Where Will the Jobs Come From?

-

John Mauldin

John Mauldin

- |

- March 17, 2012

- |

- Comments

- |

- View PDF

Getting Back to Full Employment

Who’s Participating in Employment?

4 Million New Jobs a Month!

Where Will the Jobs Come From?

Stockholm, Paris, San Francisco, and New York

"Six years into our global data collection effort, we may have already found the single most searing, clarifying, helpful, world-altering fact.

"What the whole world wants is a good job.

"This is one of the most important dsicoveries Gallup has ever made. At the very least, it needs to be considered in every policy, every law, every social initiative. All leaders – policy makers and lawmakers, presidents and prime ministers, parents, judges, priests, pastors, imams, teachers, managers and CEOs – need to consider it every day in everything they do.

"That is as simple and as straightforward an explanation of the data as I can give. Whether you and I were walking down the street in Khartoum, Cairo, Berlin, Lima, Los Angeles, Baghdad, or Istanbul, we would discover that the single most dominant thought on most people's minds is about having a job.

"Humans used to desire love, money, food, shelter, safety, peace and freedom more than anything else. The last 30 years have changed us. Now people want to have a good job. This changes everything for world leaders. Everything they do – from waging war to building societies – will need to be in the context of the need for a good job."

- From The Coming Jobs War, by Jim Clifton, Chairman and CEO of Gallup

Each month investors and politicians in countries all over the world obsess over the release of the monthly employment numbers. Even though these numbers are likely to be revised significantly from the original release, the markets can't help responding to the variations from the expected number. Why the focus on numbers that are likely to be proven wrong in the coming years? Because the single most important factor in the direction of an economy is employment. Consumer spending, personal income, tax revenue, corporate profits, and a host of other variables all swing on rising and falling employment.

This week we begin a series of letters on employment. I have been researching the topic more than usual for the book I am writing with Bill Dunkelberg (the Chief Economist of the National Federation of Independent Businesses) on the entire employment issue. We will look at why employment is so critical. How are jobs created and what policies can be adopted to help foster more jobs? Should the US try and keep jobs that are going overseas, or develop whole new industries? Who exactly is the competition globally for jobs?

We will find that billions of jobs will disappear in the coming decades and even more will be created. There are today some 1.2 billion good jobs, but 1.8 billion people want them. Over the next 30 years the world economy will double and then almost double again. Where will the new jobs be and who will get them? What should you and you children be doing today to be sure that you have jobs in the future?

In order to try to answer these questions, we will start with a general view of the employment situation in the US. What has it looked like in the past and where is it going? Today, we will look at the direction of employment in the US and then focus on both what employment is likely to be in the next few years as well as the dynamics of the labor market. There is a lot to cover. (This letter might print a little longer, as there will be lots of charts.)

Getting Back to Full Employment

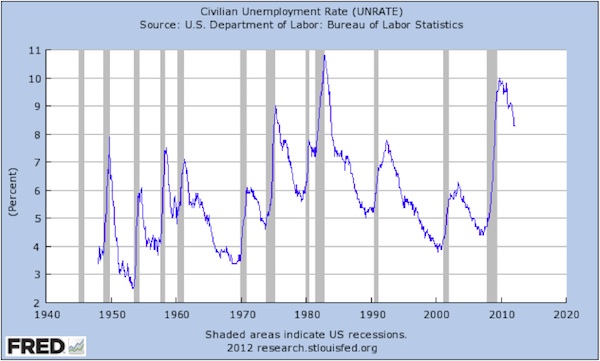

The headline unemployment rate is 8.3%, down from 10% only a couple years ago. But ten years ago it was less than half that, and at the beginning of the last decade it was less than 4%. 60 years ago it was less than 3%! Employment is a very volatile number, and as we have seen, it can rise substantially before and during a recession. The first graph we will look at is the unemployment rate, from the FRED database created by the St. Louis Federal Reserve.

Notice how much unemployment fell after the recession that followed World War II, during the '60s, and then in the Reagan and Clinton years. What kept it from rising in the last decade less than after almost any previous recession, and what caused it to rise more following the recent recession than in any since WWII? We'll look at that later, but for now let's just get the lay of the land.

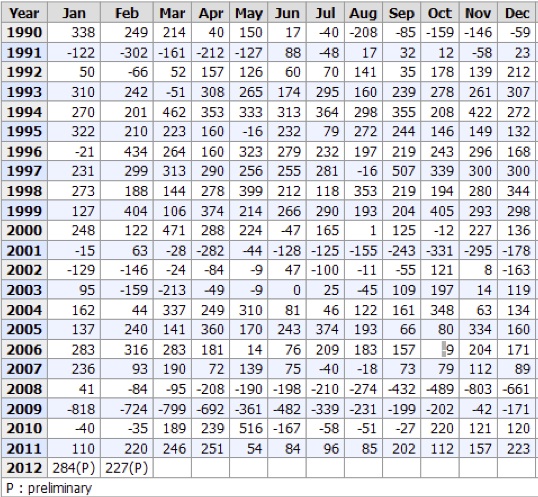

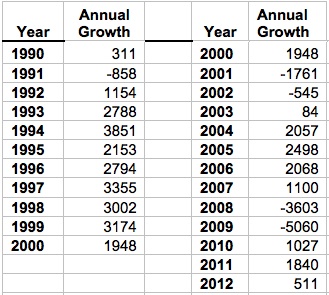

The last few months have seen good overall employment growth. January was revised up by 61,000 to 284,000 jobs created and February was 227,000. If we could keep that up it would mean 3 million new jobs this year. How likely is that to happen? Let's look back over the last 20 years for evidence. The next table is from the Bureau of Labor Statistics (BLS) web site, a treasure trove of employment data. Then I will sum up the monthly numbers for you in the next table.

[Hundreds of thousands of jobs]

Notice that about half of the time in the 1990s we saw growth in the neighborhood of 3 million annual jobs. We only went above 2 million in three years this last decade, and the rise over 2 million in those years was entirely due to construction jobs, which have since plummeted by 25%. Does anyone expect construction to supply such growth in the next few years?

Then look at employment growth month by month and notice that putting together a long string of 250,000 new jobs a month has not been easy in the last 13 years. You can get 3-4 months with solid job growth … which is then followed by a falloff in job growth. For instance, in 2010 the entire year's growth of 1 million jobs came in just three months. And last year two months (February and March) saw almost 500,000 jobs and half the year's growth.

The 1990s were the years of growth in all sorts of technology areas, and a resulting strong economy.

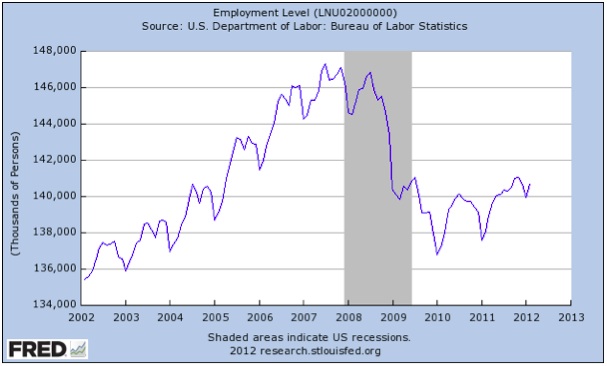

How long will it take us to get back to 4% unemployment? First, let's look at how many jobs we have lost.

We lost 10 million jobs peak to trough in the last recession. We are still down 7 million jobs from the high-water mark. But it is actually worse than that, because we need 125,000 new jobs each month just to keep up with population growth. That is 1.5 million jobs a year. IF we grew at 3 million jobs a year, it would still take over 4 years (until some time in 2016) to get back to the level of unemployment (4.5%) that we saw in 2007.

It will be even tougher in coming years, as we are watching government jobs fall steadily by around 15,000 each month, rather than adding 10,000 or so each month. Government jobs are down around 500,000 over the last three years. That is a big swing.

Who's Participating in Employment?

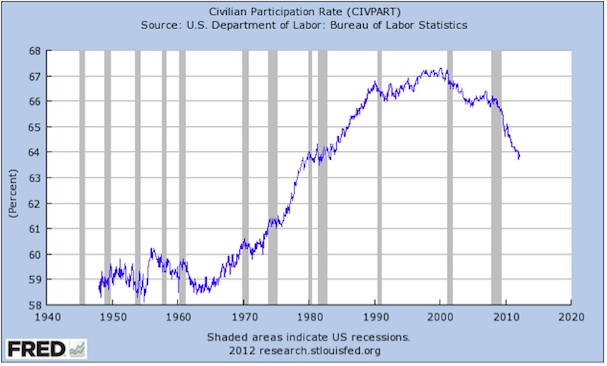

The articipation rate is the number of people who either have a job or are looking for one, as a percentage of the total population. Students and retirees, for example, are not considered as participating in the labor force. Nor are people on disability payments who are not looking for a job. Some 25% of the people who lost jobs since 2008 have applied for and received government disability checks. As an aside, we normally think of disability as something physical (back pain, etc.), but since 2008 43% of those getting approved for disability cited psychological reasons like stress. A rising percentage of them are white-collar workers. This is now costing us over $200 billion a year, which is almost 10% of total federal revenues. (I get it that individual people get very small checks, but there are now 10 million people on disability. And less than 1% a year either give up or lose their disability payments.)

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The last month saw an increase in the civilian labor force (the people who are counted as either employed or looking for a job) by 476,000, which is a healthy rise. Most saw it as a positive sign that people had better expectations of finding a job and were therefore looking. And that is a good part of the reason. But remember that you have to have been looking for a job within the last four weeks to be counted as unemployed. We are now seeing an increasing number of people coming to the end of their employment benefits, which were extended to 99 weeks. There were over 100,000 more people who were no longer getting benefits in just one week in February. There is clear research and evidence that losing your benefits can be a real motivator to start looking for a job!

And that is one of the reasons (as I have written for years) that bringing the unemployment rate down is harder than merely adding jobs. Those who are not considered to be in the labor force will either be motivated to look for a job because of improved conditions or be forced to look for a job because their benefits run out. Either way, the participation rate rises, which means you need at least as many new jobs as new people entering the labor force, just to keep the unemployment level even.

I point out the mountain we face in getting back to a reasonable unemployment level, not to be negative but to highlight the importance of job creation. The engine of job growth in the US is small business and new business. If we want to see rising employment, we need to be figuring out how to create more entrepreneurs. Roadblocks need to be removed. The amount of paperwork (and the cost!) required to hire just one new employee can be daunting for a small business. All those reports don't just magically fill themselves out. It takes time and money away from core business efforts to prepare them.

There are areas where new jobs will be created. The US has the opportunity to become energy self-sufficient by the end of the decade. That effort can create hundreds of thousands of direct jobs, with hundreds of thousands more created to service the people who are doing them. And those are jobs that pay well. We will explore various new industries that can supply jobs in the US (and in other countries as well).

4 Million New Jobs a Month!

Now let's turn to something that I find encouraging. If I told you that there were 4 million new jobs created in January, most readers would want to know what I was drinking. But that is the reality we find in another report by the BLS, called the JOLTS report or Job Openings and Labor Turnover Survey. It comes out each month and reports on just what it says.

In January there were actually 4.1 million new hires in the US, according to the JOLTS report. Of course there were also 3.9 million "separations." Separations can be voluntary (called quits), as in a person leaving a job to either go to or look for another job. Or they can be involuntary, as in layoffs and discharges. The quits rate can serve as a measure of workers' willingness or ability to change jobs. It will surprise no one that quits are down by 1/3 in the last few years as fewer people quit without a job in hand. But layoffs are also down by a third from 2009, which is a clear sign of improvement in the job market.

And that brings us to the job openings. The good news is that job openings are up 50% from the bottom in 2009, but still off by 1 million jobs from 2007. The bad news is there is still only about 1 job for over 3 people who are looking.

What that says is that the labor market in the US is still very dynamic and fluid, even with the high unemployment level. When 3% of the labor force changes jobs in any one month, that means there are companies hiring somewhere. And while 3% may sound high, the rate has been over 4% in the last ten years. And when 1.5% of the labor force voluntarily quits, that means they are either retiring or expect to find a new job.

The BLS has an item in its monthly labor report (the establishment survey) called the birth-death ratio. This is basically a number they use to estimate the number of net new businesses created each month. In times of rising employment, the survey of businesses misses new businesses (as a new business is obviously not on the call list). In some years, especially after a recession finishes, those new businesses can account for a large part of net new job creation.

But if we go back to the unemployment rate (the first chart in this letter), you have to ask yourself, why are we not creating new jobs like we did in the past? Why has job growth been sluggish for over a decade, especially if you take out the construction jobs in the middle of the last decade? Doing so makes job growth last decade look particularly bad in comparison with other recoveries in the previous 20 years (before 2000).

In coming letters we will look at what I think might be some of the reasons. But for now we will close with a quote from Jim Clifton, who I quoted at the beginning on the importance of creating jobs. Clifton and the Gallup organization have been surveying people about their jobs for decades, and Jim has been consulting on employment for at least that long. I find his book, The Coming Jobs War, to be very readable (and provocative) and to offer a lot of good ideas. I recommend it.

Where Will the Jobs Come From?

I came across this quote from an interview Jim did with Forbes, when he was asked the question, "What obstacles do leaders have when trying to create more jobs?"

"There are no real obstacles. Just wrong thinking, bad assumptions. When you build strategies and policies on wrong assumptions, the more you execute, the worse you make everything, which is what we are doing now. There are three wrong assumptions that cause all the current job creation attempts to not work.

1. "Innovation is not scarce. Entrepreneurship is scarce. We are spending billions and wasting years of conversations on innovation and it isn't paying off. Great business people are more valuable and rarer than great ideas.

2. "America has about six million active businesses. Ninety-nine percent of them are small businesses. An incalculably huge mistake leaders are making now is spending time, money, strategies, and especially policies for those who need 'help' getting a job. A useful way to look at any citizen is this, 'Can she herself create jobs or does she need a job created for her?' We are spending all our time on the cart and doing little or nothing on the horse. We have our assumptions and futurism that backward. 'The horse (small and medium business) stopped, so we fix the cart (jobs).' If we change all our strategies and policies to favor the job creators (small and medium businesses) the horse and cart will get moving again. We have our compassion right, but the logic is staggeringly stupid.

3. "It is wrong thinking to imagine that Washington has solutions. Job creation is a city problem. There is great variation in job creation by city in the United States. San Francisco and the greater Valley keep pumping away while Detroit isn't. Austin's cart works while Albany's doesn't. Cities need to look inwardly and say, 'What can I do to create great economic energy, to bring new customers for all existing companies and start-ups?'"

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

We will follow up on those thoughts in coming weeks.

Stockholm, Paris, San Francisco, and New York

I am off on Monday to Stockholm to speak at a conference for Swedbank, and then on to Paris for the weekend, to be with friends, attend the Global Interdependence Center conference on central banking, and enjoy one of the most beautiful cities in the world. It has been some time since I have been to the Louvre, and I hope to be able to enjoy a few of the exhibits. Then back for a week before I head for San Francisco for the Life Extension Conference and to meet with Pat Cox and other friends, and then on to New York, where I will speak Tuesday afternoon at the Bloomberg conference room for Investorside, a nonprofit group of independent trade research providers.

The Strategic Investment Conference I hold each year in California (along with my partners, the team at Altegris Investments) is sold out. We got a much larger venue this year but still sold out earlier than we ever have. I did tell you that we would, and sorry if you wanted to go.

I will also be speaking at the Casey Research Conference ("Recovery Reality Check"), near Miami April 26-29. There is a decided natural resource theme as well as more general investment topics, and quite a good line-up of speakers. You can learn more at http://www.caseyresearch.com/2012-spring-summit?ppref=JMD439EA0312A.

It is time to hit the send button. The Chinese translators are waiting and they have a deadline approaching quickly, as they must get into print in the Hong Kong Economic Journal on Monday morning. It is a darned quick turnaround and they have yet to miss a beat, although I am somewhat late from time to time. Have a great week.

Your thinking about where his kids will work analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin