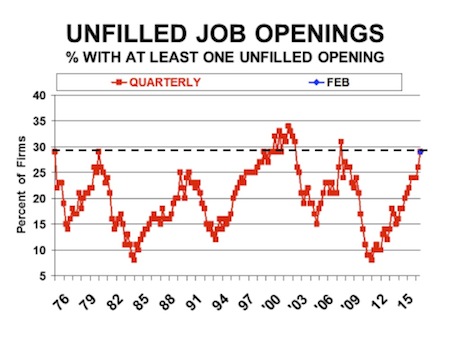

The employment report was bolstered by this week’s release of the National Federation of Independent Businesses monthly jobs report. All in all, it was a generally bullish report. Then again, the bear in me was struck by how many of the charts seem to be at levels last seen prior to recessions (one example below). The chief economist for the NFIB is William Dunkelberg, or Dunk to his friends. I shot Dunk an email, asking him “Does it bother you that we are approaching levels (in so many charts) only seen prior to the last two sell-offs?”

He came back with this pithy note:

Yes, I keep trying to think of reasons why we won’t fall back, but USA INC is overvalued, stock market at a record high but output of USA INC growing slowly and under-performing. Good thing small businesses are not publicly traded. We know the Fed has boosted stock and bond values so those will [eventually –JM] succumb to rising rates. But the NASDAQ is not the same as the one in 2000, it looks a lot firmer. Lots of stock buybacks, consumer sector may still be a net seller of stocks. There is a shortage of risk-free, safe assets, the central banks are hoarding them. … A “deflation of asset prices” would likely be more like 2000 (financial assets owned by a few fools) than the housing bubble which cut deeper into the middle class wealth AND jobs. I figure you will sort all this out in one of your brilliant essays. I will be watching :) – Dunk

(Dunk is obviously trying to position himself to get me to pick up his next bar tab, which I should hasten to point out can be high, not due to quantity but quality. He is a bit of a wine connoisseur.)

But he makes a point. US S&P 500 corporate profits are forecast to fall by 4.6% in Q1 and by 1.5% in Q2 this year, the first fall in profits for two consecutive Q's in six years, if those forecasts turn out to be true. Falling earnings are not the stuff of roaring bull markets. That being said, the NASDAQ of today is not like 2000’s.

First, the NASDAQ would have to be at 6900 to give an investor a return in terms of inflation. (It’s oscillating around 4925 now.) Remember the secular bear market in 1966 to ’82? It was actually 1992 before the market reached an inflation-adjusted new high. (Tell me one more time why we think 2% inflation is good. When you lose 20% of your buying power in just 10 years, which span has included two deflationary recessions, the 2% inflation premise begins to look a little suspect.) Second, there is actually an E in the P/E ratio for the NASDAQ. Some of the stocks in the NASDAQ 100 are actually on various investors’ value lists.

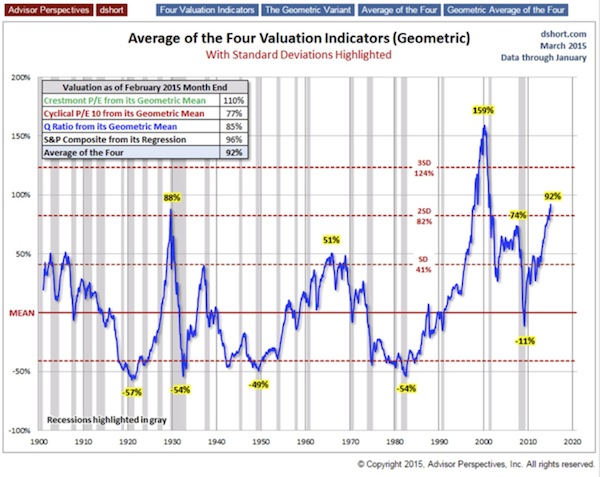

Even so, valuations are stretched. Doug Short combines four different ways to compute valuations (basically, derivatives of the price-to-earnings ratio) into one average. In the graph below you will note that there was only one previous time (during the tech bubble that popped in 2000) when valuations were higher than they are now. Bear markets and recessions can start from much lower valuations.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

But then again, my friend Barry Ritholtz argues in his March 7 Washington Post column, that valuations using other metrics are quite reasonable.

If it appears I’m trying to make you nervous, that’s because I am. I’m not suggesting you exit the market entirely. As the hero of my youth, Lazarus Long (one of Robert Heinlein’s recurring characters) said, “Certainly the game is rigged. Don’t let that stop you; if you don’t bet, you can’t win.”

I am suggesting you have a well-thought-out, calmly reasoned algorithm that will tell you when to enter and exit specific markets. You should already be out of small-caps, as in a long time ago. And energy and emerging markets, etc. Trying to catch absolute tops or bottoms is a fool’s mission, but with a methodical program you can avoid large drops and, just as importantly, latch onto big runs. It takes a well-reasoned system and discipline. You or your advisor should have both.

Strategic Investment Conference 2015

I am excited to announce a few additional attendees to the Strategic Investment Conference. First, Peter Diamandis, physician, engineer, serial (and parallel) entrepreneur, founder and chairman of the X PRIZE Foundation, and an extraordinary visionary (and my friend) will be doing a keynote dinner presentation. Peter is simply mind-expanding. His latest New York Times bestseller, Abundance: The Future Is Better Than You Think, offers a far different vision of the future from the dystopian images that are in vogue today.

My good friend George Friedman of Stratfor has cleared his schedule to be able to drop in as well. Then, Richard Yamarone, chief economist for Bloomberg, and Gary Shilling (whom all of my readers already know) have both agreed to come grill our speakers. They will be joined by (in no particular order) Peter Briger of the $66 billion Fortress Investment Group, who will talk on the state of credit in the world; David Rosenberg; Dr. Lacy Hunt; Grant Williams; Raoul Pal; Paul McCulley; David Harding (of the $25 billion Winton fund family); Louis Gave; Jim Bianco; Larry Meyer (former Fed Governor); the irrepressible Jeff Gundlach; the wickedly brilliant Stephanie Pomboy; Ian Bremmer; David Zervos; Michael Pettis (flying in from China); and Kyle Bass, along with Jack Rivkin of Altegris and your humble analyst. Seriously, where is there a better lineup of thinkers, people who can give you the insights you need to navigate these unprecedented economic waters – not to mention that all of them are A+ speakers and communicators.

The conference is in San Diego, April 30–May 2, and will once again be at the Hyatt Manchester. For the first time this year, our conference is open to everyone, not just accredited investors.

Attendees routinely tell me that this is the best conference anywhere, every year. And most of the speakers hang around to hear what is being said, which means you get to meet them at breaks and dinners. Plus, this year I am arranging for quite a number of writers and analysts to show up, just to be there to talk with you. And I must say that the best part of the conference is mingling with fellow attendees. You will make new friends and be able to share ideas with other investors like yourself. I really hope you can make it.

Registration is simple. Use this link. While the conference is not cheap, the largest cost is your time, and I try to make it worth every minute. There are also two private breakfasts where hedge funds will be presenting. Altegris will contact you to let you know the details.

This last week has been full of paradoxes. I’ve been on the phone and writing with my friend Patrick Cox on some very exciting developments in the whole anti-aging and life-renewal/regeneration arena. Pat in particular, with some cheerleading help from me, has been involved in midwifing several new technologies into companies and people who can actually take them to completion. When these amazing breakthroughs become available, they will have a significant impact not just on our lifespans but on our healthspans. We will live better as we live longer. It is truly an exciting era we live in.

Then Saturday I went with my daughter Tiffani to a surprise birthday party for her high school classmate Scott, who is the son of one of the most remarkable couples I know. Darrell and Phyllis Wayman had six biological children but also adopted 17 special-needs children. Because of my activity in adoption circles (I adopted five children), we became close friends. For the most part, they did not adopt the “easy” kids. Most of them had serious handicaps, problems that would need lifelong special attention. Going to the Wayman’s house was always an adventure, but I always found it full of happiness and love. I never truly understood how they did it. Just thinking about what they did left me exhausted.

Tragically, Darrell passed away suddenly in the mid-’90s, and Phyllis joined him in the middle of the last decade. To watch those children rally around each other, even the young ones, and take care of each other and make sure they all stayed together was very inspiring. With all the bad news about the depravity of humanity on TV, knowing this family gives you hope for the human race. You can see the legacy of Phyllis and Darrell in the way these children work together and care for each other, persevering in the midst of what (to merely normal human beings like myself) seem like overwhelming circumstances.

Those 23 kids now have 21 grandkids; and once again, walking into their family home, we felt the love and happiness. Scott, at 40, has become quite the young software executive and is getting ready to launch his next venture. I’m not certain I understand it, but if you are ever going to bet on a young man with character, drive, and perseverance, this would be that man. I know some venture capital experts who say that picking the right management team is more important than picking the project. I may just ride along on this one, if for no other reason than to see how it turns out.

And, as we were in the area, we dropped by afterwards to see my mother. She has been bedridden for almost two years and has been visibly failing for the last few months. At 97½ years, she has lived a long and amazing life, persevering through many good and some very difficult times, spreading happiness to all who knew her.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

When we walked into the family home where mother had lived for almost 50 years, we knew as soon as we saw her that the end was quite close. You could see in her eyes that she knew it, too. She did not want to go to the hospital, but my brother did call hospice, who came and offered some care that provided some relief, and she passed away quietly a short while later.

Even though this was an event we knew was coming for some time, the finality of death always brings a personal confrontation with your own mortality. The loss of a parent compounds the emotions in complex ways. The juxtaposition of the conversations I was having with Pat on our efforts to postpone our own personal eventuality, the overwhelming joy of those 23 kids who I no longer see as having special needs but rather special lives, and then the cruel finality of my mother’s parting, is a bit overwhelming.

We all go through such experiences, and if past performance is somewhat indicative of future results, we endure and go on with our lives. But such times do give us pause for reflection.

I want to believe there is a Very Special Place, beyond a mere heaven, where certifiable Saints like Darrell and Phyllis and my Mother are rewarded for a lifetime of caring for others and spreading blessings in the midst of the chaos of normal human life. If I were a god, I would make it so.

Your reflective analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin